In practice, more GDP growth (by 0.3%) on top of what was originally announced 6 months ago automatically “translates” into more pension growth. The reason is the Katrougalos law and the rule that pension increases are given in advance each year based on GDP and inflation projections, but “corrected” in the following year.

From 1.1.2024 pensioners got increases based on the government’s October last year Budget estimate of 2.4% GDP growth in 2023. In March 2024 the National Statistical Office announced (1st estimate) that GDP in 2023 grew not 2.4% but 2%. This means that in the increases to be given from 1.1.2025, 50% of the Growth that was predicted but did not come should be deducted. That is, 0.2 points would be “cut” from the 2025 increase.

This was “corrected” yesterday, however, as ELSTAT raised GDP to 2.3%. The difference from last year’s Treasury forecast is considered negligible and will not be removed in 2025. Based on the new 2025 budget estimates, the final pension increases will be 2.4%, without the reduction they would have been if the MoF’s GDP forecast had been off.

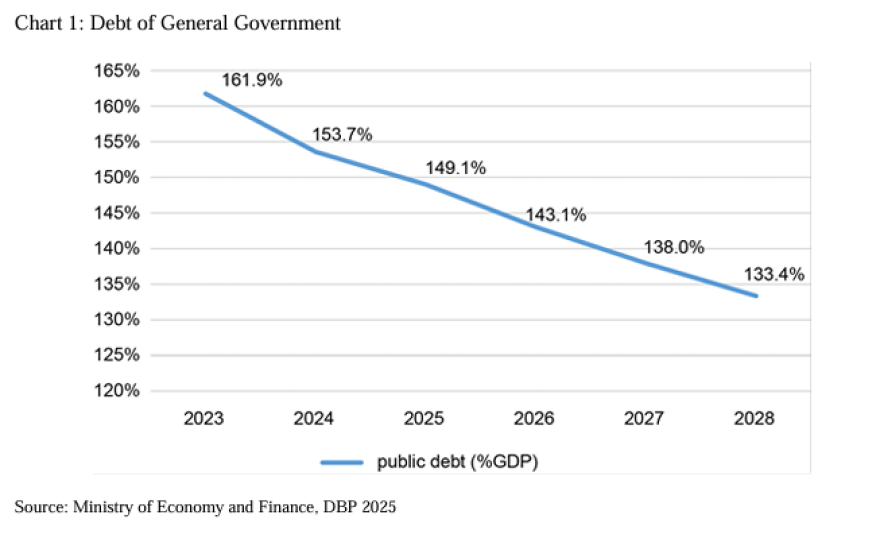

– The country is spared the “debt bomb” that – according to many – was threatening it. This is the statistical change in Eurostat’s rules that, if finally imposed and implemented, will oblige the country to show – and retroactively too – in its public debt, deferred interest on loans that have a grace period for payment from 2032 onwards!

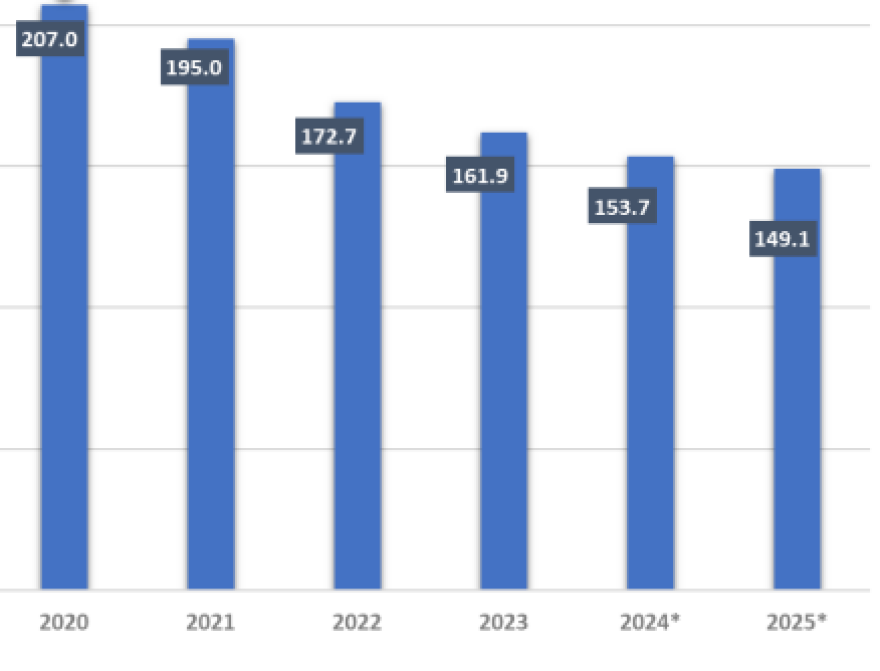

Although it is a statistical illustration with no real risk to investors (while on the contrary this risk has been anticipated and addressed in all Greek debt sustainability reports -DSA), there was concern in Athens that this change would spoil abroad the excellent picture of Greek debt reduction, which shows it falling to 153.7% this year, and even lower in the coming years.

