Study shows Southern Europe’s high-end property prices are on the rise. In particular, cities such as Lisbon, Madrid and Athens saw strong growth in residential property prices in the first half of the year, as continued tight supply strengthened the market.

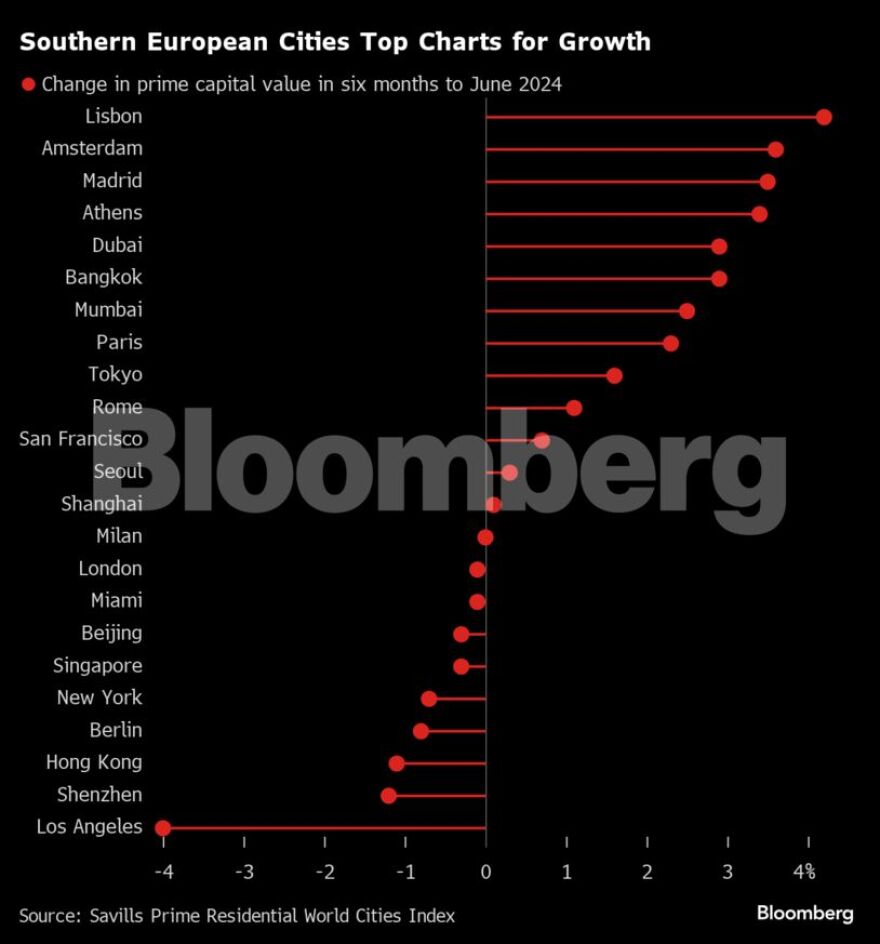

Of the 30 cities analysed by property firm Savills Plc, Lisbon saw the strongest growth in the capital value of prime homes, up 4.2%, thanks mainly to an influx of wealthy foreign buyers. Amsterdam, Madrid and Athens all posted increases of more than 3%, according to an index that tracks prime residential real estate in cities around the world.

Capital value growth in these destinations far exceeded the 0.8% average recorded across all cities in the Savills index, according to Bloomberg.

As Europe faces a housing supply shortage due to high construction costs and development challenges, Americans have become a key base of prospective buyers in many southern European cities. The comparatively strong dollar and growing interest in regional lifestyles are attracting US buyers, Savills said in the report. The value of prime real estate in Dubai also rose as the Middle Eastern hub continues to attract wealthy workers with lower taxes and luxury lifestyle offerings.

While confidence in the high-end property market has withstood recessions in many of the world’s largest economies, some buyers remain cautious as they wait for more clarity on interest rates.

In the US, stubbornly high interest rates have brought the country’s property market to a standstill, according to Savills. As many US homeowners are taking out 30-year fixed-rate mortgages, few are willing to get back into the housing market and risk increasing their monthly payments. Prime home prices fell in three of the four U.S. cities tracked in the first half of the year.

Rent increases

Growth in the prime rental market continues to outpace growth in sales markets around the world, Savills said. Supply constraints in many cities in Europe, the Middle East and Africa mean that those looking to rent high-end properties continue to face soaring rents. No market in the EMEA region tracked in the index had a fall in rental prices between December 2023 and June 2024.

“High interest rates continue to contribute to cautiousness in the sales markets and are pushing more would-be buyers into the top rental markets,” said Kelsey Sellers deputy director at Savills World Research. “We expect rents to continue to outperform capital values for the remainder of 2024 and into the medium term as supply remains constrained in many cities around the world.”

And in the case of rents, Lisbon led the pack, along with Dubai and Bangkok. Rents rose by 7.5% in the Portuguese city in the first half of the year. Athens, Barcelona, Amsterdam, Amsterdam, Berlin and Cape Town all saw prime rents rise by more than 3% in the first half of 2024, with Athens recording a 4.6% increase over the six months, according to the report. This was much higher than the average growth rate of 2.2% across the 30 cities tracked by Savills.

Ask me anything

Explore related questions