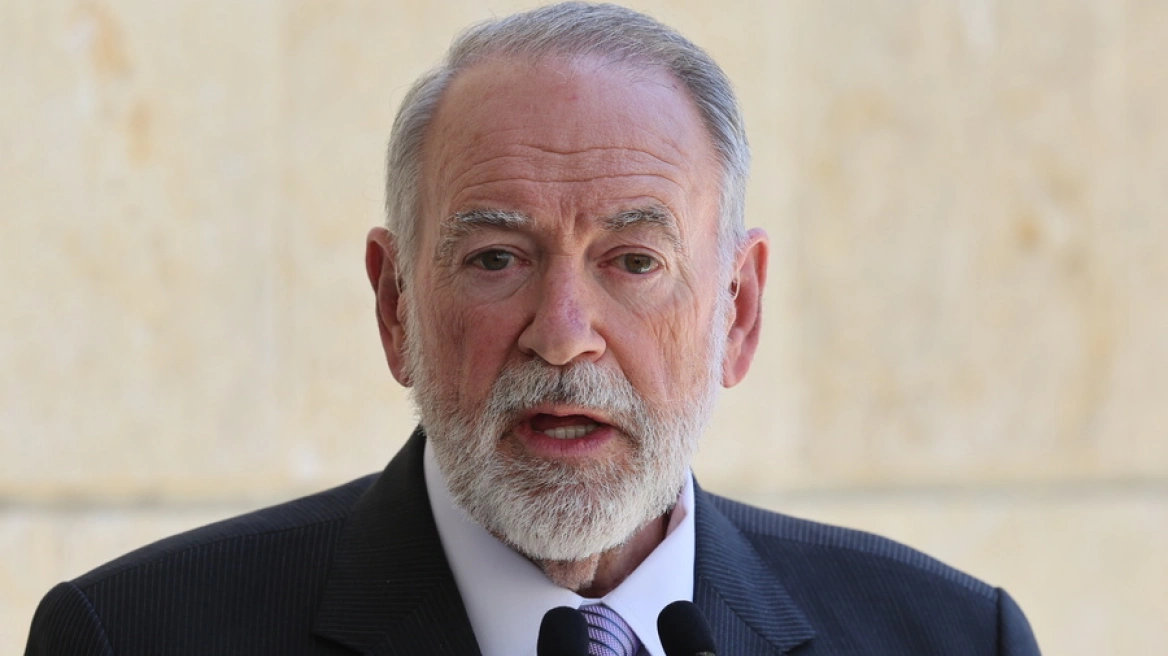

In an interview to German publication “ Süddeutsche Zeitung”, ESM Managing Director Klaus Regling compared Greece with post-WW2 Germany which needed 57 years to pay off its debt on the basis of the 1953 London Debt Agreement.

Following is some of the excerpts from the interview to Alexander Mühlauer:

Why should German savers be liable for Italian banks?

That is not the issue. What counts is that we create a system that benefits everybody. This deposit insurance would probably not be used a lot.

Why not?

Because the reason for a possible bank run would disappear when savers know that in a crisis, deposits up to € 100.000 are guaranteed not only by their own country but by the entire euro area. If this is the case, why would a saver withdraw his money?

But banks in Italy, Greece and Cyprus are still sitting on a huge pile of non-performing loans. That is a big risk.

That is true. But we are working to reduce that. These legacy risks have to disappear before the deposit insurance is put in place. But Germany should not forget that its banks received more public money during the financial crisis than almost any other European banking system – with the exception of Spain and Ireland. Taxpayers had to shoulder high losses. It is wrong to assume that German banks would never need any money.

“Everybody wants our money” – that’s the narrative that has emerged in Germany since the euro crisis. What do you say to that?

Let me be clear: there is no transfer union. I know that many people think all the other countries want is German money. But so far, that hasn’t happened, also not in the context of the ESM rescue loans. And the government is paying attention that this will not happen.

The Netherlands are seeing the Eurozone budget, which was proposed by Berlin and Paris, as a first step towards a transfer union.

The German-French proposal explicitly states there will not be a transfer union. But there are some countries that do want it. Of course, we already have transfers in Europe. Not because of the monetary union, but, since 1957, because of the EU budget. These transfers are deliberate, they are supposed to help convergence of living standards. Germany and France want the euro budget to be part of the EU budget. That clearly means: If there is more money for euro area countries, there is less for non-euro area countries.

But who decides whether or not it is really the country’s own fault?

That has to be debated. A country may also be able to counter the shock on its own. Germany’s reunification is an example.

So far in the history of monetary union, there could only be an agreement during a crisis. Is there a risk that we miss a chance to reform the currency union now that the economy is doing well?

Would the ESM be able to rescue Italy?

I don’t see a crisis on the horizon. But I see that the ESM has an unused credit capacity of around €400 billion. Enough to help even a large country.

Let’s talk about Greece. What makes you so certain that Athens will now manage on its own?

The Greek economy has been completely restructured over the past eight years and during the three adjustment programmes. Since 2016, Greece has posted a small fiscal surplus. I don’t doubt that Greece will be able to return to the market. And Greece will repay our loans. This will take time. But the last repayment of the London debt agreement of 1953 for Germany only happened in 2010. Nobody noticed that at the time – and that is how I imagine it will be with Greece.

What was the biggest mistake in the eight years of the Greece crisis?

Sometimes we took too much time reaching decisions. But then again, we had to develop new instruments. We simply hadn’t imagined there could be a crisis of this magnitude. If decisions had been taken more quickly, a lot of money could have been saved. Also, earlier debt relief would have been better.

What did you think when Wolfang Schäuble proposed a Grexit?

I was always of the view – and I also told Mr Schäuble this – that Grexit would be the most expensive solution, for Greece and for its creditors. But I also know that you can see this differently. When a country breaches certain limits, it has to draw consequences. So the thought wasn’t wrong. But it is good that we were able to keep Greece, but also Ireland and Portugal inside the monetary union, also thanks to the ESM. If we hadn’t been there, it is my opinion that Europe would look differently today.

for full interview visit here

Ask me anything

Explore related questions