An unprecedented tax storm, with increases in tobacco excise tax reaching a staggering 1,090%, is about to break out in the pockets of millions of Greek and European citizens.

The European Commission and an alliance of 15 member states, led by France and the Netherlands, are strongly pushing for a radical revision of the Tobacco Excise Tax Directive (TED).

Especially in Greece, where the average retail price of cigarettes is currently 50% to even 70% lower compared to many other countries (such as the UK, Ireland, France, the Netherlands, etc.), the proposed pan-European increase of the minimum tax could drive the retail price of a pack to Luxembourg or Germany levels, over 6 or even 7 euros.

Not only traditional smokers are in Brussels’ sights, but also users of the tobacco industry’s alternative products, such as heated and electronic cigarettes.

The proposal, as revealed by an internal Commission document (see the full proposal here), provides for a sweeping increase in minimum tax rates on tobacco products across the European Union.

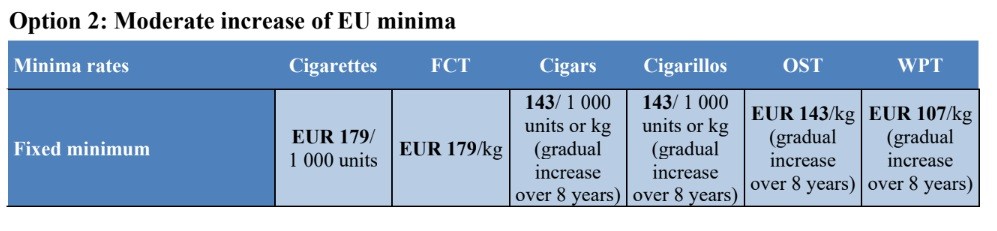

The proposed increases in excise tax per product category are as follows:

Cigarettes: 139% increase, from 90 euros currently per 1,000 cigarettes, to 215 euros. The new minimum taxes proposed by the Commission would raise prices by 2–3 euros per pack.

For example: today, a 20-cigarette pack sold at 4.60 euros includes taxes of 3.74 euros (81.3% of the price), of which 1.65 euros is the fixed tax. If this rises to 4 euros (by 139%) and carries along the embedded VAT included in the final price, the total of all taxes (fixed excise tax, proportional excise tax, and VAT) will exceed 6 euros, with the final price reaching or surpassing 7 euros per pack.

Rolling tobacco: 258% increase, from 60 euros per kilo to 215 euros. This proposal essentially aligns its taxation with manufactured cigarettes, eliminating the price advantage it enjoyed until now.

In practice, the excise tax on a 30-gram pouch will rise from 1.8 euros of its price to 6.45 euros. Together with embedded VAT, this will burden the price by nearly 5 euros!

Cigars and cigarillos: the most explosive increase, reaching 1,090%, from 12 euros per 1,000 pieces or kilo to 143 euros. The price of a 10-cigarillo pack will automatically rise from around 2 euros to 3.30–3.50 euros.

Where there’s smoke (and vapor), there will be tax

The plan on the table spares no tobacco or nicotine product.

Specifically:

■ Heated tobacco products: proposed tax of 108 euros per 1,000 pieces or 155 euros per kilo. Although the Commission calls this a “moderate approach,” it results in a 2–3 euro increase per pack, similar to conventional cigarette prices.

■ Electronic cigarettes: proposed tiered tax based on nicotine content: 0.36 euros/ml for liquids with nicotine content above 15 mg/ml and 0.12 euros/ml for lighter ones. It is estimated this will lead to a roughly 1-euro increase.

■ Nicotine pouches: proposed taxation at 143 euros/kilo.

■ Hookah tobacco: the proposed tax is lower than that of cigarettes, at 107 euros/kilo.

Tax revenues in smoke, inflation on fire

Athens is observing developments from a distance, likely aware that a final decision requires unanimity, which signals tough negotiations between member states.

Countries such as Italy and Romania are already expressing skepticism about Brussels’ rhetoric, which on one hand invokes public health reasons but on the other overlooks:

■ the inflationary consequences of tax increases,

■ the specter of economic slowdown in the EU due to Trump tariffs,

■ the risk of increased cigarette smuggling, which last year alone deprived public coffers of 14.9 billion euros across the 27 EU countries, according to KPMG’s annual pan-European study “Illicit Cigarette Consumption in Europe 2024.”

Notably, the current Commissioner for Taxation, Wopke Hoekstra, was five years ago the Dutch Finance Minister who significantly raised the tobacco excise tax.

The result? Cigarette smuggling in the Tulip Country tripled in five years (from 6.2% in 2020 to 17.9% in 2024), with lost public revenues reaching 869 million euros, according to KPMG’s report. The Netherlands even surpassed Greece in cigarette smuggling (!), as illicit cigarettes in our country fell to 17.5% in 2024, with state revenue losses significantly reduced to 438 million last year from 624 million euros in 2023.

Similarly in France, which is leading the charge in raising cigarette taxes, smuggling skyrocketed to 37.6% last year from 23.1% in 2020, with staggering losses in state revenues, amounting to 7.2 billion euros in 2023 and 9.5 billion in 2024.

Ask me anything

Explore related questions