It’s been a bloodbath for the majority of companies that go overtly woke in the new era of American consumer rebellion, and the establishment is not happy. Corporations like Disney, Anheuser-Busch, and Target are plunging in profits and losing billions in market cap after pledging fealty to the trans agenda. In particular, the public is setting out to make examples of institutions that support the trans indoctrination of children. Simply put, a line in the sand has been crossed.

With conservative boycotts far more effective than leftist boycotts ever were, the movement makes evident that the political left is a paper tiger and that conservatives and independents have the real majority power in the US. In response, the media is claiming that this movement is a form of “economic terrorism.” That is to say, if you refuse to support the woke hive mind with your wallet, you should be considered a domestic enemy.

It took long enough, but average Americans are finally engaging in a culture war that was started years ago, not so much by the political left, but by globalist institutions using leftist activists as enforcers and saboteurs. The key issue that very few people talk about is that activist groups would have NO POWER whatsoever if it weren’t for the unprecedented backing they receive from governments, non-profits, think tanks, and the corporate world. And, a lot of this support has been injected through ESG-style financing as well as DEI (Diversity, Equity, and Inclusion) programs.

ESG (Environment, Social, Governance) is becoming a well-known term and is, at the bottom, a form of “impact investing” – Meaning, major lenders such as Blackrock or Carlyle Group, or think tanks like the Ford Foundation, seek to control societal outcomes using lending as leverage. Watch the video HERE featuring the Ford Foundation’s head of “mission investments” to get a basic understanding of what ESG really is: Social engineering.

In the past, lenders would base their financing standards on good credit scores and the likelihood of return on investment. If you had a business with a history of solid returns and worthy collateral then you would probably get whatever loans you needed. Today, however, lenders are trying to set political and ideological terms for companies seeking to obtain financing. You must signal your virtue to get access to money, and this includes supporting climate and carbon initiatives, reorganizing your labor based on diversity and inclusion rules, and even promoting LGBT activism might be a big factor in your next infusion of cash.

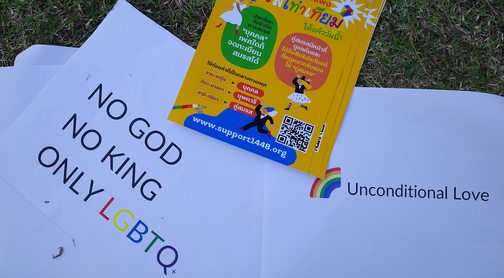

The higher your ESG score, the more likely it is that you will qualify for access to debt. This is part of the reason why a large array of corporations are increasingly jumping on the “pride month” bandwagon. All they have to do is slap some rainbows on some products or commercials or publicly defend the trans grooming of children and suddenly they are golden for another year of subsidized funds.