But now, because of the GDP revision, the risk to the country is zero! No matter what, in 2024 the debt will remain – statistically and accounting-wise – at almost 153.7%, following the same downward trajectory. The debt-to-GDP ratio improves by about 3.5 percentage points. This implies that, combined with the repayment of loans (of €7.9 billion from the GLF), almost all of the effect of any retrospective inclusion of EFSF interest in the debt-to-GDP ratio is absorbed.

All of the above is about the future.

But the retrospective GDP revision for 2023 shows something more: that the country has consistently now “growth on top of growth”, despite all the crises that are erupting internationally. By following stability rules, it may be doing better and better, not only relative to the initial forecasts of the government and international agencies but also better than the preliminary accounts.

With these continuing surprises (including yesterday’s one from ELSTAT), it is finally becoming apparent that:

1. The nominal GDP in 2023 was 225.2 billion euros, not 220.3 billion as estimated in March.

2. in 2023, investment in the country grew 6.6% and not 4% as originally forecast.

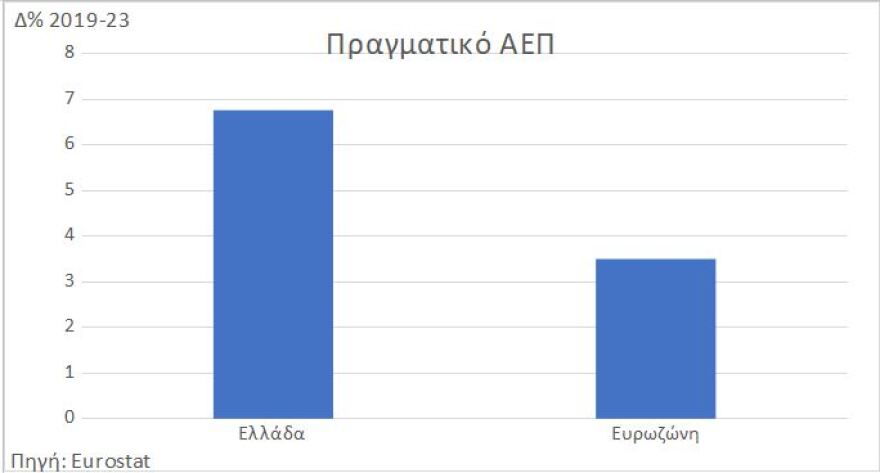

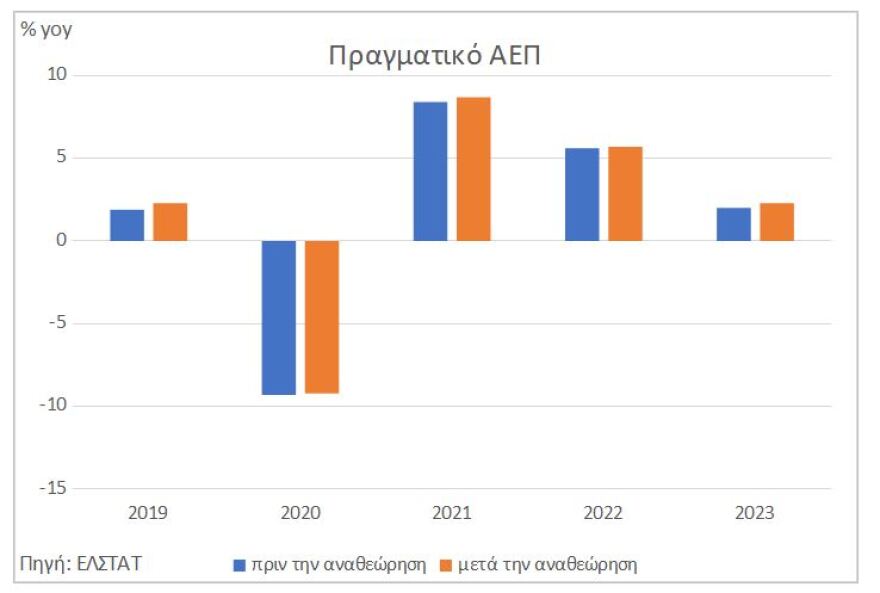

3. overall in the five years 2019-2023, the country’s real GDP grew 6.8%, not 5.8% as it appeared. In the same period, the Eurozone had real GDP growth of only 3.5%.

4. Despite the global recession of 2020 (-9.2% of GDP in our country), in 2019-2023 Greece is “running” with an average growth rate of 2% (!) and not 1.7%, which was the “official” picture of the country.

5. Greece had the second-highest GDP per capita growth in Europe (EE-27). Based on the GDP revision, in 2022-2023 GDP per capita grew 2.8%, instead of the 2.5% initially estimated. Overall over the five years, cumulative real GDP per capita growth reached 8.7%, instead of 7.8% as previously estimated.

“No one is claiming, of course, that our country has suddenly become an economic superpower,” Kostis Hatzidakis said on the occasion of the review. On the contrary, the finance minister sent a message that “they are in no way a reason to rest. We must build on this progress and move forward with reforms aimed at a modern and fair economy that boosts incomes, supports entrepreneurship, and provides more opportunities for all.”

Ask me anything

Explore related questions