Hello, the…composure and methodical approach that I wrote yesterday the government was supposedly showing in dealing with the blockades did not appear at all; clearly it was a wrong assessment. Judging from the images we saw in Crete, the situation got out of hand at Heraklion airport (I don’t remember runways and taxiways being occupied for years) but also elsewhere, with smashed patrol cars and beaten police officers. Unfortunately, crime in Crete — the…favorite of all governments from the junta onwards — has reached other levels, and the fact that lawlessness prevails is not something we learned only yesterday. The vendettas and the heavy weaponry on the one hand, and the OPEKEPE scandal in which the “Land of the Brave” stars by far on the other, show political choices and behaviors that have left their negative mark for many decades. Otherwise, obviously the “softly” system chosen at the Maximos Mansion for the farmers is not working. People, public opinion, are not stupid: they know that the Cretan tough guys are not exactly disadvantaged, hungry farmers — and they are also outraged by the ostrich-like tactics the government is following. So, since we are still at the beginning of the agricultural “mobilizations” (or acts of bullying), it would be best to address the issue as it is, and not as they would like it to be.

The reaction of the Maximos Mansion

Now, as I said, the Maximos Mansion did not like at all the image Crete projected, because they understand that there is more to come in the rest of Greece with the farmers’ “mobilizations.” Mitsotakis called Chrysochoidis as well as everyone involved, demanded arrests, and told him that from today there should be zero tolerance for any unlawful act. This constitutes a change of course, because the government had agreed to go easy on the farmers for a few more days. Well, after the fiasco…

Time for the opposition…

All weekend the opposition leaders paraded through the farmers’ blockades, from Famellos and Koutsoumbas to Velopoulos and Natsios. They say, “now the issue sells, let’s go too.” Only our leader Nikos had stayed off camera, and only a small PASOK team had gone to the blockades, but today… he takes back lost ground and heads out into the Plains. He will go to the E65 in Karditsa and then to Trikala. Let’s see the needle move…

The kilos and the money

It was no accident, perhaps for the first time, that the Maximos Mansion responded to Karamanlis’ “barbs” regarding agricultural policy. After all, it hasn’t been that long since there was a party going on in the agricultural sector. Recently, in his book, Ambassador Vasilis Kaskarelis — who headed the Permanent Greek Representation in Brussels — recounted his tragicomic experiences with then–Minister of Agriculture under Karamanlis (of Rafina) Sotiris Hatzigakis, who in 2009 came to Brussels with a little niece of his (he wanted to “teach her the job”) and asked for approval of €500 million in compensation for farmers. Brussels of course told him “no,” but Hatzigakis was not discouraged, since he had already signed the ministerial decision before setting off to see the “dumb foreigners”! In this vein, spokesperson Marinakis and parliamentary representative Makarios Lazaridis appeared yesterday with… a self-critical disposition, far from the “all the kilos, all the money” logic that has traditionally electrified the farmers’ blockades.

Karamanlis’ kite and the other guys…

Amid the general gloom of yesterday’s sad incidents, there was also a very interesting and rather amusing gathering on the occasion of the 15th anniversary of the newspaper Dimokratia, to which we wish many happy returns. The combination of guests was what made eyes pop: for example, Karamanlis with Venizelos, Samaras with Lazopoulos, Dendias with Kammenos, Laliotis with Aris Spiliotopoulos, and many more politicians together. I fear the only thing uniting them is their deep hatred for Mitsotakis combined with the loss of power. Nevertheless, I must admit I find it exceedingly civilized for them to attend a media event.

