The Greek State and with an official announcement, is attempting a new exit to the markets by proposing to the holders 20 bonds issued with the PSI to swap them with five new issues. The exchange concerns securities whose total amount is close to € 30 billion.

According to the proposal, which opened on Wednesday and is due to expire on the 28th of the November, the new issues will expire in 2023, 2028, 2033, 2037 and 2042. The final settlement will take place on 5 December.

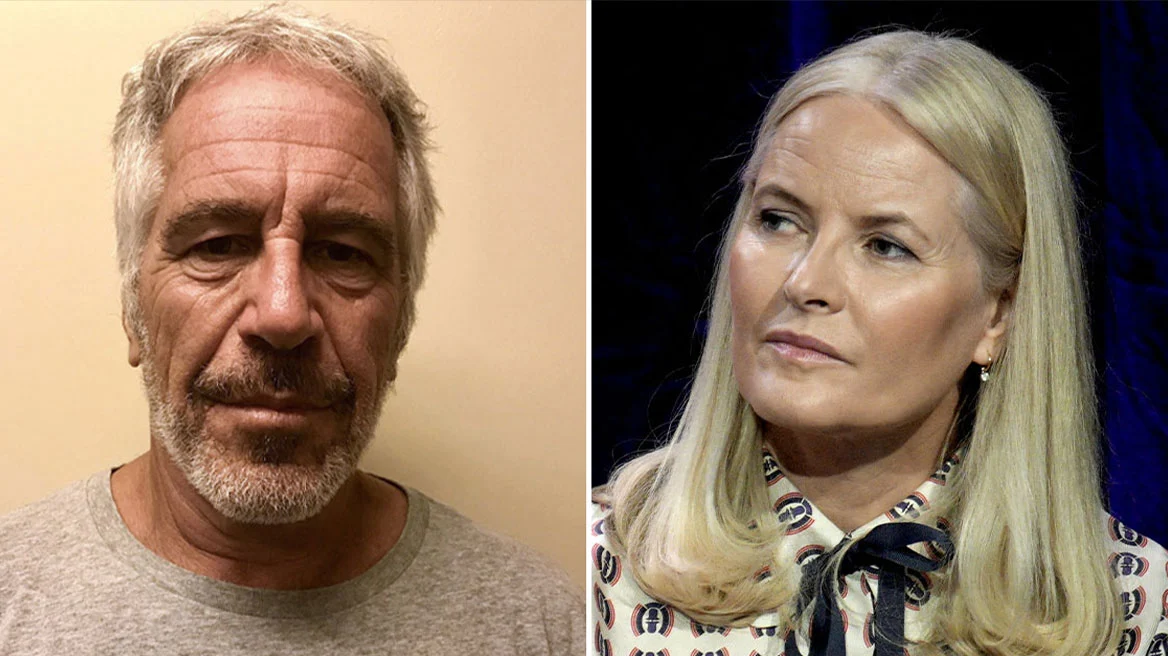

DSID chairman Stelios Papadopoulos This move was being planned since from 2013, when the Finance Minister was Yiannis Stournaras, now head of the Bank of Greece, who seems to fully support this move.

By decision of Finance Minister Euclid Tsakalotou, this structural move, although it will not involve raising new money from the markets, was seen as a priority since it will pave the way for a return to normality when Greek bonds emerge from the junk category.

The move aims to prevent Greece from appearing only on the hedge funds’ “radar”, but also on the so-called “real money investors”, that is, investors who do not just borrow money to invest (as hedge funds do) but place customers’ money on secured cards with good odds.

Ask me anything

Explore related questions