According to protothema.gr, Labour Minister Niki Kerameous proposed — and effectively secured — a raise of €50, bringing the minimum wage from the current €830 to €880. It is worth noting that the government has committed since 2023 to raising the minimum wage to €950 by 2027, a target that appears achievable given the current pace of increases.

This new minimum wage will also directly affect the public sector, as starting April 1, 2025, the entry-level salary for public servants will be aligned with the private sector’s minimum wage. For this reason, Finance Minister Kyriakos Pierrakakis has jointly recommended the increase alongside the Labour Minister.

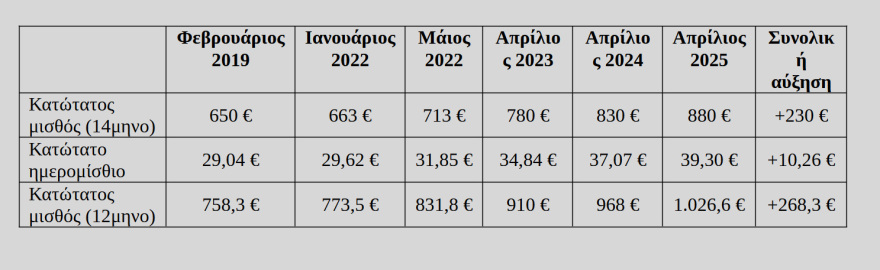

As government sources note, with the new increase, the minimum wage will be 35.4% higher compared to 2019.

Specifically, following a proposal by the competent Ministers in the Cabinet, the minimum monthly wage will increase from €830 to €880—a percentage increase of 6.02%—and there will be a corresponding increase in the minimum daily wage from €37.07 to €39.30. The new minimum wage will take effect on April 1, 2025. The primary goal is to boost the disposable income and purchasing power of wage earners, support workers, improve living standards, and further stimulate the country’s economic growth.

This marks the fifth increase in the basic wage since 2019. The cumulative increase over six years reaches 35.4%. The gain for workers now amounts to the equivalent of roughly five additional 2019-level minimum wages per year. Moreover, the total increase of 35.4% since 2019 is nearly double the cumulative inflation rate over the same period, which stood at 18.1%. This means that workers’ real income is significantly protected.

Greece now ranks 11th among the 22 EU member states that have a statutory minimum wage. The government’s target is to raise the minimum wage to €950 by 2027.

More than 1.6 million people will directly benefit from the increase in the minimum wage and daily wage, including:

- Over 575,000 private-sector employees currently earning the minimum wage,

- Public sector employees, who will also see a salary increase,

- Individuals receiving benefits tied to the minimum wage (such as maternity, marriage, parental leave, and unemployment allowances), as well as seniority bonuses.

This year’s increase is accompanied by an institutional shift: for the first time, the protection of the minimum wage extends to the public sector, as it will serve as the entry-level salary bracket for civil servants. As a result of this linkage, public sector salaries will increase across the board by €30 this year, with further increases expected in the coming years.

Taking into account all salary-related interventions for public servants since 2023, the average annual increase amounts to €2,283, which is equivalent to 1.3 additional monthly salaries per year.

Indirectly, the minimum wage also influences the formation of the average wage.

At the same time, government sources noted that this is the first application of the recent law on setting the minimum wage, which enhanced the role of social partners in the process and, for the first time, includes public servants. The minimum wage now acts as a safety net for all workers in the country, as the new law stipulates that it can no longer be reduced.

It is also noted that starting in 2028, the minimum wage will increase automatically based on a mathematical formula that will take into account objective ELSTAT data on inflation and productivity growth.

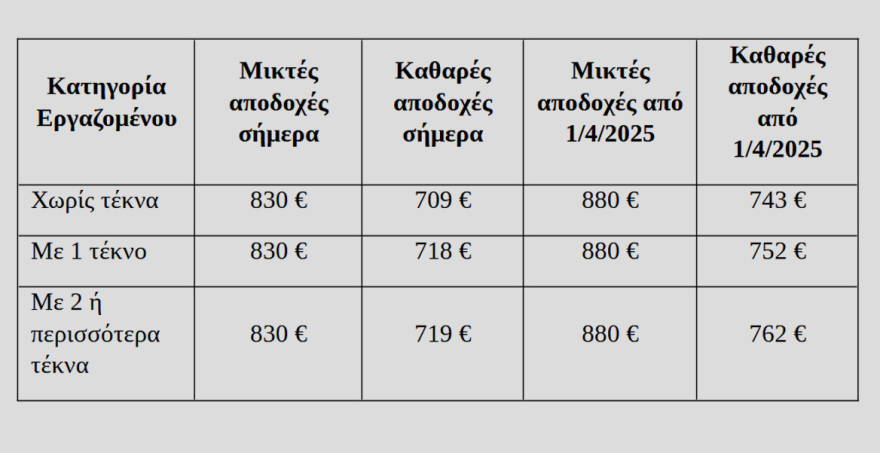

Examples:

- The gross increase in the minimum wage that will take effect on April 1, 2025, will amount to €50.

- This corresponds to a net monthly increase of €34 for employees without children and no other income, and €43 for employees with two or more children and no other income, after insurance contributions and income tax.

- On an annual basis (14 monthly salaries), the net benefit amounts to €473 (for those without children) and €606 (for those with two or more children).

- In total, since December 2019, these employees receive an additional net €195 per month (without children) and €215 (with two or more children), or €2,735 to €3,010 annually.

Ask me anything

Explore related questions