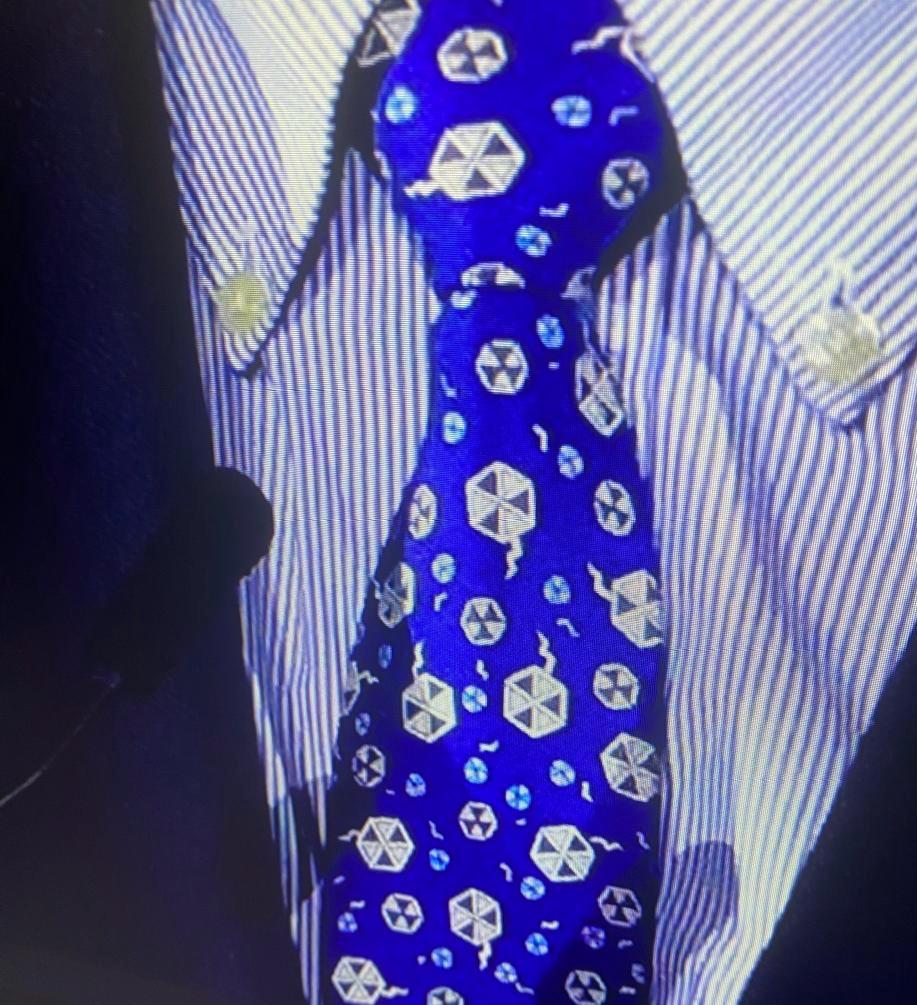

Cat with a kite tie…

I listened intermittently to their speeches and singled out Karamanlis’. The truth is that my eye first fell on his tie, which had kites on it! And I realized that the… flying of kites for beloved K.K. of Rafina was a way of life since his premiership. After all, we all felt it thoroughly since we got hit with two memoranda on the head thanks to the deficit and debt of the “golden era” of his tenure. I found interesting, but also strange, a part of his speech stating that “in the previous 60 years political formations with tradition and history, with moderate discourse and program, predominated, ensuring smooth alternation of power and political stability; in recent years we see the exact opposite phenomenon. The traditional formations are becoming marginalized and evaporating, while sharper, sometimes extreme voices take the upper hand.” Truly, who contributed to the marginalization of the traditional formations, one wonders — perhaps he himself? Because if we hadn’t gone off the rails, Tsipras wouldn’t have even seen the Parliament usher. Not to mention that later he also lent a hand supporting SYRIZA’s levers with Mimis and Prokopis. At any rate, the party founded by his late uncle, despite the diligent efforts of himself and other fellow diners, won 41% in the elections and today leads PASOK by 15 points in the polls.

They’re looking for extra money

Keep in mind that the Maximos Mansion in general is “searching” for ways to subsidize farmers, even with specific limitations, for the loss of income due to very low purchase prices of their products this year. Coordination with the Commission is obviously required, so that it can be properly justified why we compensate and why this does not constitute state aid, but overall the exercise is underway. However, my source told me to be “reserved” and not get… enthusiastic about the amount of potential extra support, especially since these days €180 million are being paid out from the so-called “Measure 23,” which concerns agricultural income loss due to natural disasters.

