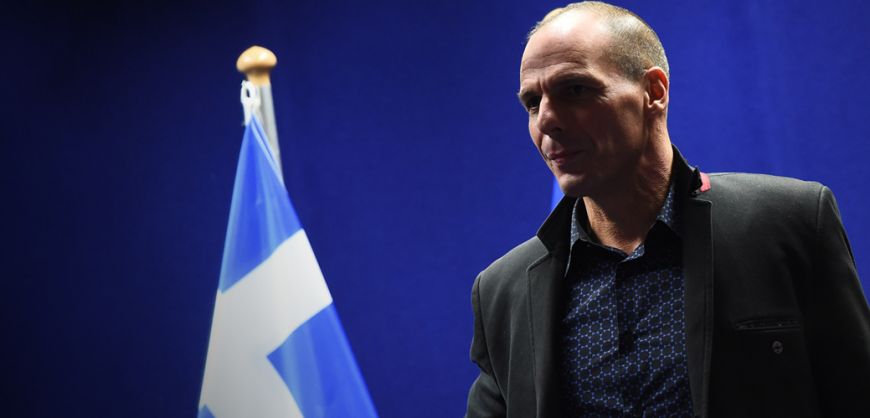

Foreign parliaments and institutions are struggling to keep Greece on track with its ‘program’ by voting on the 4-month extension to Greek funding attacked to a reforms list created by Greek Finance Minister Yanis Varoufakis. The extension, however, doesn’t automatically come attached with money and even if it is ratified by the institutions or Greek parliament by next week so that the country doesn’t come face to face with a stoppage in payments in the first ten days of March. Speaking with Bloomberg, Varoufakis said that he cannot imagine Europe or the International Monetary Fund (IMF) letting Greece default next month when it runs out of money.

Varoufakis also said that the European Central Bank (ECB) could aid Greece by handing over the 2 bln euros that it owes from Greek bonds profits so that Greece could pay off the IMF, stating that this money belongs to Greece. He said that the ECB has alraedy returned this money to the eurozone’s other central banks, however ECB Chief Mario Draghi said on Thursday that the ECB would give these profits to Greece once it fulfils its program.

The last hope for the Greek government is increased revenues for February so that the state has funds to meet its internal and external needs. Varoufakis also told Bloomberg that there will be no funding shortage.

Another alternative solution to Greece’s economic woes would be to ask the IMF for a two-month postponement of the 1.6-bln-euro installment, until after Greece’s review from institutional bodies. IMF sources neither confirm nor deny that such a request has been discussed. It is uncertain if IMF members would agree to such a delay bearing in mind past behavior concerning Brazil and other BRICS representatives.

Even if Greece manages to overcome the economic obstacles it is set to face in March, the funding problem will only be solved in the short-term with new problems escalating each month until August, reaching as much as 13 bln euros in backpayments. Hence, only “permanent” solutions are worthwhile.

Greece was once again the focal point of the IMF’s meeting on Thursday, with IMF Chief Christine Laagarde at the helm. Poul M. Thomsen, the Director of the IMF’s European Department, briefed the IMF on the latest developments in Greece, characteristically saying that Athens is free to name its program anything it wishes but the MoU (Memorandum of Understanding) needs to continue because it is necessary.

On his part, Varoufakis said that Lagarde’s criticism of Greek measures as not being specific was unfair. He said that even though a three-page document had been requested over the weekend, Greece sent five pages worth of details.

He characteristically said that beyond money and jobs, Greek peopel want dignity. They want a government to represent them at ECOFIn, the EU leaders summit and Eurgroup with discussions with the IMF and ECB. They want to have a say as to what goes on in their country.