He belongs to one of Turkey’s most powerful families. The fortune of the 94-year-old patriarch is estimated at $2.8 billion, placing him at No. 1305 on the Forbes list. The total family fortune exceeds $6 billion. Koç Holding employs over 130,000 people and owns more than 100 companies (refineries, the automotive firm Tofaş, as well as companies in retail, tourism, shipping, etc.) and owns the fourth-largest private bank in Turkey.

He also owns the Mytilene marina in Greece through Setur Marinas (a joint venture with FF Group), a company that operates 11 marinas in Turkey. Koç has a special connection with the island of Lesvos, where he also owns a private residence. He restored an old olive mill and turned it into a cultural center. During his tenure as president of the Greek-Turkish Chamber of Commerce, bilateral trade tripled, reaching $900 million. In 2003, he handed over the reins of Koç Holdings to his eldest son, Mustafa, who sadly died of a heart attack at just 56 years old in 2016. Leadership then passed to his brother Ömer.

Rahmi Koç remains honorary president of the group.

As a child, he dreamed of traveling the world. In 2006, he completed a two-year continuous voyage aboard his sailing yacht “Nazenin IV.” He lives in a seaside mansion on the Bosphorus, named after Polish count Leon Ostroróg, an expert in Islamic Law.

Ferit Şahenk: Withdrew Due to Financial Problems

The Şahenk family, owners of Dogus Group, entered Greece around the same time as Koç, making major investments before eventually pulling out. The group, under billionaire Ferit Şahenk, had operations in construction, tourism, and marinas in Greece—owning half of the Hilton, half of the Astir Palace, and marinas in Vouliagmeni, Flisvos, Gouvia (Corfu), Lefkada, and Zea. Today, its footprint in Greece has shrunk to a small advisory services company with minimal activity.

Greece wasn’t the cause of Dogus’s troubles. The empire began to wobble around 2017–2018 due to massive and ultimately unsustainable debt, reaching $5.1 billion. In an effort to manage this, Şahenk signed a challenging debt restructuring agreement with creditor banks, which required him to sell off many assets. The group divested mainly from international properties and holdings, including luxury hotels and tourist complexes in Greece (“Astir Palace,” “Athens Hilton,” marinas) and Italy (“Capri Palace,” “Aldrovandi Villa Borghese”). He also sold his stake in Turkey’s Garanti Bank to Spain’s BBVA for $5 billion.

Dogus continues to operate, focusing now on hotels, marinas, and restaurants within Turkey. Yet problems persist. Recently, due to a €1.02 billion debt, it risked losing Galataport in Istanbul. The loan, issued in 2016, was for constructing a massive 400,000 sq. m. mixed-use development on the Karakoy coast, including Istanbul’s cruise terminal, 250 shops and restaurants, a hotel, a modern art museum, and entertainment venues. Despite its prime location, Galataport struggles to meet projected revenues and cash flows, which require 25 million visitors and 1.5 million cruise passengers annually.

Despite the setbacks, 61-year-old Fenerbahçe fan Ferit Şahenk remains the 7th richest person in Turkey and No. 1305 on the Forbes list with $2.8 billion. And he’s not the only one—among the 30 Turkish billionaires on the list, three are Şahenks. His 58-year-old sister Filiz, with the same net worth, leads the group’s tourism and fashion branches. Their 79-year-old mother Deniz, widow of founder Ayhan Şahenk, holds $1.5 billion.

