Festive family tables traditionally serve as a point of reconnection. In the business world, however, it is not uncommon for the holidays to coincide with new episodes in family conflicts that have been pending for years—conflicts that do not remain within the family sphere but spill over into courtrooms, affecting companies, shareholders, and employees.

During the holiday season, the latest—and so far most serious—episode is unfolding in the long-running legal dispute within the Rammou family, which controls Market In. For the first time, the conflict has entered the criminal sphere, opening an investigation into actions taken by the company’s management.

The confrontation began shortly before the death of founder Thomas Rammos in March 2021 from complications of COVID-19 and has since evolved into a prolonged family civil war.

The case dates back to November 2020, when the company planned to acquire four unfinished maisonettes in Keratea through a bankruptcy liquidation process. According to a lawsuit filed by Margarita Rammou, a minority shareholder with a stake of approximately 29.5%, the bid of €151,000 was paid with money from the company’s cash reserves.

However, the buyer listed was not Market In itself but her sister Evlambia (Evi) Rammou, chairwoman and CEO of the company and majority shareholder with approximately 50.75%. The case was initially shelved, but following an appeal it was reopened and criminal prosecution was ordered for breach of trust, with alleged damages exceeding €120,000 and estimated lost profits of around €639,000 from the future exploitation of the properties.

The “civil war” essentially began after the death of founder Thomas Rammos on March 14, 2021. Since then, Margarita Rammou has filed a series of lawsuits seeking to annul decisions of general assemblies and boards of directors, with the main battleground being the management of the group’s real estate assets. At the center are leases of properties in Lefkada to a related company, which—according to the minority shareholder—were approved without serving the company’s interests.

At the same time, an application for an extraordinary management audit has been filed, focusing on critical financial actions: the reduction of share capital by approximately €4 million in 2018, the €6.6 million bond loan in 2019, as well as accounting treatments of a receivable from the Karipidis Bros retail chain. Management rejects the allegations, speaking of lawful corporate decisions and abusive behavior by the minority.

Today, the dispute has evolved into a multi-front legal war, with civil and criminal dimensions, directly affecting the company’s operations and future.

The judicial “matryoshka” of Pavlidis Marbles

The family confrontation at Pavlidis Marbles has developed into one of the heaviest business legal sagas of recent years, against the backdrop of a conflict involving hundreds of millions of euros and scrutinizing how ownership changed at the country’s largest marble company.

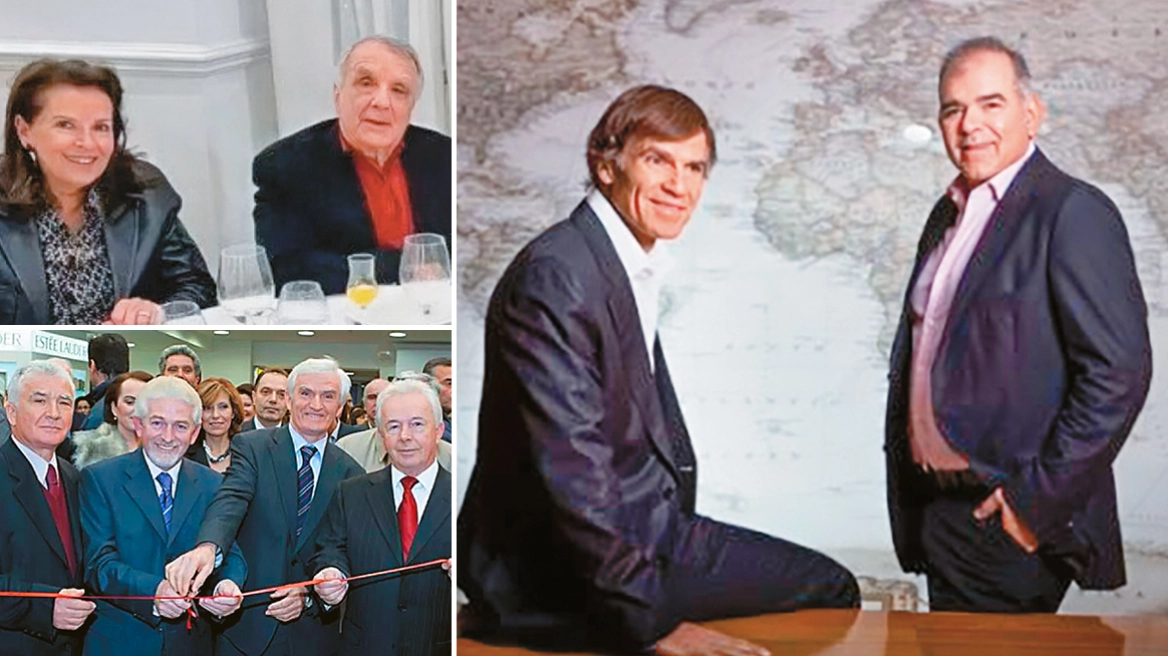

Siblings Kyriakos and Christina Pavlidis have taken legal action against their brother Christoforos Pavlidis, claiming that they consented to the sale of the company but were misled about the true terms, structure, and consequences of the transaction. At the center is the sale of Pavlidis S.A. – Marbles & Granites to the fund ECM Partners at a valuation approaching €260 million—a value that, according to them, fell significantly short of the company’s true potential.

