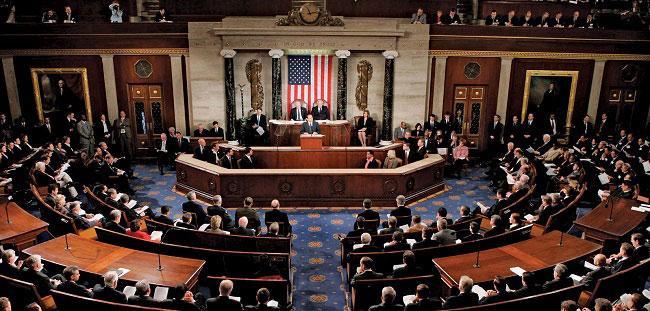

The Senate voted early Wednesday to pass Republicans’ ambitious $1.5 trillion rewrite of the tax code, moving one step closer to achieving their first major legislative victory under President Donald Trump.

The Senate bill was passed, 51-48, in a vote that didn’t come down until 12:45 a.m. ET. The voting was along party lines, with all 48 Democrats voting against the legislation.

About a dozen protesters in the Senate chamber interrupted the vote multiple times, shouting “Kill the bill!” before they were escorted out of the gallery. Vice President Mike Pence had to call for order in the chamber on at least three occasions.

Now the bill heads back to the House, where Republicans voted earlier Tuesday to also approve the measure — a compromise bill between the two chambers — but a late technical objection by the Senate parliamentarian to three small parts of the legislation means the House will have to vote again on a revised version.

The House vote on the bill, the largest overhaul of the tax code in 30 years, was along party lines, 227-203.

House Speaker Paul Ryan, who had long sought the overhaul, was triumphant announcing the vote, bringing the gavel down emphatically and then letting it drop off the podium.

Afterward, Ryan said on “New Year’s Day, America will have a new tax code for a new era of American prosperity.”

“When House Republicans began this journey, we had two goals in mind. We believed Americans deserved a tax code bill of growth. We believed America could leapfrog back to the lead of the pack as a best place on the planet for the next new jobs and next new business. Today, we achieved those goals,” Ryan said.

Pence was on hand to congratulate Republicans after the vote. He also read that the bill had passed from the Senate floor, eliciting a standing ovation from the GOP side of the room.

Senate Democratic Leader Chuck Schumer said Republicans will “rue the day” they passed the tax overhaul.

“Given the bill’s substance, it’s no surprise they’re in such a rush. Eleventh-hour backroom deals have managed to only make their bill even worse. They don’t want people — folks — they don’t want to discuss it, they don’t want to have it — have some light shed on it. They don’t want anyone to know what’s in it because it is so, so bad. And the public knows it,” Schumer said.

With the GOP unable to send the American Health Care Act to the White House, passage of the tax overhaul would finally furnish a decisive legislative victory for the president, closing out one of Trump’s chief campaign promises just before Christmas.

In the House, 12 Republicans voted no — as did all Democrats. Almost all of the Republicans represent high-tax districts where new limits on the state and local tax deduction are not popular.

Among the GOP no votes was Rep. Peter King of New York, who said earlier that Republican voters in his district won’t count the bill as a win for the president.

“People who voted for Trump are very disappointed,” King told reporters Monday evening. “It’s certainly unpopular in my district. That’s all I’m hearing from Republicans.”

The legislation maintains seven tax brackets, with the country’s wealthiest earners enjoying a top-rate decrease from 39.6 percent to 37 percent. It also dramatically cuts the corporate rate from 35 percent to 21 percent.

Republicans crafted the bill with the aim to simplify the tax code by cutting loopholes for special interests. But the new rules preserve many popular deductions, such as for mortgage interest, student loans, adoptions and charitable giving.

The measure also repeals Obamacare’s individual mandate, which requires people to buy health insurance or pay a penalty. That could lead to 13 million more Americans without health insurance, according to the Congressional Budget Office, though it would save $338 billion in federal health insurance subsidy payments over the next decade.

The bill, which carries an estimated $1.5 trillion price tag over 10 years, is not expected to win any Democratic support. House Minority Leader Nancy Pelosi points to a new analysis from the non-partisan Tax Policy Center that predicts 86 million people would see a tax increase compared to current law by 2027, while 83 percent of the anticipated benefits would be reaped by the wealthiest one percent of taxpayers.

“Republicans will vote to let the wealthiest one percent steal the future of the middle class in America,” Pelosi, D-Calif., stated prior to the vote. “The GOP tax bill will go down as one of the most scandalous, obscene acts of plutocracy ever.”

Rep. Kevin Brady, the chairman of the Ways and Means Committee, said that analyses focusing on the back end of the 10-year window are misleading because many of the individual tax breaks expire in eight years.

“That’s just cherry-picking the numbers,” Brady said. “Look, we’ve just finished eight years of Washington spending your money. Let’s try eight years of you spending your money and making America competitive and then a future Congress can decide is that right for this country. My guess is they’re going to say people should keep more of what they earn.”

President Trump tweeted ahead of the vote Tuesday saying that the Tax Cut Bill will be the “biggest tax cuts and reform EVER passed” and is “totally understood and appreciated in scope and size.”

PolitiFact rated the president’s previous similar claims about the “biggest tax cuts” as “false.”

Source: yahoo.com