Although the exposure of European banks to Greece has been dramatically reduced, the continent really can’t afford another crisis in the country. It’s already struggling to contain Italy’s budget deficit and faces the impact of Brexit, while leaders in France and Germany are having a rough time at home.

It was only last August that the International Monetary Fund ended its third Economic Adjustment Programme for Greece, and the troubled country may encounter yet another financial crisis with its lenders stuck in a downward spiral. Piraeus Bank SA is in an awkward spot as it needs to beef up its capital. Sorting out the financial companies is key to securing the revival of the economy, and to do so, the government is coming up with various plans. But the lack of clarity is playing against the lenders which keep selling off.

The latest plan includes a direct subsidy to struggling borrowers who could benefit from restructured repayments partially guaranteed by the state. Another blueprint consists of unloading bad loans into special purpose vehicles guaranteed by the government, while a third option would be to create of a so-called “bad bank” that would relieve the lenders of their worst loans.

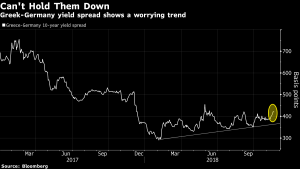

It’s unclear whether all the plans will get the green light or which is the most efficient option to help Greek lenders meet their commitment to slash bad loans by about 50 billion euros ($57 billion) through 2021 to avoid another capital injection. At the end of June, non-performing loans amounted to 89 billion euros. Any plan will require reviving investors’ appetite for Greek debt, which, at the moment, is no easy task.

Read more HERE

Ask me anything

Explore related questions