Kopelouzos announcements for a €450 million investment

Washington appears determined to maximize LNG exports to Europe, something that strengthens the prospects for new energy infrastructures and FSRUs in Greece, while interest in the ports is strong, with Volos and Alexandroupoli at the forefront. Already, Dimitris Kopelouzos is expected next week to unveil the investment plan for a new FSRU in Alexandroupoli worth €450 million, while the market is watching the next moves for other similar projects that could become a crucial link in the energy corridor of Southeastern Europe. If the above processes result in binding agreements, Greece will not simply remain a transit station for liquefied natural gas. It will evolve into an energy hub of the EU, will need more LNG infrastructure, and will gain greater negotiating power and an enhanced economic role in the new architecture of Europe’s energy security.

Exarchos’ trip to the USA

Aktor Group’s and DEPA Commercial’s effort to secure additional LNG quantities from the United States is part of a broader plan to upgrade Greece’s energy profile. The agreement with Venture Global, signed in early November, covers the 2030–2050 period, but needs begin as early as 2026, so the search for two or even three additional suppliers—as Alexandros Exarchou said yesterday—is not optional but necessary. The goal is for Greece to “lock in” a role as an entry gate for American LNG to Eastern and Central Europe, at a time when the EU is accelerating its disengagement from Russian gas and Ukraine is under suffocating energy pressure after extensive destruction of domestic production. The main vehicle for the new partnerships will be Atlantic See LNG Trade, through which new LNG supply and export deals will proceed. The company is considering not only chartering but also building its own vessels, aiming to create a fleet that will offer autonomy and operational flexibility for cargo transport.

The White House invitation

Alexandros Exarchou has been in the United States since last Saturday, invited by the White House to attend the John F. Kennedy Center for the Performing Arts event, together with members of the U.S. government, top entrepreneurs, multinational executives, Senators, and President Trump. But the trip was not limited to the social event. On the contrary, it had clear energy content, with all of yesterday devoted to meetings with senior White House officials regarding prospects for supplying American LNG and developing new partnerships. Energy Minister Stavros Papastavrou was also in Washington in recent days, returning today after meetings with energy giants, including ConocoPhillips, with whom DEPA Commercial was known to have been in discussions in the past. The market estimates that there is an increased chance of returning with tangible results, as the CEO of Aktor said yesterday that two or even three suppliers are in the picture, since larger quantities will be needed than those Venture Global can guarantee.

The stables of Lemos

Alexander Michael Lemos, as recorded in official documents, is the sole shareholder of the company “The Thyni,” which was established last Friday, December 5. The company is headquartered in Piraeus at 35–39 Miaouli Coast, in the well-known Lemos Maritime Building, and its stated purpose includes many and various activities, with the main one being animal stabling services, and ranging from organized tours with accommodation, to the wholesale trade of horses, oils and other produce, saddlery items, as well as lodging services in spaces functionally integrated with agricultural operations, short-term property leasing, and more. The initial share capital is €200,000, paid in cash by Alexandros Lemos (son of Michael), who received 200,000 company shares with a nominal value of €1 each. In other words, a Lemos who is looking not only at maritime business but also at land-based business…

