The Greek Ministry of Finance is attempting to compel banks to share details of clients’ safety deposit boxes with the Tax Office, as an act by Deputy Minister Katerina Papanatsiou revealed.

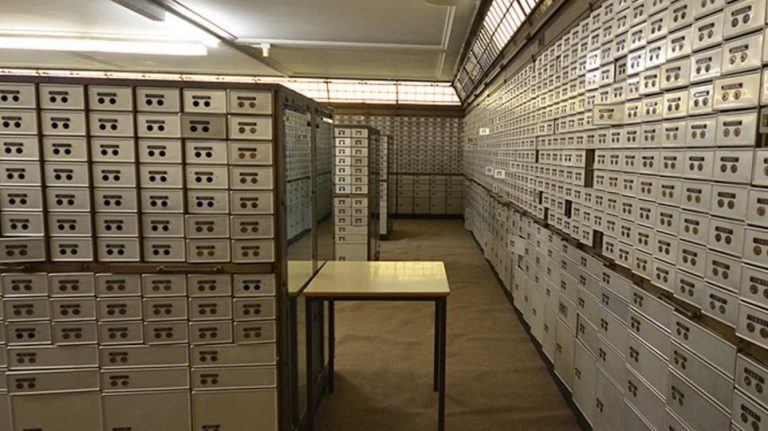

The act, published in the Government Gazette, provides that the category “safety deposit box” should be added to the list of citizens’ assets registered in the System of Register of Bank Accounts and Payment Accounts and send this information electronically for audit to the Tax Office, the Audit Centres, the SDOE (Special Secretariat for Financial and Economic Crime Unit), the Financial Police, the Anti-Money Laundering Authority, the Financial Prosecutors and the Prosecutors of Corruption.

By expanding the powers of the financial auditory authorities through access to safety box deposits, the state will be able to impose stricter control on legal entities and individuals and minimise the possibility of tax evasion, money laundering, illegal accumulation of wealth and other financial crimes. They will be able to access information about assets and hidden cash by individuals and legal entities, thus facilitating the authorities in identifying and checking their tax obligations, and wherever necessary, imposing fines while also substantiating possible criminal offences.

In addition, the decision provides that if the banking institutions do not electronically update the Registry, they will be requested via mail to provide the information within a few days.

Ask me anything

Explore related questions