In the spring of 1945, Harald Quandt, a 23-year-old officer in the German Luftwaffe, was being held as a prisoner of war by Allied forces in the Libyan port city of Benghazi when he received a farewell letter from his mother, Magda Goebbels – the wife of Nazi propaganda minister Joseph Goebbels.

The hand-written note confirmed the devastating news he had heard weeks earlier: his mother had committed suicide with her husband on May 1, after slipping their six children cyanide capsules in Adolf Hitler’s underground bunker in Berlin.

“My dear son! By now we’ve been in the Fuehrerbunker for six days already, Daddy, your six little siblings and I, to give our national socialistic lives the only possible, honorable ending,” she wrote. “Harald, dear son, I want to give you what I learned in life: Be loyal! Loyal to yourself, loyal to the people and loyal to your country!”

Quandt was released from captivity in 1947. Seven years later, he and his half-brother Herbert – Harald was the only remaining child from Magda Goebbels‚ first marriage – would inherit the industrial empire built by their father, Guenther Quandt.

The brothers took the business, which had produced Mauser firearms and anti-aircraft missiles for the Third Reich’s war machine. Their most valuable assets became stakes in car manufacturers Bayerische Motoren Werke AG ( BMW) and Daimler AG.

Lower profile

While the half-brothers passed away decades ago, their legacy has endured. Herbert’s widow, Johanna Quandt, 86, and their children Susanne Klatten and Stefan Quandt, have remained in the public eye as BMW’s dominant shareholders. The billionaire daughters of Harald Quandt – Katarina Geller-Herr, 61, Gabriele Quandt, 60, Anette-Angelika May-Thies, 58, and 51-year-old Colleen-Bettina Rosenblat-Mo – have kept a lower profile.

The four sisters inherited about 1.5 billion deutsche marks ($760 million) after the death of their mother, Inge, in 1978, according to the family’s sanctioned biography, Die Quandts. They manage their wealth through the Harald Quandt Holding GmbH, a Bad Homburg, Germany-based family investment company and trust named after their father. Dr. Fritz Becker, the CEO of the family entities, said the siblings realized average annual returns above 7 percent from its founding in 1981 through 1996. Since then, the returns have averaged 7.6%.

“The family wants to stay private and that is an acceptable situation for me,” said Becker in an interview at his Bad Homburg office. “We invest our money globally and if it’s $1b., $500m. or $3b., who cares?”

Wartime profits

Together, the four sisters – and the two children of a deceased sibling – share a fortune worth at least $6b., giving each of them a net worth of $1.2b., according to the Bloomberg Billionaires Index. They have never appeared individually as billionaires on an international wealth ranking.

Becker declined to provide the exact figure the holding manages for the four sisters. The siblings declined to comment for this account, said Ralf-Dieter Brunowsky, a spokesman for the family investment company, in an e-mail. He said the net worth calculation was “too high,” declining to be more specific.

The rise of the Quandt family fortune shares the same trajectory as Germany’s quest for global domination in the 20th century. It began in 1883, when Emil Quandt acquired a textile company owned by his late father-in-law. At the turn of the century, Emil passed the business to his eldest son, Guenther.

The younger Quandt saw an opportunity with the onset of war in 1914. His factories, already one of the biggest clothing manufacturers for the German state, quadrupled their weekly uniform production for the army, according to Die Quandts.

Weapons production

After Germany’s surrender four years later, Quandt put the company’s wartime profits to use. In 1922, he bought a majority stake in Accumulatoren-Fabrik AG, a Hagen-based battery manufacturer. Six years later, he took over Berlin-Karlsruher Industriewerken AG, a Berlin-based manufacturer that made sewing machines and silverware. The factory, once one of Germany’s largest weapon producers, had been forced to retool as part of the country’s disarmament agreement.

“The Quandt’s business grew in the Kaiserreich, it grew during the Weimar Republic, it grew during the Second World War and it grew strongly after the war,” Rudiger Jungbluth, author of Die Quandts, said in an interview at a Bavarian restaurant in Hamburg last November.

