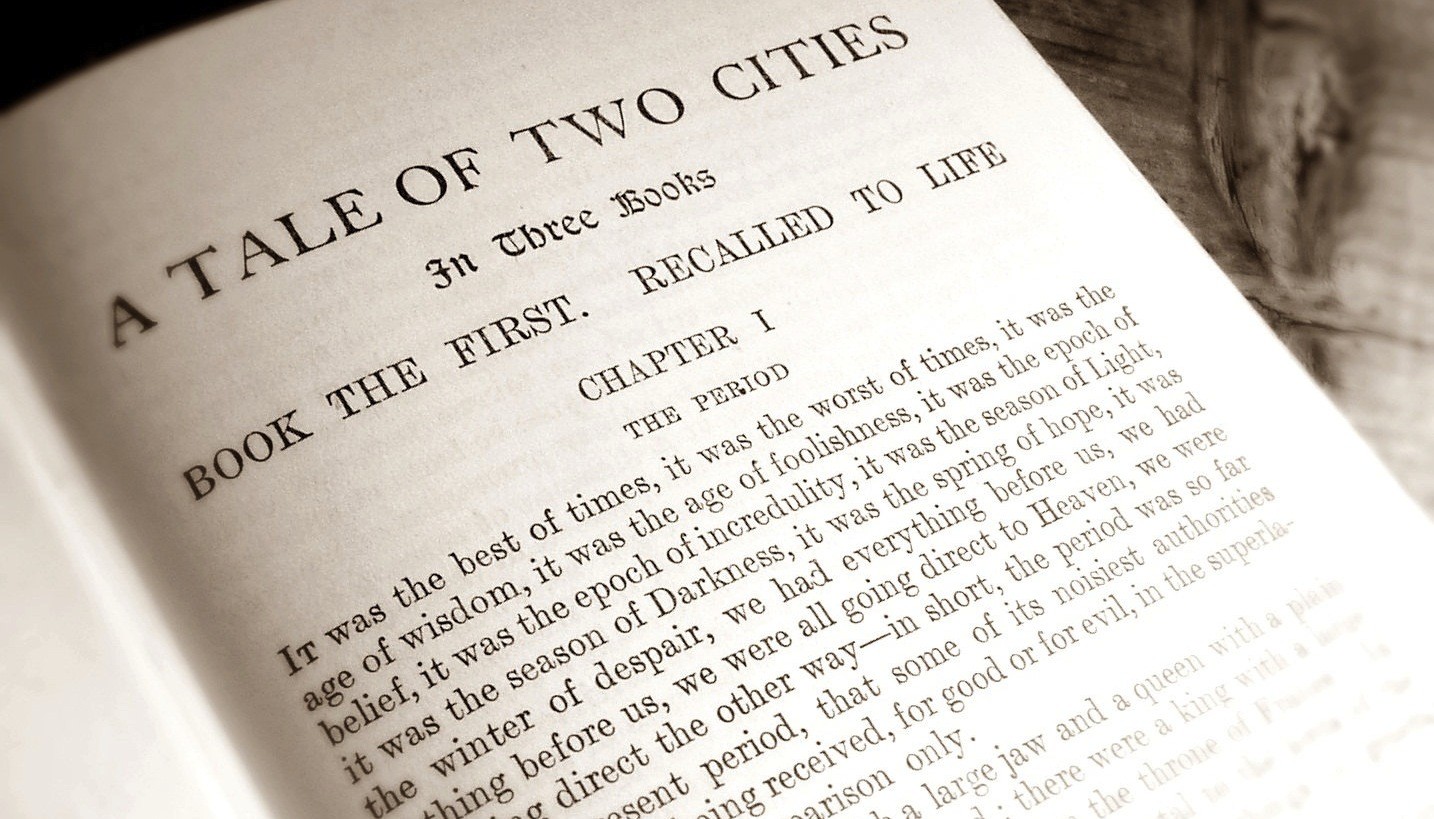

“It was the best of times, it was the worst of times,” wrote Charles Dickens in “A Tale of Two Cities” and this quote may well apply to Athens right now, as two worlds are on a collision course:

Yes vs. No, Greece vs. Creditors but NOT Drachma vs. Euro (though it could be!)

