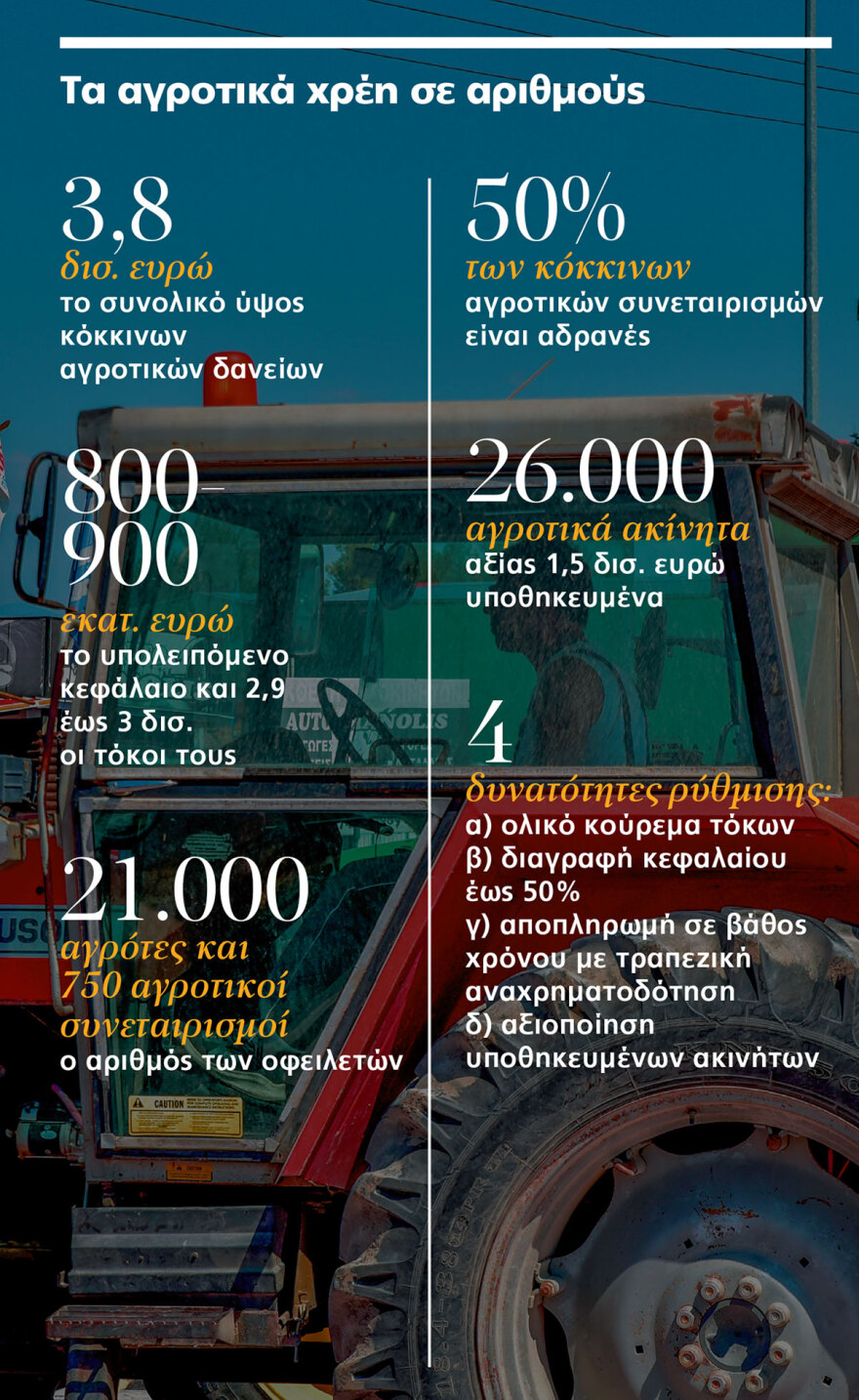

Flexible regulation for a holistic approach to the explosive problem of red agricultural loans exceeding €3.8 billion is expected to be tabled for a vote in parliament in the coming days by the government.

According to “THEMA” sources, the new framework will concern 21,000 farmers and 750 agricultural cooperatives, and will be based on three pillars that allow for the first time:

– total forgiveness of interest and a significant cut in the initial capital

– time comfort for repayment

– refinancing of the borrower

The new regulation is part of Kyriakos Mitsotakis’ overall plan for the reconstruction of the primary sector and the substantial support of the rural population. It is recalled that the permanent reimbursement of the special tax on agricultural oil, and the low energy tariffs have already been legislated, while 600 million euros of investments for greenhouse crops are being promoted. Measures with which the government aspires to shake up the relationship it traditionally has with the people of agricultural production since the last European elections recorded a significant decline in its percentages.

The problem

According to Bank of Greece data, the overdue agricultural loans in the Special Liquidator’s (PQH) portfolio exceed €3.8 billion and are accompanied by the additional problem of heavily mortgaged agricultural real estate worth €1.5 billion.

These are very old debts with an original principal amount of 800-900 million euros, which due to the inflexible regulation framework that does not allow haircuts remained frozen, resulting in interest rates soaring to 80% of the original loan obligation. The debts, and by extension the new arrangement, concern 21,000 farmers and over 750 agricultural cooperatives, with half of them, however, having been inactive for years.

The “architect” of the new arrangement is State Minister Makis Voridis, who has already taken initiatives to address the problem since his time at the Ministry of Rural Development (2019-21). The efforts did not succeed then and the exploding debt remained unregulated.

Recently, however, the minister came back and in collaboration with the governor of the Bank of Greece, Giannis Stournaras decided to move forward with a comprehensive settlement of the issue.

The solution

According to the new framework presented by “THEMA”, the role of the regulator is now assumed by servicers instead of the Single Special Liquidator.

The essential difference compared to the regulation of other overdue securities is that servicers will not buy the red agricultural loans, but will be involved as administrators. In this way, they will have more flexibility for generous write-offs. A source with knowledge of the new framework says that if servicers bought the loans at the principal price they would have little haircut margin, which would be limited to some of the interest. Now, with the agreement of the Bank of Greece, they will be able to proceed with a total write-off of interest and a haircut of up to 50% of the outstanding principal, depending on the assets of the farmer or cooperative.

At the same time, according to the regulation, the administrators will work with financial institutions with experience in agricultural lending to refinance debtors in order to meet the requirements of the new regulation and at the same time to return to production.

A government agent with knowledge of the new framework gives the following example to THEMA: “In a loan with an initial principal of 600,000 euros and interest of 400,000 euros, where the debtor has paid part of his obligations, the possibility of a total haircut of interest and a 50% write-off of the principal will be given. For the 300,000 euros that remain, the possibility of a 10-year repayment and the provision of a new loan is given so that he can repay and restart his productive process.”

Leveraging pledges

It also adds that the overall settlement of the debts will include the immediate utilization of the liens. According to available data, over 26,000 properties (farmland, packing plants, manufacturing plants, warehouses, etc) are mortgaged under the red farm loans. They will now be able to be sold, leased, etc., providing much-needed liquidity to the original borrowers.

According to reports, the government’s goal is to release within the next two years rural properties and infrastructure of high productive potential worth €200 million. Also, especially for inactive cooperatives, a consensual transfer of their assets to active farmers and cooperatives is planned.

Finally, it should be noted that according to the timetable the regulation is expected to be submitted to the Parliament in October. A tender process for the transfer of the portfolio from PQH to a servicer and bank scheme will follow, while the design of the business plan, the bank refinancing program, and the detailed registration of debtors will start early in the new year.

Ask me anything

Explore related questions