Greece is set to miss yet another deadline for unlocking bailout funds this week, edging closer to a repeat of the 2015 drama that pushed Europe’s most indebted state to the edge of economic collapse.

Euro-area finance ministers meeting in Brussels on Monday will reiterate that the government of Alexis Tsipras has yet to comply with the terms attached to the emergency loans that have kept the country afloat since 2010. While Tsipras had promised the long delayed review of the latest bailout would be completed by March 20, a European official said last week that reaching an agreement even in April is now considered a long shot.

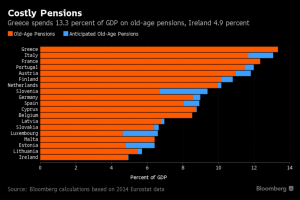

The two sides are still far apart on reforms demanded by creditors in the Greek energy market and the government in Athens is resisting calls for additional pension cuts. And while discussions continue on how to overhaul the labor market, a finance ministry official said in an email to reporters on Friday that the issue can’t be solved in talks with technocrats.

Stalled bailout reviews and acrimony between successive governments and auditors representing creditor institutions are all too familiar themes in the seven-year crisis that has reduced the Greek economy by a quarter. Failure to resolve the latest standoff before the summer could mean that Greece may not be able to meet debt payments due in mid-July.

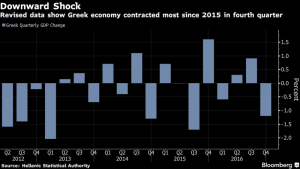

Even as Greek bonds have performed better than most of its euro-area peers this year on expectations that the government will capitulate, uncertainty has weighed on economic activity, raising the risk that an additional bailout may be needed. Unemployment rose in the last quarter of 2016, the economy unexpectedly contracted, and a bleeding of deposits from the nation’s battered lenders resumed.

“The Greek recovery is once more significantly delayed by politics,” said Nicholas Economides, a professor of economics at New York University’s Stern School of Business. “Tsipras will blink at some point in time, the question is when.”

Ask me anything

Explore related questions