Nazi connections

In 1918, Guenther Quandt’s first wife died of the Spanish flu, leaving him a widower with two young sons, Hellmut and Herbert. He remarried Magda Ritschel in 1921, and the couple’s only son, Harald, was born later that year. Hellmut died in 1927, from complications related to appendicitis.

Quandt and Magda divorced in 1929. Two years later, she married Joseph Goebbels, a member of the German parliament who also held a doctorate degree in drama and served as head of propaganda for Germany’s growing Nazi party. After the Nazis took power in 1933, their leader, Adolf Hitler, appointed Goebbels as the Third Reich’s propaganda minister.

Guenther Quandt joined the party that same year. His factories became key suppliers to the German war effort, even though his relationship with Goebbels had become increasingly strained.

“There was constant rivalry,” said Bonn-based history professor Joachim Scholtyseck, author of a family-commissioned study about their involvement with the Third Reich, in a telephone interview. “It didn’t matter that Goebbels didn’t like him. It didn’t have any influence on Quandt’s ability to make money.”

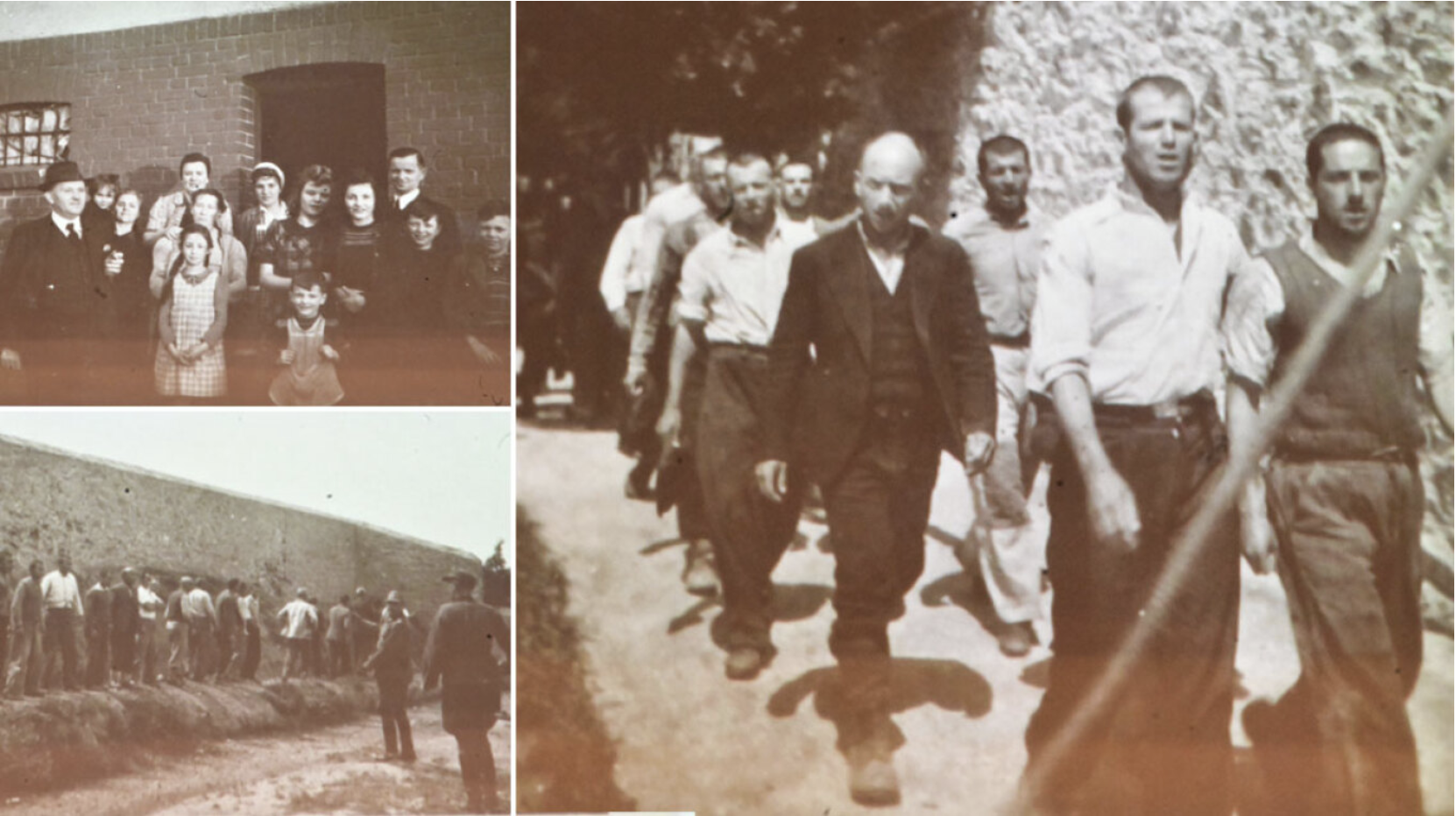

Forced labor

In 1937, he earned the title of Wehrwirtschaftsfuehrer, the name given to members of an elite group of businessmen who were deemed beneficial to the production of war materials for the Third Reich. During the war, Quandt’s AFA manufactured batteries for U-Boat submarines and V-2 rocket launchers. His BKIW – which had been renamed Deutsche Waffen-und Munitionsfabriken AG in 1936 – produced Mauser firearms, ammunition and anti-aircraft missiles.

“He was one of the leading industrialists in the Third Reich and the Second World War,” Scholtyseck said. “He always kept a very low profile.” From 1940 to 1945, the Quandt family factories were staffed with more than 50,000 forced civilian laborers, prisoners of war and concentration camp workers, according to Scholtyseck’s 1,183-page study. The report was commissioned by the family in 2007 after German television aired the documentary The Silence of the Quandts, a critical look at their wartime activities.

Released in September 2011, the study also found that Quandt appropriated assets from Jewish company owners and that his son Herbert had planned building an AFA factory in which slave laborers would be deployed.

Army volunteer

