Amid closed banks, capital controls, fear of private depot bail-ins, pensioners lining up at ATMs, the economy teetering on collapse and an acrimonious blame game between the Greek government and its creditors, Greeks will go to polls tomorrow to decide whether to accept or reject a program reportedly offered to their government 2 weeks ago by the institutions. Four internationally renowned economists explain why they would vote ‘Yes’ or ‘No’ in the plebiscite.

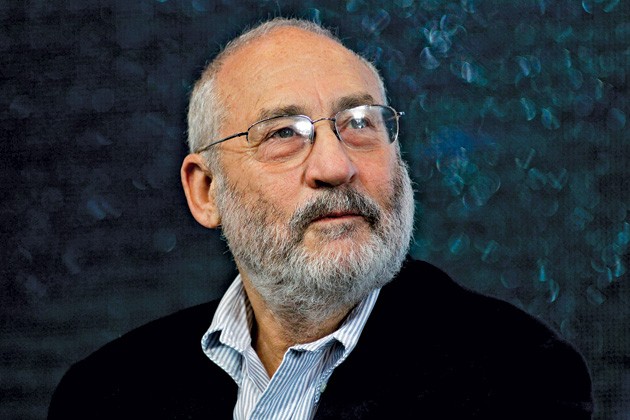

1. Joseph Stiglitz, Nobel laureate in economics and professo at Columbia University – NO

Stressing that both options entail huge risks has notes: “A no vote would at least open the possibility that Greece, with its strong democratic traditions, might grasp its destiny in its own hands. Greeks might gain the opportunity to shape a future that, though perhaps not as prosperous as the past, is far more hopeful than the unconscionable torture of the present”

2. Christopher Pissarides, British-Cypriot economist and Nobel laureate – YES

“The way forward is to reform from within, not by running away from the problem. There are already signs that sentiments are changing … With patience other changes will follow. It is clear to most politicians in Europe that austerity is dividing the continent and damaging the European project. Reforms will follow. Greece has a role to play in this agenda but only if it stays within the eurozone.”

3. Paul Krugman, Nobel prize-winning US economist – NO

He notes that Greece’s creditors are effectively demanding the continuation of the policies of the past five years which has proven unsuccessful. “The troika clearly did a reverse Corleone – they made Tsipras an offer he can’t accept, and presumably did this knowingly. So the ultimatum was, in effect, a move to replace the Greek government. And even if you don’t like Syriza, that has to be disturbing for anyone who believes in European ideals”

Vicky Pryce, Chief economic adviser at the Centre for Economic and Business Research – YES

She believes that both sides are to blame about the impasse and the failure of implementing the failed economic policies. “There has been too much austerity but a no vote would make things worse. It would almost certainly mean banks becoming insolvent, an exit from the euro and a much faster decline in economic activity, with hyperinflation following as the drachma that is introduced instantly devalues. A yes vote would keep banks open and give mandate for a deal to be struck that recognises the new Greek realities and includes, as the IMF now says, restructuring of the debt which every economist knows is unsustainable.”

Ask me anything

Explore related questions