The Indian’s political commentary

We told you yesterday about the party hosted by Indian businessman Taizoon Khorakiwala of Switz Group at the Ekali Club, but his political insight was also interesting. “My view of Greece is actually that, in contrast to the United Kingdom, Germany, France and even the United States, the two ends of the political spectrum are essentially weakening or remaining at about the same levels. And the center of politics, meaning center-left or center-right, is actually quite strong and very stable,” he said. And he continued: “When we invested here in Greece, you had the most left-wing prime minister the country ever had in that sense. And he adopted austerity measures which, in my view, no prime minister in the Western world had ever adopted! And after him, we had a right-wing prime minister, Mitsotakis, who was re-elected with an even greater majority. And he raises minimum wages, which is a left-wing position! So, we actually find that pre-election they may say anything. But when they come to power, they adopt policies that are good for the country. And that’s what makes it very attractive for us—that there are rational people at the center of politics. They fight to win votes and get elected. But when they get power, they do good things for the country.” A little earlier, he reminded that when Switz Group decided in 2015 to enter the Greek market “there were capital controls, demonstrations, and talk of the country exiting the Eurozone and returning to the drachma,” explaining that as a contrarian he followed his instinct about the long-term opportunities created by the country. Today, as he said, “the whole world considers Greece investable. All the private equity funds—and many of them are here tonight—are now very active in Greece.” And this now makes it harder to find acquisition opportunities. “Deals are becoming more and more expensive. And we will probably focus much more on organic growth from here on,” he stressed.

The strategy of patience

George Giouroukos and the listed Global Ship Lease show that a strategy of patience and strong financial footing bears fruit. The recent acquisition of three Korean-built 8,600-TEU containerships, aged 12–13 years, for $90 million proves that GSL takes advantage of opportunities in a discounted market, buying three ships at the price of one charter-free vessel. With eco-upgrades and multi-year charters to major liner companies, the ships offer predictable income and low risk, while also creating room for significant future profits. The fact that GSL paid in cash shows determination while preserving the option to add financing after the deal’s completion. International stock analysts note that this move signals three key things: Exploiting market opportunities: the company buys assets at a discount with large upside potential. A strategy of patience: GSL takes advantage of the cyclical nature of the market, having previously sold older vessels and now investing in newer, larger, and more efficient ones. Strengthening future position: increasing its fleet to 71 ships with long-term charters creates stable income and offers security to shareholders. Overall, Giouroukos’ moves are not merely ship purchases; they are strategic placements reflecting a long-term approach to value and performance, something any Wall Street analyst would observe carefully.

Why shipping is no longer a sure bet

There is a strange mood on Wall Street: everyone recognizes that freight rates remain high, shipping companies have strong cash reserves, and dividends are flowing. Yet investors hesitate. The phones of shipping analysts ring less, and major institutional players seem cautious. What’s going on? According to top fund managers, the biggest fear is that shipping has reached the peak of its inefficiency. In other words, the geopolitical upheavals that sent profits soaring—such as the Red Sea crisis, the Russia–Ukraine war, and U.S.–China trade tariffs—may start easing in 2026, causing revenues to fall. One Wall Street analyst put it bluntly: “If the world becomes calmer, shipping loses money. And no one invests to bet on global calm.” Additionally, there is another factor not discussed publicly but circulating at closed fund-manager dinners: shipping currently has no “story.” Investment funds need a narrative to justify their positions—something appealing, something that explains why a sector will “run.” Last year, the story was logistics disruptions. Before that, the green transition. Now? Nothing that “sells” politically or on the stock market. Add to that the volatility of the stocks, which in many cases don’t even follow the fundamental reality of freight rates. A typical example is the companies with VLCC supertankers: freight rates are soaring, but the shares remain frozen in anticipation of peace in Ukraine.

Unloading old ships

The capesize market—large dry-bulk carriers—is on an upward trajectory, giving major Greek-owned shipping companies the chance to dump their older vessels at very good prices. George Economou’s TMS Dry sold the 19-year-old Pompano for just over $20 million, showing that even high-age ships with scrubbers and a completed survey are in demand. Similarly, the Golden Union group of the Theodoros Veniamis family managed to sell the 16-year-old Cape Providence for around $28 million, upgrading the price from the $26 million they had been offered in October, thanks to the continuing bullish sentiment for capesizes and demand from China. The freight market remains positive for large vessels. High charter rates and strong demand for ships aged 15+ years create opportunities for profit without requiring immediate investment in newbuilds. Overall, Greek shipowners such as Economou and Veniamis appear to be exploiting the current market momentum with strategic moves that maximize the value of their older units without taking on the risk of uncertain future freight rates.