“Guenther Quandt didn’t have a Nazi kind of thinking,” said Jungbluth, the family biographer. “He was looking for any opportunity to expand his personal empire.” Quandt’s youngest son, Harald, lived with his mother, Goebbels and six half-siblings. In 1939, he joined the German army after the country’s invasion of Poland, volunteering for the army’s paratrooper unit one year later.

During the war, Harald was deployed in Greece, France and Russia, before being shot and captured in Italy in 1944, and taken to the British Army-run POW camp in Benghazi where he received his mother’s farewell letter.

His stepfather also sent him a goodbye note.

“It’s likely that you’ll be the only one to remain who can continue the tradition of our family,” wrote Goebbels, who served as Chancellor of Germany for one day following Hitler’s suicide on April 30, 1945.

After the war, Guenther Quandt served in an internment camp in Moosburg an der Isar for more than a year, before being judged a “Mitlaeufer” – a Nazi follower who wasn’t formally involved in the regime’s crimes – in denazification hearings in 1948. No repercussions followed.

“He was lucky that he wasn’t as prominent as someone like Flick or Krupp,” said Scholtyseck, referring to the German industrialists Friedrich Flick and Alfried Krupp, who were sentenced to prison terms at the Nuremberg war crimes trials.

Guenther died in 1954 while vacationing in Cairo, leaving his business empire equally in the hands of his two surviving sons, Harald and Herbert. Most notably, the assets included ownership of AFA and Deutsche Waffen-und Munitionsfabriken – renamed Industrie-Werke Karlsruhe AG after the war – and stakes in Daimler-Benz and potash miner Wintershall AG.

Sovereign wealth

Herbert managed the stakes in the battery, car and potash firm, while Harald oversaw the interests in the industrial companies, according to Jungbluth’s biography.

Over the next decade, the brothers increased their stake in Daimler; Herbert saved BMW from collapse in the 1960s after becoming its largest shareholder and backing the development of new models.

Harald died in 1967, at age 45, in an airplane crash outside Turin, Italy. The relationship between his widow, Inge, and Herbert deteriorated after his death. Negotiations to settle the estate by separating assets commenced in 1970.

The most valuable asset that the Harald Quandt heirs received was four-fifths of a 14% stake in Daimler, according to the biography. In 1974, the entire stake was sold to the Kuwait Investment Authority, the country’s sovereign wealth fund, for about 1b. deutsche marks, according to a DaimlerBenz publication from 1986 celebrating its centennial.

