Yanis Varoufakis took to his blog (yet again!) to focus on what he claimed were European creditors’ “vindictive privatization plan for Greece”, as outlined in an article he wrote for the Project Syndicate, which bills itself as a global platform for statesmen, policymakers, intellectuals and activists.

Referring to the eurozone summit, Varoufakis said the “terms of surrender” of Greece were outlined on July 12. A “terrified” Prime Minister Alexis Tsipras accepted all the terms on behalf of the Greek people, or so the ex-minister claims.

Varoufakis writes:

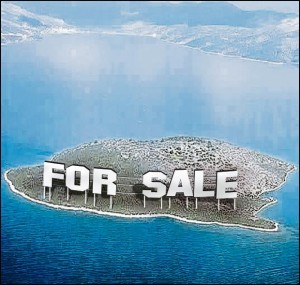

Eurozone leaders demanded that Greek public assets be transferred to a Treuhand-like fund – a fire-sale vehicle similar to the one used after the fall of the Berlin Wall to privatize quickly, at great financial loss, and with devastating effects on employment all of the vanishing East German state’s public property.

Is the erratic Marxist’s comparing Greece, circa 2015, to the dour totalitarian state of East Germany?

Initially, the Greek Treuhand was to be based in Luxembourg and run by a company overseen by Germany’s Finance minister Wolfgang Schaeuble (!) and would have completed the sales within three years with the Greek people receiving no benefit of any sorts from the proceeds of Greece’s largest ever sell-off.

In an effort to ameliorate the Treuhand plan, new Finance Minister Euclid Tsakalotos managed to base it in Greece and ensure that sales would be complete in 30 rather than three years, so that they could be sold or leased at a better price.

Despite this, Varoufakis describes the plan as an “abomination” and a “Stigma on Europe’s conscience.” For Greeks the plan is a wasted opportunity as the assets could have been used to help the Greek people by creating homegrown investments to counter recession rather than pay off what even the IMF admits is an “unpayable debt”.

Obviously, Varoufakis did not dwell on the Greek state’s management of its assets over the past several decades, including and not exclusive to the nationalization of what was once the country’s biggest private company, the textile maker Piraiki Patraiki. The industrial giant went belly up after it was taken by the state. It was once managed, properly, by Varoufakis’ current father-in-law.

Another “homegrown” investment is the now closed state-run… horsetrack, which accumulated more than 300 million euros in losses (!), possibly a European or world record for what’s essentially a “cash machine” for proprietors granted such a pari-mutuel gambling license.

Ask me anything

Explore related questions