No sooner did Prime Minister Alexis Tsipras announce the Radical Left Coalition (SYRIZA) government’s decision to hold a referendum on the creditors’ proposals for Greece that the panic began. All hell broke loose as people rushed to ATMs in fear that banks would collapse, cars lined up at gas stations, people rushed to supermarkets to stock up on food and other necessities.

The country is bracing itself for the worst-case scenario that looks likely after the Eurogroup meeting that announced that there would be no extension to the Greek program. If Greece fails to repay 1.6 billion euros to the International Monetary Fund (IMF) on Tuesday it will be cut off from markets. A collision course seems likely as Greece is just a breath away from a Grexit.

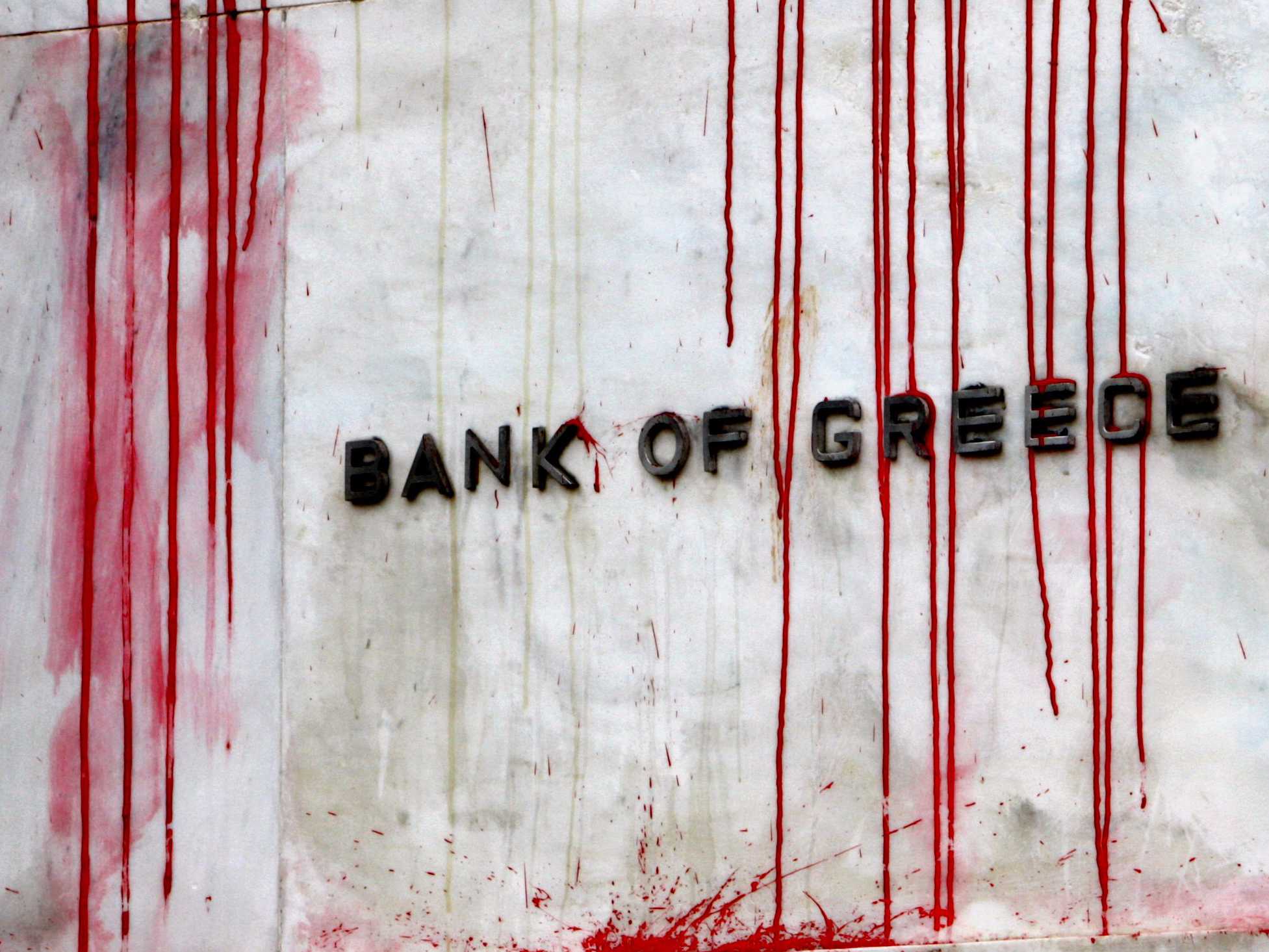

Capital Controls

The prospect of default has already resulted in people emptying ATMs and it seems likely that a bank run will be triggered on Monday, just ahead of a formal default.

Greece defaults on IMF payment

In this scenario, Greece would refuse to move its red lines and would not make its debt repayment to the IMF. This would not mean an automatic eurozone exit. Debtors have a 30-day grace period with the IMF. The creditors may be willing to negotiate as they would be the big losers in the case of a default.

Turning to the ECB

SYRIZA is likely to seek aid from the European Central Bank (ECB). The eurozone closing the door on Greece on Saturday and an IMF default however would mean that Greece would have no collateral, essentially shutting down support from the ECB. It remains to be seen whether the ECB would maintain the country’s emergency liquidity funding if the IMF does not immediately declare Greece to be in technical default.

Slow and painful Grexit

Without ECB support, Greek banks would likely collapse and a parallel currency would need to be introduced to cover the government’s domestic obligations. The new currency would be devalued. Unemployment could climb further and Greek companies would close. Tourism would be hit hard.

Social unrest

The July 5 referendum would likely create two camps in Greece rather than unite the nation. The pro-Europe “Yes” group would be at odds with the “No” group bringing about friction, protests, rallies… The government would need to either step down or – in the case of a “Yes” vote – head back to the negotiating table. This time, however negotiations would be even more difficult than before.

Contagion?

The eurozone would suffer and a Grexit may be followed by other exits as markets become nervous. Default would mean a steep loss for the ECB that has already lent 118 billion euros to Greek banks and has spent 20 billion euros buying Greek government bonds. Anti-euro movements would rise in other countries.

Recovery

A number of economists say that a return to the drachma could ultimately benefit Greece. There would be substantial pain but there would also be some benefits. Greece would once again manage its own currency and this would give it a level of control far greater than it has now. It would be good for tourism and would help agricultural producers allowing Greece to expand the service center.

Ask me anything

Explore related questions