According to their filings, the business—with exports to more than 40 countries, strong quarry reserves, and high production potential—should have been valued in the range of €500–600 million or even higher. A few months after the sale, Christoforos Pavlidis is said to have repurchased control of the company from the same fund through corporate vehicles, a move the plaintiffs describe as the pivotal point of the case.

The allegations brought before the courts include, among others, felony fraud, misleading shareholders, and manipulation of corporate acts, with estimated damages—according to the claimants—exceeding €200 million. Requests have also been filed for the delivery of critical corporate documents, interim measures, and independent financial and management audits.

For his part, Christoforos Pavlidis rejects the accusations, arguing that his siblings had full knowledge of the terms and structure of the transaction and that the sale to the fund was carried out with the consent of all shareholders and based on valuations he considers entirely reasonable for the market conditions at the time.

According to his position, the subsequent repurchase of the company was carried out with private funds and lawful corporate procedures, without violating the rights of other shareholders, while the allegations of deception and damage are attributed to a later reassessment of the agreed terms rather than to illegal acts. The case remains ongoing, with multiple open legal fronts.

Creta Farms: When the civil war opens the door to third parties

In the Greek business landscape, there are many cases where a family conflict did not remain at the level of shareholders or management but evolved into a destabilizing factor, ultimately leading to the loss of control of historic companies. Two characteristic examples, with different starting points but almost identical outcomes, are the Domazakis brothers at Creta Farms and the Malamatina family at the historic Malamatina winery.

In the case of Creta Farms, the family civil war between brothers Konstantinos (Takis) and Emmanuel (Manos) Domazakis escalated during 2017–2019, at a time when the company had already grown dynamically but relied on high bank borrowing.

Disagreements over management, strategy, and financing quickly turned into open conflict, with mutual accusations of mismanagement, allegations of illegal share transfers, and successive court actions. Testimonies at the time spoke of “personal grievances” and a family rivalry which, despite efforts by many family and non-family figures from Crete, created the perfect explosive cocktail.

The internal conflict quickly acquired a systemic dimension. Banks froze financing, suppliers hardened their stance, and the company was driven into a liquidity squeeze. In 2019, with the civil war unfolding publicly and deepening, the court appointed an interim administration, effectively removing the family from the helm. A restructuring process followed, with creditors playing a decisive role.

The result was the entry of the investment vehicle Impala Invest of Dimitris Vintzilais, which acquired control of Creta Farms through the Bulgarian group Bella Bulgaria. The family civil war did not end with an agreement between the Domazakis brothers, but with a complete change of ownership, leaving out the family that had created and developed the company.

A similar outcome, though with different internal dynamics, unfolded in the Malamatina case. Here the conflict did not manifest as a sibling dispute but as a shareholder and management war between Konstantinos Malamatinas and his former wife Katerina Malamatina, at a time when the historic winery was already facing high debt and liquidity pressures.

The confrontation, with strong personal and business elements, was accompanied by successive legal actions and an inability to form a common front toward the banks. The lack of a unified strategy deterred any internal restructuring effort, while the company lost time and credibility at a particularly critical moment for the sector.

The result was Malamatina’s entry into a going-concern restructuring process, through which the company was acquired by the Mantis Group. The change of ownership sealed the multi-year conflict and led the Malamatina family out of control of the business that had been associated with its name for more than 100 years.

In both cases, the common denominator was not simply financial difficulty, but the fact that the family civil war accelerated developments, turning internal disagreements into a factor of systemic risk. When conflict becomes entrenched and no solution emerges from within, banks and creditors stop waiting—and the next day is shaped by third parties.

The Karnesis family: The civil war was stained with blood

In the Karnesis case, the family conflict took on a dramatic, almost tragic dimension. Here, the business war left not only financial and corporate scars, but real victims.

While most family disputes among Greek business dynasties are written into court files and general meeting minutes, the Karnesis case was also written in blood. In February 2024, at offices of a group company in Glyfada, a deadly incident carried out by a long-time trusted employee cost the lives of three people—including Maria Karnesi and Antonis Vlassakis.