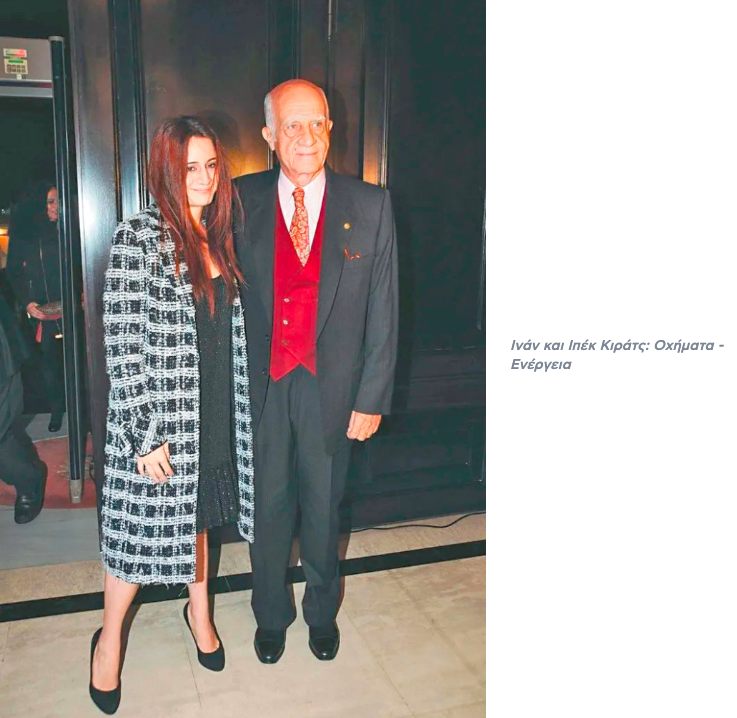

İnan and İpek Kıraç: Entry into the Greek Market with Buses

Recently, the first of 200 compressed natural gas buses (12 meters long) by the company Menarini began arriving at OSY’s depot in Rentis, Athens. Menarini is the former Industria Italiana Autobus (IIA), whose shareholders included Invitalia (a state investment fund – 42.76%), Leonardo (state-owned – 28.65%), and Turkish Karsan (28.6%), owned by billionaire İnan Kıraç. This was the ownership makeup when the contract for the 200 buses was signed in January 2024, marking the Kıraç family’s indirect entry into the Greek market. However, IIA has since been acquired by Italian industrial group Seri Industrial.

İnan Kıraç amassed wealth through his marriage to Vehbi Koç’s daughter. He worked at Koç Holding, climbed the ranks, and in 1998 founded Kıraç Holdings, acquiring majority stakes in Karsan and Kiprart while retaining key positions at Koç Holding. Kıraç Holdings is active in automotive and energy, and Karsan supplies electric buses across Europe (Spain, France, Germany, Belgium, Bulgaria, Ukraine), with plans to expand into Greece.

According to the Nordic Research Monitoring Network, his success may not be solely from clean business practices, as his name has appeared in shadowy political and military dealings and in the Pandora Papers.

Leadership has now passed to his adopted daughter from his first marriage, 40-year-old İpek Kıraç, the richest woman in Turkey with a $3.2 billion fortune. The two are in legal dispute, as 87-year-old İnan recently married Emine Alangoya, a longtime executive in the company’s finance department.

Mustafa Küçük: The “Turkish Zara” Aiming for the Top

Among Turkish retail chains active in Greece, LC Waikiki stands out—currently leading the pack and known as the “Turkish Zara.” The chain has 13 stores across the country (Athens, Piraeus, Patras, Heraklion, Alexandroupoli, Larissa, etc.), starting in Xanthi in 2018 with plans to reach 30 by 2026. Globally, it operates 1,300 stores in 61 countries.

Owned by billionaire Mustafa Küçük, whose net worth is $2 billion, LC Waikiki aims to rank among the top three apparel retailers in Europe, competing with Spain’s Inditex (Zara, etc.) and Sweden’s H&M. Its motto: “Everyone deserves to dress well.” In 2023, the chain had a turnover of €33.2 million—up 43.7% from €23.1 million in 2022. The brand’s name combines Hawaii’s famous beach and “LC” from the French “Les Copains” (The Friends). Küçük acquired it in 1997 from its French founder, designer Georges Amouyal, who had run it for 12 years.

Cemil Kazancı: Balkan Business from a Major Competitor

Another Turkish tycoon—Turkey’s second richest—is 64-year-old Şaban Cemil Kazancı, worth $4.3 billion. He owns Kazanci Holdings, a dominant energy giant in Turkey with international operations, including in Northern Cyprus and North Macedonia. He’s seen as a formidable rival to Greek energy groups, especially for Balkan energy projects.

While it’s early to draw conclusions, a sequence of events in North Macedonia’s energy sector seems more than coincidence. In early January 2024, the government abruptly canceled the billion-euro tender for the Chebren hydroelectric plant, which had been awarded to a PPC-Archirodon consortium. Of the nine original bidders, two were Turkish.

Soon after, Prime Minister Hristijan Mickoski, alongside Kazancı, announced a new €1 billion, 500 MW thermal power plant project to be built by Kazancı’s AKSA Energy. AKSA had not participated in the original hydroelectric tender but is now expected to be the frontrunner when the tender is relaunched—for the 15th time—likely influenced by diplomatic interests.

Ask me anything

Explore related questions