Greek MEP Nikolas Farandouris, a member of the European Parliament’s Budget Committee, made a statement from Brussels regarding Eurostat’s newly published poverty indicators.

“In the European Union, the average share of citizens who cannot make ends meet stands at 17%. In Bulgaria, it’s 37%. And in Greece, 67%. Seven out of ten Greeks say they are becoming impoverished and cannot cope with their income. Do these figures honor us?”

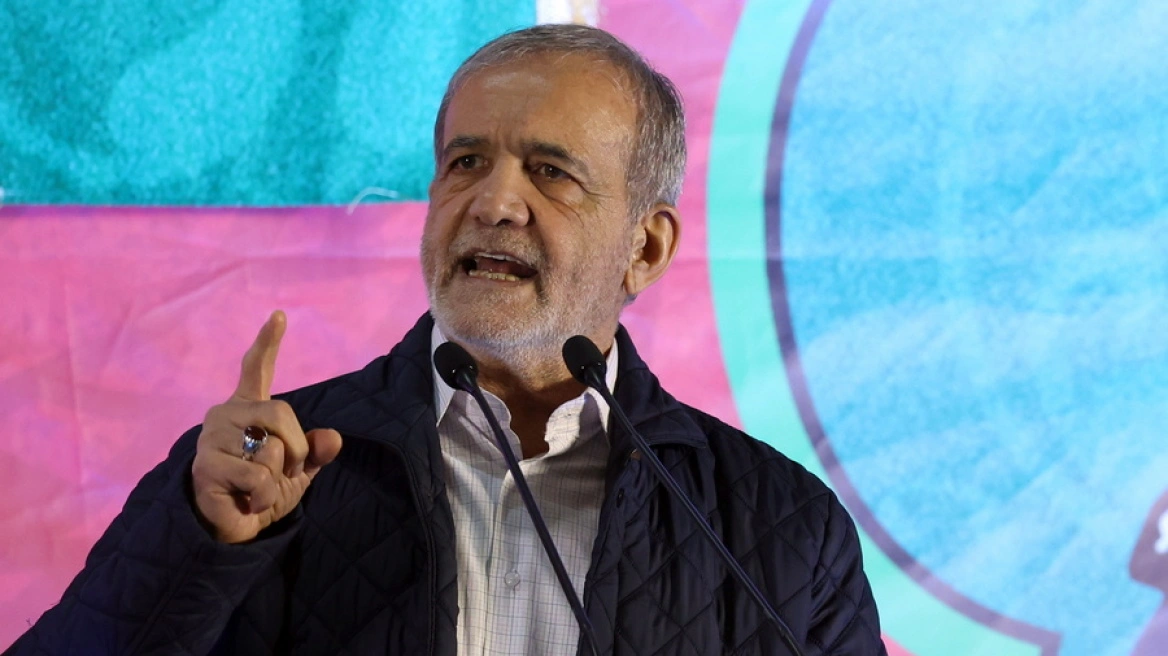

— Nikolas Farandouris, MEP

The Government Should Examine Other EU Budgets

Farandouris urged the Greek government to study the 2026 budgets of other EU member states that have been submitted to the European Commission.

“I have before me the budgets of other Member States, and I can see what they are doing. The Greek government, by choosing not to touch the windfall profits of banks and their excessive dividends—as other countries have done—deprives citizens of over €7 billion in potential relief,” he said.

According to the MEP:

- Italy has officially included in its 2026 Budget a plan to collect €11 billion from banks and insurance companies over the next three years.

- Austria, Slovenia, and the Netherlands foresee higher corporate tax rates or one-off levies on companies with excess profits.

- Austria and Latvia have introduced increased taxation on dividends.

Thanks to these additional revenues, governments in those countries are able to relieve citizens and stimulate their economies through measures such as:

- Reductions in fuel excise duties (Netherlands, Slovenia)

- Cuts in VAT on food (Ireland, Cyprus, Latvia, Italy)

- Reductions in personal income tax rates (Italy, Portugal, Estonia, Germany, Malta, Netherlands)

- Increases in minimum guaranteed income (Portugal, Germany)

- More hiring and higher pay in healthcare (Italy)

- Salary raises for public sector workers (Italy)

- Higher disability benefits (Estonia)

- Pension increases (Estonia)

“Why doesn’t Greece do the same?” Farandouris concluded.

“Poverty and Inflation Are the Result of Policy Choices”

According to Farandouris, the worsening cost-of-living crisis and increasing poverty are due to the lack of market oversight and the absence of targeted fiscal measures and interventions.

He pointed out that in Q2 2025, Greece’s tax revenue from products (VAT, excise, etc.) as a share of GDP reached 14.5% — the second-highest level since 1999 (the highest was in 2022, at 14.6%).

“This shows that during the entire period of the cost-of-living crisis, the government has chosen to rely on excessive tax revenues instead of offering relief,” he said.

Ask me anything

Explore related questions