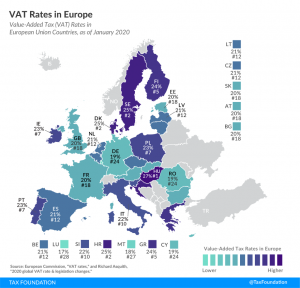

Greek households are one of the most burdened in Europe, a Tax Foundation study on VAT rates has found in a report.

According to the report, Greece is in the 1st spot in the Eurozone, with a 24% base rate, along with Finland. Compared to all EU members, Greece is in fifth place.

The EU countries with the highest VAT rates are Hungary (27%), and Croatia, Denmark and Sweden (25%).

Luxembourg imposes the lowest VAT rate (17%) followed by Malta (18%), Cyprus, Germany and Romania (19%).

The EU average VAT rate is 21%, six points higher than the minimum VAT rate required by EU regulation.

According to the European Commission, the increase in VAT rates in previous years has deepened the revenue gap. About 6 billion euros are lost in Greece each year due to non-payment of VAT.

Ask me anything

Explore related questions