When the Shah of Iran wanted to borrow $80 million in 1969, a Greek banker in London was in a good position to oblige him.

Minos Zombanakis, who had cultivated contacts across the Middle East and attended the imperial coronation of Shah Mohammad Reza Pahlavi two years earlier, presided over a London offshoot of New York-based Manufacturers Hanover Trust. He assembled a syndicate of banks to provide the loan and found a novel way to set an interest rate, to be adjusted periodically based on the banks’ costs of funds.

His innovation helped establish the London interbank offered rate, or Libor, a global benchmark for pricing loans. The bankers celebrated with champagne and Iranian caviar.

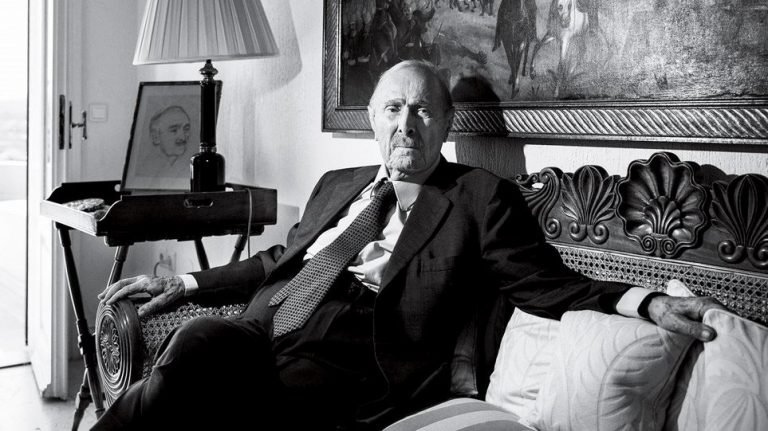

Mr. Zombanakis, who died Dec. 22 at the age of 92, was a pioneer in the Euromarkets, a means of tapping the billions of dollars and other currencies held outside their countries of origin. He and other bankers used those funds to package loans and bond issues for companies and nations. The Euromarkets thrived by bypassing national regulations and recycling expatriated funds held by companies, oil exporters, people with numbered Swiss accounts and others.

read more at wsj.com

Ask me anything

Explore related questions