It’s crunch time with a referendum on July 5. Contrary to tabloid press accounts, Greeks are not being asked to choose between Greece remaining in eurozone or a Grexit, nor is the question of a euro vs. drachma put on the table. The question calls on people to approve or disapprove of a proposal made to the leftist SYRIZA government by the European Commission, European Central Bank and International Monetary Fund during the Eurogroup of June 25. The proposal consists of two documents titled “Reforms for the Completion of the Current Program” and “Beyond and Preliminary Debt Sustainability Analysis.” The referendum question will give two choices: “Those citizens that reject the proposal of the three institutions vote: Not approved/No” and “Those citizens that agree with the proposal of the three institutions vote Approved/Yes.

Of course, in announcing the referendum, Greek PM Alexis Tsipras called for a “no” vote, something his party’s members and the rightist Independent Greeks (AN.EL) party, his coalition partner, support. Also in the “no” camp are the ultra-nationalists and alleged neo-Nazis of Golden Dawn.

Others point out that Tsipras and his radical leftists have backed themselves into a corner, saying that a “yes” vote means the government has been served up with a grand “no confidence” vote, i.e. snap elections again, ecumenical coalition government etc. Also, there are no guarantees that creditors will want to continue negotiations, either on the proposal that appears now withdrawn, or on Athens previous proposal totaling … eight billion euros in tax-and-tax measures.

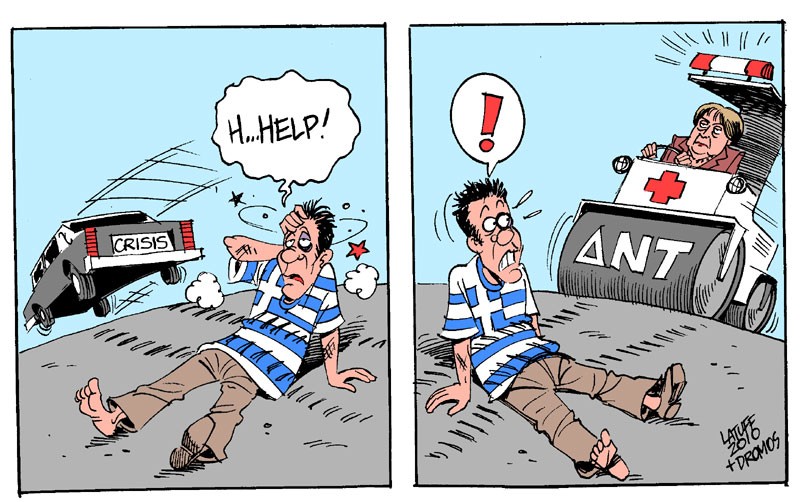

A “no” vote, conversely, doesn’t mean that … banks will open when the government says they will. The specter of “bank run” will not have dissipated, and its improbable that the ECB will open its liquidity flow when there’s no bailout plan in place. Beyond banks, the probability of missed payments to the IMF and ECB, there’s also the “minor” issue of paying civil servants and pensioners for July…

Rich vs. Poor

A north-south divide in a two-speed and a two-tier European continent of rich and … less rich has been in place for decades. Nobel laureate Paul Krugman writes that Greece is little more than a “financial slave state mired in an economic depression. There is no way Greece will ever be able to cut its way to prosperity.” From acronyms such as PIGS (Portugal, Ireland, Italy, Greece, Spain) to the holier-than-thou attitudes of wealthier Europeans being derogatory and showing sheer disrespect to the elected officials of a country. German constraints on Southern Europe are seen to be creating generations of 500 euros who cannot make ends meet.

Austerity vs. Development

Many Greeks say austerity is unbearable and crippling growth, but the Germans and other more developed European states can hardly be expected to be enthusiastic about extending yet more credit to a country where the retirement age was only extended by two years to 63 in 2010, when it has been 67 years in Germany for many years.

The system vs. democratic rights of people

What can one say about a system where subsidies are given to farmers not to produce and the slow dismantling of industry so that people could have all their needs served from abroad? When PM A. Tsipras called for the people to decide on Greece’s future through a referendum he was criticized. Does he not know that this is not how the eurozone and the EU work? The Eurogroup leaders were so angered by this move that they rendered their offer void. EU leaders fear referendums like the plague.

With elements of good vs. evil and European ideals vs. money… one can safely say, like Dickens: