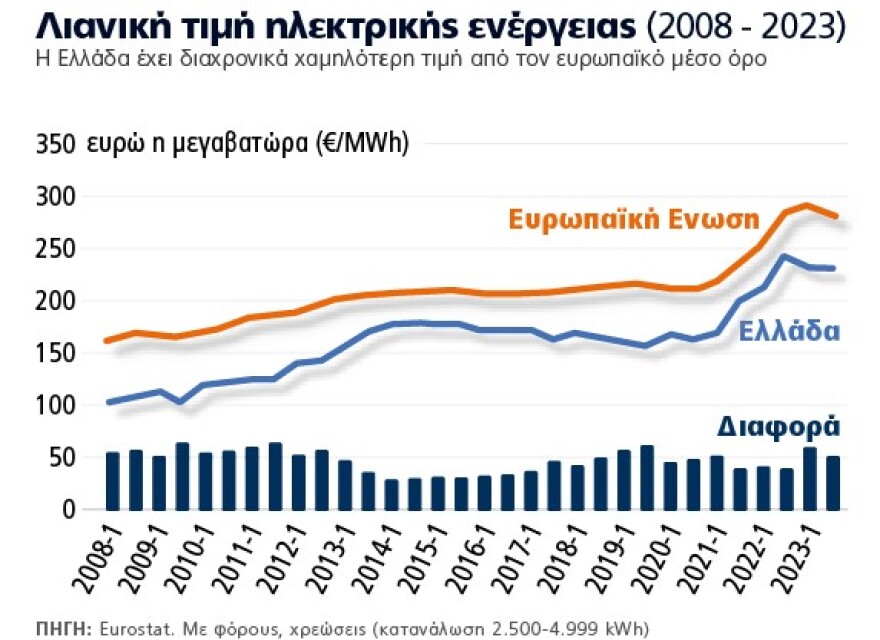

Between €80 million and €100 million is estimated to be thrown at subsidies to current the government in order to keep the price of household tariffs at 15 cents per kilowatt-hour. Although the final level will be determined by the wholesale price at which July will close, on the basis of which the PPC and other energy suppliers will set their retail market tariffs for August, this range is considered a realistic basis for what the prime minister called “sky-high” profits for gas-fired power generators.

Since July 11, when the turmoil in electricity markets erupted, revenue from the gas surcharge has been estimated at €30 million, with the bill “ballooning” as prices continue to hover at high levels.

The tax, imposed during the energy crisis and proposed as deputy finance minister by Theodoros Skylakakis as a tool to defend government policy, will boost the “piggy bank” of electricity subsidies. Thus, he is spreading a safety net for consumers from unexpected price hikes and avoiding unpleasant surprises that would await them upon their return from summer holidays, when they would receive their August bills.

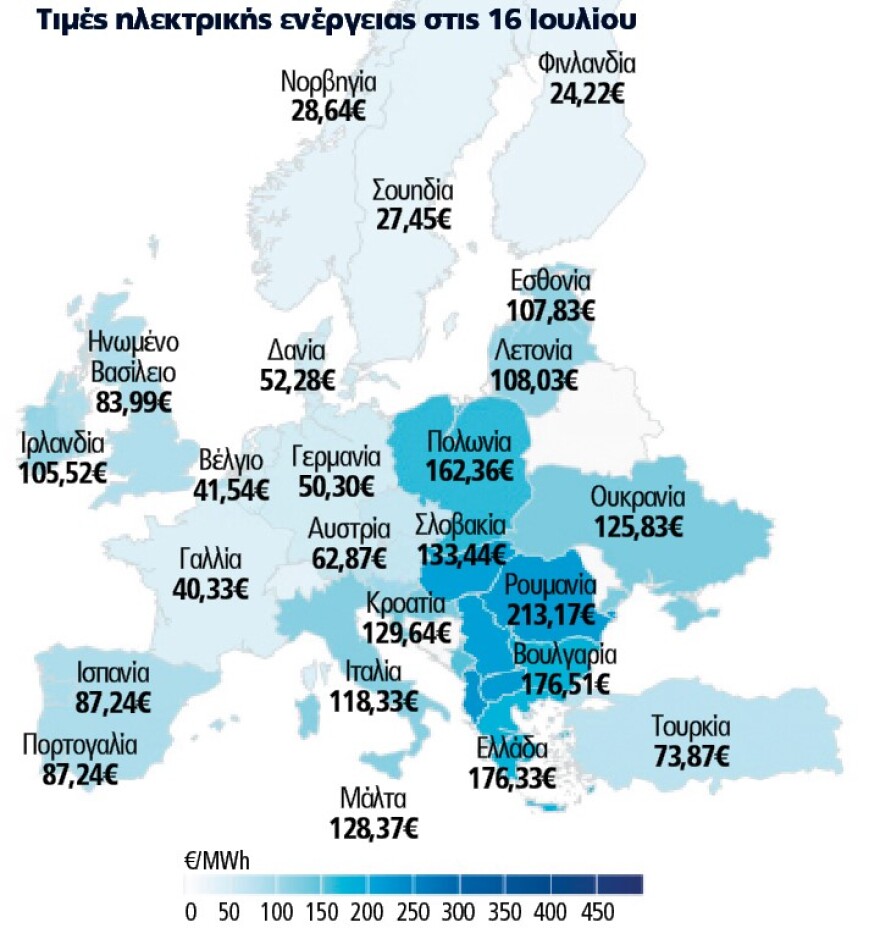

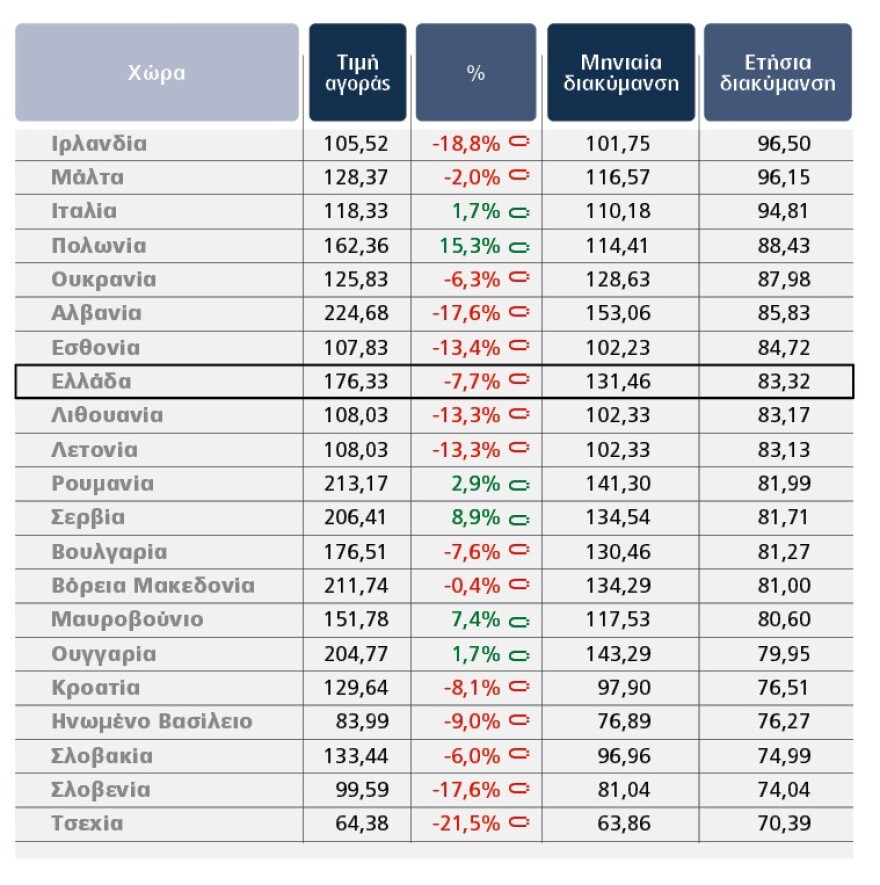

The government is rushing to put out the fires that the fierce and prolonged heatwave has lit in electricity prices, resulting in a sharp increase in electricity demand. Despite the assistance of Renewable Energy Sources, particularly in the midday hours, in helping to contain prices, wholesale price costs have soared in the past few days as high temperatures have dominated across Eastern and South Eastern Europe, making imports expensive. The “toxic” cocktail for family budgets, with the risk of severe power increases after a period of calm and low prices, was encouraged by a shortfall in power generation due to maintenance of nuclear power plants in the Balkans, and by failures in the carrying capacity of electricity cables that caused an unprecedented spiral of price rises.

If prices continued their upward race and the state did not intervene with subsidies, at the current average wholesale price the green tariff, where the majority of consumers are located, would be charged about 18-20 cents per kilowatt-hour from 16.3 cents in June and 10.3 cents in May, recording an increase of more than 60% in two months.

With the safety net of the August horizontal subsidy for consumption up to 500 kilowatt-hours, consumers will not be charged the price above the 15 cents estimated to form the basis of the subsidy. In this way, the Ministry of Energy will reactivate the Energy Transition Fund piggy bank to which the revenue from the tax on gas-fired electricity producers will be directed.

The exact amount of the surcharge will be determined early next month, but political leaders are reportedly accepting suggestions that it should not exceed €5 per thermal megawatt-hour. This is a tax levied on the price of natural gas at the Dutch trading hub (TTF) that charges power generators for the quantities they buy in order to run their plants and produce electricity. However, according to the sources, the final charge will also take into account the attitude of the suppliers in the electricity tariffs they will offer for next month. That is, whether the vertically integrated market players (PPC, Metlen, Elpedison, Heron) will accept, in addition to the profits they will return to the market through the tax on imported fuel, to absorb part of the mark-ups through the tariff rebate program.

Green, yellow or blue tariffs;

“All consumers should keep in mind that if on August 1 the provider they have is expensive, they should leave and choose the cheapest one,” Environment and Energy Minister Theodoros Skylakakis said, estimating that the deceleration of prices in recent days shows a realization of reality and a retreat from the extreme prices of previous days. In fact, he stresses that especially for businesses that will not be subsidized by the upcoming regulation of the extraordinary support, moving to a cheaper blue or even a yellow variable tariff may be a safe solution.

However, from the suppliers’ camp, the message being conveyed is that they are waiting for the PPC’s stance on the green tariff to determine their own tariff policy. Currently, two views prevail in the retail market with regard to the proposed government measures being discussed. The one that wants the PPC to benefit from the government’s policy, as it will be able to raise tariffs and with the subsidy (without having to go for big discounts itself) its customers will continue to feel protected from the July price rally, as they will pay 15 cents a kilowatt hour from 13.6 cents in July, which is a small difference.

But the PPC seems to benefit for two additional reasons: one is that its hydroelectric plants have been left out of the tax net, but in the days of the crisis they offered unusually high prices. The other is because the PPP sells more energy than it produces, so it receives part of its customers’ subsidy from the taxation of its “competitors.”

But other energy suppliers are also estimated to benefit, especially those alternative providers who had tariffs above 160 euros per megawatt-hour in July, which is most of them. The latter have created a ‘distrust’ among their customers with the green tariffs, because they are charged much higher prices than the dominant supplier (PPC). With the August subsidy, industry executives say, consumers of private suppliers will also be protected, because they will all ‘button a price on top of the 15 cents per kilowatt-hour subsidy.

Red July

July will have high electricity consumption and a high price estimated at 196 euros a megawatt hour (19.6 cents a kilowatt hour), so the bills that consumers will get their hands on will be significantly higher than the previous ones, says Yannis Mitropoulos, general manager of Natural Gas EEE and president of the Association of Alternative Suppliers (ESPEN). But he stresses that the subsidy comes to relieve citizens to a large extent and cushion the reactions that tariff increases may cause compared to previous months.

For example, as July progresses, it appears that electricity costs are so high that yellow ex post tariffs (i.e., tariffs that are formulated ex post based on the wholesale rate for the month of application) will exceed 18 cents a kilowatt hour or even 20 cents, depending on the price at which the wholesale rate closes. Equally high will be the yellow ex ante tariffs (announced early in the month and calculated on the basis of the previous month’s wholesale), which will incorporate the bitter July prices, but due to the subsidy, the charge will “snap” to near 15 cents.

The picture is more complex on blue tariffs which offer fixed charges from 6 to 12 months and provide the security consumers need in times of price rises. The latter will remain attractive even though forward prices are repositioning them on the market at 140 euros a megawatt hour. Today, there are blue tariffs charging less than 10 cents a kilowatt hour, which will not be seen again, at least for the foreseeable future. “You don’t sign forward contracts in a period of turmoil when prices are soaring,” stress market executives and say that currently the fixed ones are approaching the prices of the green subsidised tariffs. “If the market waits for prices to de-escalate in two months, the cost of blue tariffs will be much more competitive,” energy suppliers say.

Can the companies “back down” and bring power prices down further? The government expects a lot in this area from the vertically integrated market players, especially the PPC. Other suppliers are more concerned as they factor in the high wholesale price costs and the clearances from normalisation rates that have created a high cost environment for the industry that leaves little room for discounts.

Ask me anything

Explore related questions