This tragedy, regardless of whether it was legally linked to the intra-family dispute, indelibly marked a family “civil war” that was already unfolding in the courts over assets worth hundreds of millions of dollars.

The Karnesis family is one of the most characteristic examples of a shipping dynasty that moved from unity to rupture and from there into one of the heaviest family legal battles of recent years. The five siblings, children of a butcher from Elefsina, built from the late 1970s a dynamic shipping group of product tankers through European Navigation and European Product Carriers, before expanding into energy through Elinoil.

For years they operated as a unified business entity. The balance began to unravel after the death of Prokopis Karnesis in 2011, who was considered the family’s binding force. The open rupture came in late 2022, when sisters Despina and Maria Karnesi, together with the husband of the former, Antonis Vlassakis, filed a 63-page lawsuit against Spyros Karnesis, alleging that he transferred $325.5 million from joint family accounts to a company under his exclusive control. According to the plaintiffs, these were undistributed profits from shipping activities, of which they claim at least $175 million was due to them.

Spyros Karnesis rejects the allegations, arguing that the assets in question belong exclusively to him and that his sisters were not equal business partners but employees within the family structure. The dispute has evolved into a multi-front legal war, with requests for asset freezes and a series of civil and criminal actions.

The case took a dramatic and tragic turn in February 2024, when at offices of a family company in Glyfada a deadly incident occurred, carried out by a long-time trusted Egyptian employee, in which Maria Karnesi and Antonis Vlassakis lost their lives.

The dispute remains ongoing, with assets estimated at more than $1 billion at stake, marking one of the most severe family wars in modern Greek shipping history.

Ellaktor: The breakup of a united front

The Ellaktor case stands apart from classic family civil wars, as the conflict did not unfold within a closed family circle but on the public stage of a broad corporate battle for control of one of the country’s largest construction groups. At the center were brothers Dimitris and Anastasios Kallitsantsis, representatives of the family’s second generation.

In 2018, the Kallitsantsis brothers led the Change4Ellaktor initiative, openly challenging the group’s management and denouncing mismanagement, overleveraging, and loss of value. With the support of significant shareholders, they succeeded in overturning the existing administration and taking control, marking a new phase of restructuring.

However, unity did not last. In the following years, serious disagreements emerged between the two brothers over strategy, subsidiary management, and attitudes toward new shareholders. The rupture culminated when Dimitris Kallitsantsis was removed from the management of Aktor Concessions by a decision also signed by his brother, signaling the complete breakup of the family front.

At the same time, the group became the arena of fierce confrontation with new powerful shareholders, led by Reggeborgh Invest, which gradually strengthened its position. The family civil war weakened the Kallitsantsis camp, facilitating a shift in the balance of power.

The Ellaktor case is recorded as a modern example where a family civil war did not lead directly to collapse, but undermined cohesion in a critical battle for control. Ultimately, the family that had put the group back on a new trajectory found itself outside the center of decision-making—not because of an external enemy, but due to its own internal split.

Hondos: A velvet divorce

The Hondos family case is a characteristic example of a family rupture that did not end in a noisy courtroom civil war, but in a clean business split, with two different entities claiming the same legacy. At the center are the five Hondos brothers (Nikos, Giorgos, Argyris, Giannis, and Kostas), who together built the Hondos Center group, one of the most recognizable brands in Greek cosmetics and personal care retail.

The rupture emerged in 2004, when Giorgos Hondos withdrew from the joint corporate structure, citing irreconcilable differences with his brothers over the group’s strategy and operation. The departure did not lead to a judicial clash like other family cases, but to a business divorce, with the creation of a second retail network under the name Hondos Palace.

For several years, the two entities coexisted in the market, often in close geographic proximity, creating consumer confusion and intense competition. Although they shared a common name and similar commercial identity, they operated with different business models, different supplier agreements, and different financial bases.

The outcome came in 2017, when Hondos Palace was driven into bankruptcy, with Giorgos Hondos exiting the market permanently. The remaining brothers, who continued to control Hondos Center, issued a public statement clarifying that they had no business or shareholder relationship with Hondos Palace and that cooperation had long been deemed “difficult to impossible.”

In most of these cases, the problem was not only financial. It was deeply familial. And precisely for that reason, it proved far more difficult to resolve. When conflict moves from the family table to boardrooms and from there to courtrooms, the business ceases to function as an organization and begins to function as a battlefield.

Banks, investors, and ultimately the market do not wait for family disputes to be resolved. They intervene, rearrange, change ownerships. And thus, many historic Greek business dynasties lost not only their peace, but also their control…

Ask me anything

Explore related questions