Inge Quandt, who suffered from depression, died of a heart attack on Christmas Eve 1978. Her new husband, Dr. Hans-Hilman von Halem, shot himself in the head on Boxing Day. The five orphaned daughters, two of them teenagers, were left to split the family fortune.

Family meetings

The estate’s trustees had started overseeing the daughters’ money in 1974. An active investment approach commenced with the founding of the family investment company in 1981.

“It’s different if you work for a family than a corporation,” said Becker. “You can really invest instead of fulfilling regulation requirements.” According to Die Quandts, the siblings try to get together a few times a year to discuss their investments. Gabriele Quandt lives in Munich. After earning a master’s degree in business administration at INSEAD in Fontainebleau, France, she married German publishing heir Florian Langenscheidt, with whom she had two sons. The couple divorced in 2008.

Katarina Geller-Herr owns Gestuet Waeldershausen, an equestrian center in Homberg (Ohm), Germany. She sponsored Lars Nieberg, a twotime Olympic gold medalist in show jumping.

Jewish conversion

Colleen-Bettina Rosenblat-Mo is a jewelry designer who runs a studio and showroom in Hamburg. She converted to Judaism in New York at age 24. Her first marriage was to Michael Rosenblat, a German-Jewish businessman, whose father survived a concentration camp. The couple divorced in 1997. She remarried Frode Mo, a Norwegian journalist.

Anette-Angelika May-Thies lives in Hamburg, according to the Harald Quandt Holding shareholders list filed with the German federal trade registry. Her first marriage was to Axel May, a Goldman Sachs Group Inc. international adviser for private banking, who managed the family’s investments for about 25 years.

The siblings are also majority owners and investors in five financial services companies, all of which pay dividends, according to Becker. The firms were founded to manage the sisters’ wealth and subsequently opened up to third parties.

Private equity

The six companies combined manage $18b. in assets, according to the family investment company’s website. Becker said the majority of the money controlled by these firms is invested for third parties. One-fifth of the family fortune is managed by trustees for the two children of the youngest Quandt sibling, Patricia Halterman, who died in July 2005, four days before turning 38. Her Upper East Side townhouse sold for $37.5m. in 2008.

Auda International LP serves as the sisters’ New York-based privateequity unit. It manages almost $5b. and was founded as their US office in 1989, said Becker. Real Estate Capital Partners LP started the same year and has invested about $9b. in real estate, according to its website. Both companies are owned through HQFS LP, an offshore entity based in the Cayman Islands.

In Bad Homburg, HQ Trust GmbH serves as a investment management company for about 30 families with fortunes ranging from 50m. euros to 500m. euros. Equita Management GmbH invests in small and mid-cap companies in Austria, Switzerland and Germany. HQ Advisor GmbH provides accounting and controlling services.

Only one sister, Gabriele, carries the family name, and none are active in the day-to-day business of the family office, said Becker.

“Sad truth”

Their uncle, Herbert Quandt, died in 1982. His fortune was divided between six children from three different marriages. BMW, his most valuable asset, was inherited by his third wife Johanna Quandt and their children, Stefan Quandt, 46, and Susanne Klatten, 50. The three billionaires hold 46.7% of the Munichbased car producer, according to the company’s 2011 annual report.

After Scholtyseck’s study was published in 2011, cousins Gabriele and Stefan Quandt acknowledged their family’s ties and involvement with the Third Reich in an interview with Germany’s Die Zeit newspaper.

“Magda killed her six children in the Fuehrerbunker. Our father loved his half-siblings very much. And when, like me, you have something like this in your family history, you think: It can’t be any worse,” Gabriele Quandt said in the interview. “It’s a sad truth that forced laborers died in Quandt companies,” said Stefan.

The acknowledgment didn’t prompt a public distancing from the men that made their family Germany’s richest. The families’ offices in Bad Homburg are named after Guenther and Harald Quandt, and the Herbert Quandt media prize of 50,000 euros is awarded annually to German journalists.

“They have to live with the name. It’s part of the history,” said Scholtyseck. “It will be a constant reminder of dictatorship and the challenges that families have to face.”

Source: jpost.com

Ask me anything

Explore related questions