The “golden” refining margins boost Motor Oil and HelleniQ Energy

Global oil refining margins are at their highest levels in at least two years, and this is evident from the rally in the two Greek listed companies in the sector. Analysts at the Oil Price Information Service point out that diesel margins have surged to levels not seen since late 2023, mainly due to… disruptions in the supply chain. TotalEnergies reported that European refining margins (ERM) rebounded to $63/ton from the dismal $15/ton of the third quarter of 2024. Drone attacks on Russian refineries, scheduled maintenance, and stricter sanctions have created tightness in petroleum product markets. At the same time, European demand for middle-distillate fuels remains resilient, while diesel inventories are drying up. In this environment, Motor Oil’s share price rose to €30.48 (+1.74%), above its 52-week high, with a market capitalization of €3.37 billion. Similarly, HelleniQ Energy is soaring to €8.63, with a market cap of €2.63 billion and a dividend yield of 8%.

Trump’s tariffs “inflate” global copper prices

The news is that 2025 may well go down as the “year of copper,” since international prices have surged to historic highs. Behind the headline lie Trump’s tariffs and the scramble by importers to secure the metal before the measures take effect. This created an incredible arbitrage, with London prices reaching a record $11,643 per ton, while on the U.S. COMEX copper trades at $5.37–$5.40 per pound, roughly $11,860 per ton. A rare strategic shift of inventories is taking place. The COMEX warehouses—a large network of approved storage facilities for the U.S. Commodity Exchange (part of CME Group)—have become the epicenter of the tremors. Since last February, inventories there have risen +87%, reaching 174,607 tons in May, the highest level since 2018. Official data show that by autumn more than 600,000 tons of copper had accumulated in U.S. warehouses. Thus, an unprecedented 30% premium opened between COMEX and LME prices, when historically the difference was just 0.5%. Amid all this, the International Copper Study Group announced that it expects the projected 2025 production surplus (178,000 tons) to turn into a deficit due to production shutdowns in Congo and Indonesia.

A new episode in the Netflix saga

David Ellison’s Paramount Skydance became angry with Ted Sarandos’ offer for Warner Bros. Discovery and yesterday announced a hostile takeover bid of $30 per share. All this just four days after Warner Bros. Discovery announced its deal with Netflix. Paramount’s offer is “all cash” and values WBD at $108.4 billion. In other words, it offers a 139% premium (!) over the average share price of the past three months. To prove they mean business, Paramount secured binding financing of $54 billion from Bank of America, Citi, and Apollo, while the Ellison family and RedBird Capital will also contribute their own funds. Paramount’s bid puts $18 billion more cash on the table than Netflix, which had offered $27.75 per share (but only $23.25 in cash and $4.50 in stock). A very critical difference is that Paramount wants the entire WBD, including CNN and TNT Sports, whereas Netflix wanted to buy only the studios and HBO Max after spinning off the cable networks into a separate company. The offer expires January 8, 2026. Paramount promises $6 billion in synergies and quicker regulatory approvals, while the participation of Larry Ellison (net worth $266 billion) adds credibility to the proposal.

The SEC discovers the risk of over-leverage

The U.S. Securities and Exchange Commission (SEC) has identified a major risk and decided to curb the uncontrolled proliferation of leveraged financial products. The SEC sent letters to ETF providers that have recently been issuing highly leveraged products with 3× and 5× exposure, promising to multiply the daily returns of underlying indices by three to five times. The SEC makes it clear that products offering more than 200% leveraged exposure raise concerns at a time when market volatility has skyrocketed. Paul S. Atkins, sworn in as the 34th SEC Chair on April 21, 2025 by President Trump, is making a desperate and belated attempt to fix the market after the destructive losses caused by the phenomenon of “compounding decay” over multi-day horizons. Highly leveraged ETFs require constant portfolio rebalancing, creating artificial market pressures that can amplify fluctuations. In times of crisis, this can act as a panic accelerator. On the other hand, leveraged-ETF managers invoke “market freedom,” noting that leveraged products are extremely profitable.

Ask me anything

Explore related questions