The IMF has said the Eurozone must lower Greece’s financial targets to prevent crippling the country and causing it to go into a second economic crisis.

The IMF believes the harsh bailout demands imposed on Greece by the EU are unrealistically forcing the country to strive for a primary surplus of 3,5%, and the increased austerity measures that would result from needing to meet the target could damage it more in the long run.

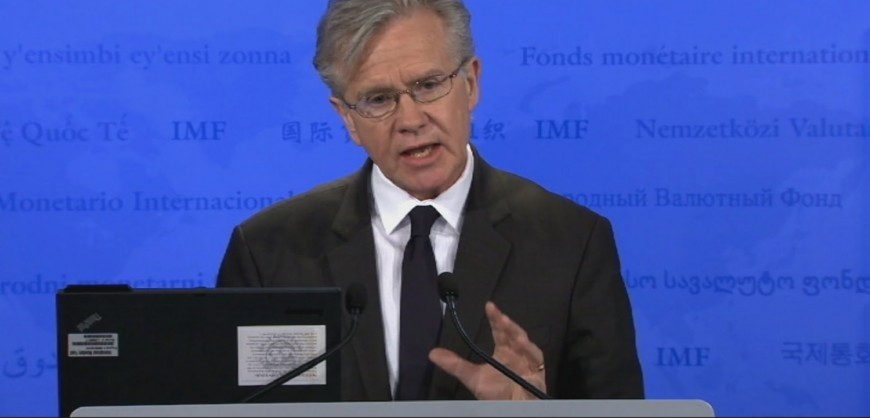

IMF experts want Greece’s €2.8bn bailout package to only require a primary surplus of 1.5% of the country’s economic output. “We continue to believe a medium and long-term primary surplus of 1.5% of GDP is appropriate for Greece and can be attained through the measures currently included in the ESM program,” said Gerry Rice, the IMF’s communications director. “We‘ve said this before and say it again: the IMF is not asking for additional austerity, and we could support a program based on a target of 1.5 percent of GDP. That is our preferred option.”

Rice said that it would “mean less austerity for Greece and the Greek people, adding: “We would like to see debt relief that is commensurate with that. And we need two legs; we need the combination.” However, he specified that the IMF would go along with the EU’s increased demands for primary surplus providing it were “underpinned by credible and high quality structural reforms.”

With the highest debt and unemployment rates in the world and seven years into recession and austerity, Greece is still seen as one of the biggest threats to the future of the European Union, and its deteriorating state has sparked fears that the country could still collapse, bringing the euro down with it.

Source: Express