Prices at supermarket chains will fall by 1.92% in June 2024 compared to June 2023, a targeted survey by the Consumer Goods Retail Research Institute (IELKA) exclusively to the channel of large supermarket chains on inflationary trends in organised food retailing.

The following conclusions emerged from the survey:

The findings of the study revealed the following conclusions:

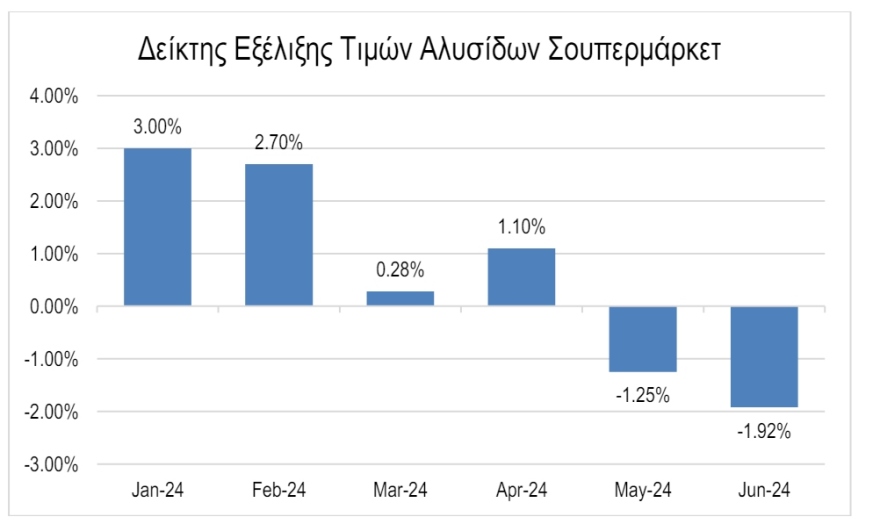

1. The net decrease in the supermarket chain price trend index in June 2024 indicates that the inflation in supermarket chains is negative by -1.92% (compared to -1.25% in May, +1.10% in April, +0.28% in March, +2.70% in February and +3.00% in January 2024).

The change in June is mainly due to the continued deceleration in prices and partly to the effect of seasonality due to summer.

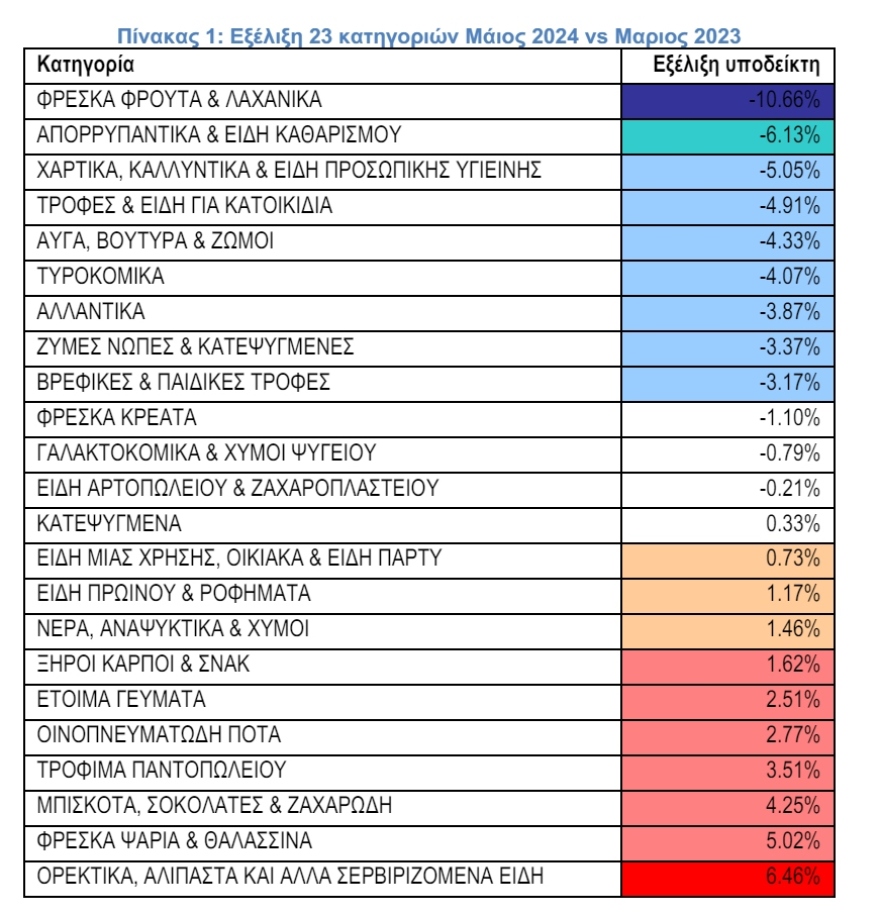

2. Larger price reductions are recorded in the categories:

– Fresh fruit and vegetables: -10.66%

– Detergents and cleaning supplies: -6.13%

– Stationery, cosmetics, and toiletries: -5.05%

Fresh fruit and vegetables have benefited from comparatively better weather conditions compared to 2023. In other items, the decreases recorded are the result of both the normalization of the market after the pandemic and the reduction in producer prices for some products.

3. Larger increases are recorded in the categories:

– Appetizers, brines and other serving items: +6.46%

– Fresh fish and seafood: +5.02%

– Biscuits, chocolates, confectionery: +4.25%

– Groceries: +3.51%

– Alcoholic beverages: +2.77%

Most of these items are affected by international raw material prices, sugar and cocoa prices and other production costs.

Of the 23 categories examined, 13 recorded a decrease and 10 an increase.

The reasons IELKA attributes the trend of product price moderation in supermarkets to:

– Better weather conditions in May 2024 compared to 2023 and seasonality. Last year’s rains had significantly increased the costs of fresh fruit and vegetables. This year’s better weather conditions have reduced prices of fresh fruits and vegetables by more than 10%. At the same time, seasonality in the category’s products is having a greater impact on the overall index.

– Gradual deceleration of inflation. Prices have stabilized in recent months in large food stores due to the large volumes of products they handle, economies of scale, their organizational/technological readiness, and the range of private label products.

– Government institutional interventions. Supermarket chains operate within a strict institutional framework (e.g. prohibition of promotional actions in case of 6969/2024 price increases).

– Offers and discounts. Offers and discounts in the organized retail channel are more in number, intensity, and percentage discount, which affects the final prices of products.

– The development of raw material prices in the previous months on international markets and the normalization of the market. International food commodity indices (e.g. FAO Food Price Index) show a decline in the first months of 2024 in most cases. In cases such as coffee and cocoa, however, the effect is reversed.

– High inventory turnover. Price moderation occurs much faster at large outlets due to higher inventory turnover rates. That is, they move their stock more quickly and make new purchases to replenish stock more quickly.

– Effect of private label products. Sales shares of private label products are higher in supermarket chains due to a wider range of codes and have been increasing over the last two years.

The survey data

According to IELKA, the conclusions and results of the survey are based on an analysis on the total actual monthly sales rather than sampling For the survey, the change in unit value by product category (sales to volume) between June 2024 and June 2023 was analyzed. This indicator reflects both price trends and consumer purchasing choices.

The survey aims to objectively record prices separately in the organized retail channel (supermarkets), which is now the main channel for the distribution of basic consumer goods, with significant operating differentials compared to the rest of the market, both due to the State’s measures and economies of scale.

.

Ask me anything

Explore related questions