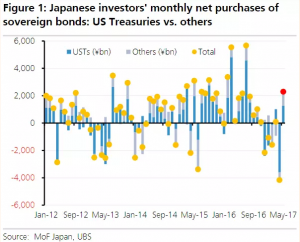

Japanese bond investors are growing fonder of European government bonds now that political risks are subsiding, according to analysis by UBS.

Purchases of European government bonds represented more than half of those of Treasuries in May, a historically rare situation, the Swiss bank noted on Monday, adding that this “may indicate a shift in sentiment from Japanese investors, towards European government bonds and away from Treasuries… is already underway.”

Combined purchases of French and German bonds by Japanese investors as is usually below 50 per cent of the total value of US Treasuries purchased, judging from data from Japan’s ministry of finance. However, UBS points out that French and German bond buying by Japanese investors hit ¥0.8tn in May, representing 65 per cent of the value of US Treasuries purchased during the period.

Demand for US Treasuries from Japanese investors rose to ¥1.3tn in May, the highest level since August last year and up from record net selling in the previous month.

“A convergence in FX-hedged yields across credit markets, reduced EU political risk, and gradually rising Bund yields should further increase the relative attractiveness of euro fixed-income,” UBS added.

Asian bonds were less attractive for Japanese investors in May resulting in the first monthly net emerging market outflow for 2017. Japanese investors sold Singaporean, South Korean and Malaysia while Indian bonds attracted interest.

Ask me anything

Explore related questions