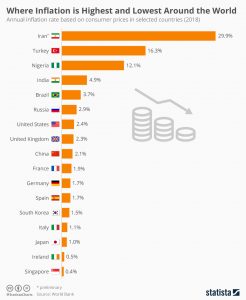

High inflation rates can hurt any country’s economy and point to underlying problems in economic policy. Currently, Iran, Turkey and Nigeria are three countries where high inflation rates are putting a strain on citizens and businesses, with effects ranging from exorbitant food prices, rising rents and falling sales on non-necessary items.

But very low inflation, as Singapore, Ireland and Japan are experiencing at the moment, has its own set of problems. While low inflation will encourage consumers to make purchases, it can lead to less earnings for companies and decreased hiring and it also means people don’t get the benefit of paying off their debt quicker with the help of a little inflation. Ultimately, low inflation can lead prices into a downwards spiral, causing deflation and a deterioration of prices equally bad as an inflation crisis.

According to data compiled by the World Bank, countries currently in price deflation around the world were Ecuador (-0.2 percent), the Maldives (-0.1 percent), Rwanda (-0.3 percent) and Burundi (-2.8 percent). On the other hand, inflation in Venezuela has recently gone to extreme levels, causing hyperinflation which is inflation spiraling out of control at a 50 percent increase (and often much more) per month. Venezuelan inflation for 2018 was literally off the charts at approximately 1 million percent, according to the International Monetary Fund.

source statista

Ask me anything

Explore related questions