Hotel owners request strategic plan for tourism in Athens as they watch the hotel bookings in Athens, with the first signs being visible from the previous year and becoming more intense since the start of the new year.

And indeed, in a total of 11 major European cities that are major tourist destinations, Athens with the record of 5.5 million or more visitors last year saw one with the most significant declines in hotel bookings (by 8.7% compared to January 2018) as well as the Average Room Price and Income Per Available Room. The increased competition due to the addition of new hotel units in the capital, short-term tourist leases and intense seasonality that that is still present are some of the main reasons for the decline.

According to the Athens Hoteliers Association of Attica (A.H.A.A.), “while our competitors come back on the tourist market harder and with more ‘weapons’ in the battle of competition (modern convention centers, organized harbors and marinas, new tourism products etc.), Athens still faces key problems of cleanliness, safety, lack of social structures appropriate to meet the increased needs of the population, but also of its visitors. In parallel, major investments and projects that will enrich the Athenian proposal emphasizing the seafront (conference center, Ellinikon, etc.) are unduly delayed”. Especially, if one takes into consideration that both categories for improvement have remained the same in recent years: Indicatively, based on the guest satisfaction survey conducted by the A.H.A.A. in collaboration with GBR Consulting firm, these issues include the cleaning of graffiti in the city, pavement maintenance, street and pavement cleaning, landmarks in English, building renovation.

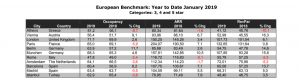

Based on the data of the A.H.A.A. and their processing by GBR Consulting, in January 2019 occupancy was at 51,2%, from 56,1% in January 2018, falling by 8,7% on a yearly basis, while the Average Room Price appears slightly lower at EUR 80,34 from EUR 81,64 in January 2018. A double-digit decline rate of 10,1% is recorded for the Income Per Available Room Athenian Hotels reaching EUR 41,12 in the first month of 2019 from EUR 45,76 in the corresponding month of 2018.

In comparison with other European destinations, in a total of 11 European cities (Athens, Vienna, London, Paris, Berlin, Munich, Rome, Amsterdam, Barcelona, Madrid, Istanbul), the Greek capital is along with Rome and Amsterdam the three destinations where there is a decrease in Income Per Available Room, although in the case of the other two European Capitals the decline rates are clearly lower by 2,5% for Rome and 5,2% for Amsterdam vs. 10,1% for Athens, at EUR 41,12. These three cities have also seen a drop in the Average Room Price, 1,6% for Athens (EUR 80,34), 0,1% for Rome and 1,7% for Amsterdam, while many more have experienced a drop in occupancy, with short-term tourism leases having played their role, of course.

Stefania Souki