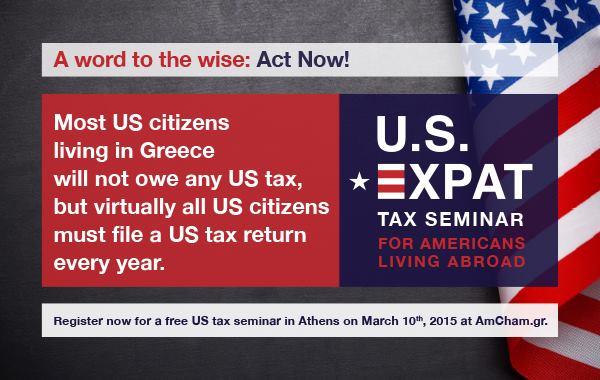

The American-Hellenic Chamber of Commerce is organizing an expat tax seminar in Greece for Americans living abroad. The free seminar by an expert on expatriate tax issues provides an excellent opportunity for anyone interested in the unique tax filing and bank report obligations of United States citizens working or living abroad. The presentation will be followed by a Q&A session. Topics to be covered include:

- U.S. citizenship taxation – every American citizen is subject to tax on his/her worldwide income regardless of the source of that income. (Note: Persons born in the United States are citizens automatically)

- Use of the Foreign Earned Income Exclusion (FEIE) under I.R.C. Section 911 and of Foreign Tax Credits to reduce or eliminate US tax.

- Foreign Bank Account Report (FBAR) filing requirements for US citizens.

- The Foreign Account Tax Compliance Act (FATCA) filing requirements for individuals and foreign bank reporting of US accounts.

- Tax return and FBAR filing compliance for delinquent US taxpauyers; using the Streamlined Foreign Offshore Procedures (SFOP) to avoid tax and FBAR penalties.

Those interested in attending need to RSVP no later than March 6 to k.tzagaroulaki@amcham.gr

The event takes place at the American School of Classical Studies at 61 Souidias Street, Kolonaki

Stephen Flott has more than 35 years experience in international business and tax matters. He specializes in U.S. citizenship issues including expatriation and associated tax issues and special compliance challenges associated with long-term non-filing of U.S. tax returns and financial reports by U.S. citizens who live outside the U.S.