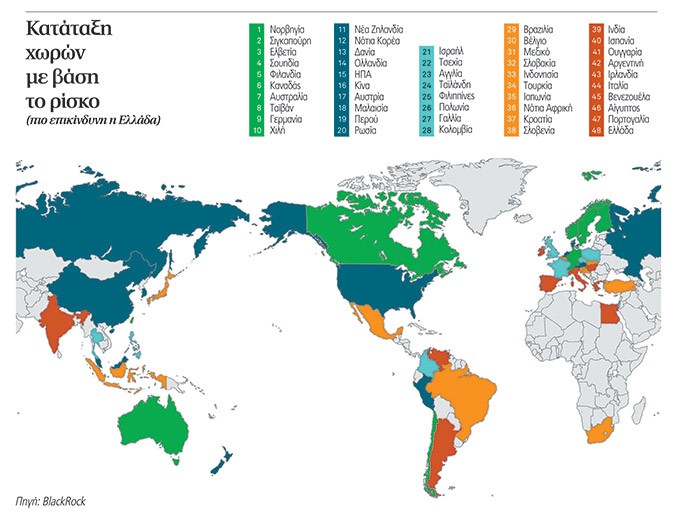

BlackRock’s quarterly Sovereign Risk Index last Tuesday that showed which countries face the highest risk of default showed Greece among the countries most likely to go bankrupt. The results created a climate of uncertainty and concern as Greece ranked at the bottom of the list making it the country with the highest chance of bankruptcy. The index showed the Greek economy well behind others such as Ukraine and Argentina.

The specific report by BlackRock is based on an index that assesses different countries according to their gross domestic products, tax revenues and qualitative assessments such as the perceived effectiveness and stability of governments. It has been published annually since 2011. In previous years, Greece had ranked at negative levels, however 2014 is a year where Greece has achieved an earlier-than-expected primary surplus and intense fiscal adjustment. Hence politicians, bankers and businessmen wonder why the report didn’t take that into account placing the country second or third amongst countries most likely to go broke.

BlackRock’s sirens signalled a warning to international investors creating a negative climate for the Greek market. All this comes at a time when the Bank of Greece has hired the specific multinational management corporation based in the U.S. to evaluate and provide solutions for the country’s non-serviceable “red” loans.This is the third time that the government has hired the group for a fee of around 60 million euros to conduct its studies.

There is speculation about BlackRock’s own interest in its assessment of Greece, bearing in mind its collaboration with the Bank of Greece. There is concern about the underlying motive for this assessment and the possible gains for BlackRock by undermining the Greek economy.

Who is Mr. BlackRock?

Laurence Douglas “Larry” Fink is a U.S. financial executive who heads BlackRock, the U.S. multinational investment corporation and the largest money-management firm in the world by assets under management. Fink grew up in a Jewish family in California and epitomizes the “American dream” as his mother was an English teacher and father owned a shoe store.

He started his career in 1976 at First Boton, a New York-based investment bank. He was instrumental in the creation and development of the mortgage-backed security marketin in the U.S. He added as much as $1 billion to First Boston’s bottom line but left in 1986 when his department lost $100 million due to his incorrect prediction about where interest rates were headed. It was this experience that influenced his decision to start a company that would invest clients’ money while also incorporating comprehensive risk management. He founded BlackRock in 1988 under the corporate umbrella of The Blackstone Group. The company went public in 1999.

Fink helped negotate the resignation of the CEO of the New York Stock Exchange Richard Grasso, led the merger with Merrill Lynch Investment Managers that doubled BlackRock’s asset management portfolio. That same year, BlackRock’s $5.4 billion purchase of a Manhattan housing complex became the largest residential-real-estate deal in U.S. history but ended in default with BlackRock clients losing their money, including the California Pension and Retirement System. The U.S. government contracted with BlackRock to help clean up after the financial meltdown of 2008. Though BlackRock was considered the best choice for the job, Mr. Fink’s longstanding relationships with senior government officials led to questions about potential conflict of interest regarding government contracts awarded without competitive bidding.

Mr. Fink is married with three children and owns homes in Manhattan, North Salem, New York and Vail, Colorado. He is a lifelong Democrat.