Greek and international investors and buyers are continuously seeking opportunities in the Greek real estate market, now in its seventh year of growth. Interest in residential properties in Athens neighborhoods and vacation homes is revealing surprising areas in terms of yields and sale prices. At the same time, the Ellinikon project, the first smart green city being built from the ground up in Europe, stands out as a unique case study in real estate. Which central Athens areas have the best yields? Where are prices trending? What are the trends in vacation homes?

New Athens neighborhoods are emerging as top choices for investors and property owners looking for attractive yields and investment opportunities. Recent analysis by Protio highlighted areas that have become investment hot spots, showcasing the ongoing momentum of the income property market in central Athens and its suburbs. Topping the list for the highest rental yields are Ano Dafni and Amerikis Square, both with a yield of 7.1%, indicating significant rent price increases in these areas. Polytechnic University follows with a yield of 7%, and Aigaleo with 6.9%, driven by the development of surrounding areas and good access to public transportation. The momentum extends to the Larissa Station – Vathis Square neighborhood with a 6.6% yield and Korydallos with 6.5%, where the interest in renovating properties for rental purposes remains strong. Kypseli shows steady performance with a 6.4% yield, while Peristeri offers attractive opportunities with a yield of 6.3%. In the northern suburbs, Marousi’s Paradise area stands out with a 6.1% yield, and Kato Halandri with 5.6%, a newer choice with notable potential for upgrades.

The term “yield” refers to the percentage of annual rental income relative to the property’s value, indicating the investment’s return via rental income. For instance, a 7.1% yield in Ano Dafni means that if someone buys a property there, the annual rental income would be 7.1% of the purchase price. In comparison, Kolonaki shows a significantly lower yield of around 3-4% due to its high property values, which reduce the rent-to-purchase price ratio. Although Kolonaki remains attractive due to its prestige and high demand, its yield is more modest than areas like Ano Dafni or Amerikis Square.

Over the past decade, the average price increase for various apartment types has exceeded 78%, almost doubling, according to GEOAXIS, a certified property appraisal company in Greece. Newly constructed apartment prices rose by 8.51% in the past year and 24.7% over two years, while older apartment prices increased by 7.81% and 22.68%, respectively.

Between Q3 2023 and Q3 2024, newly built apartments saw a median annual increase of 8.51%, while older apartments rose by 7.81%. The highest prices for new apartments were recorded in Holargos, followed by Palaio Faliro, Marousi, Ampelokipoi, and Peristeri. For older apartments, Holargos led in price increases, followed by Marousi, Palaio Faliro, Peristeri, and Ampelokipoi.

GEOAXIS’ market research involved on-site inspections and data collection from ads in newspapers and online listings. The studied areas included central Athens (Ampelokipoi), northern (Marousi), southern (Palaio Faliro), western (Peristeri), and eastern (Holargos).

The vacation home market, especially in coastal areas, is on an upward trajectory, expected to grow for the next 4-5 years. Prices are likely to increase but at a slower rate, according to Corina Saia, CEO of Premier Realty. Investors are increasingly purchasing properties for short-term rentals, attracted by the potential for high yields during the tourist season. Mykonos and Santorini have rental yields exceeding 8%, among the highest in Europe.

The most demand is in southern suburbs like Vouliagmeni, Voula, and Glyfada, as well as islands like the Cyclades, Paxos, Hydra, Crete, and Lefkada. Prices are highest in Mykonos (average €6,500/sq.m) and in the Ionian Islands like Paxos (€4,900/sq.m).

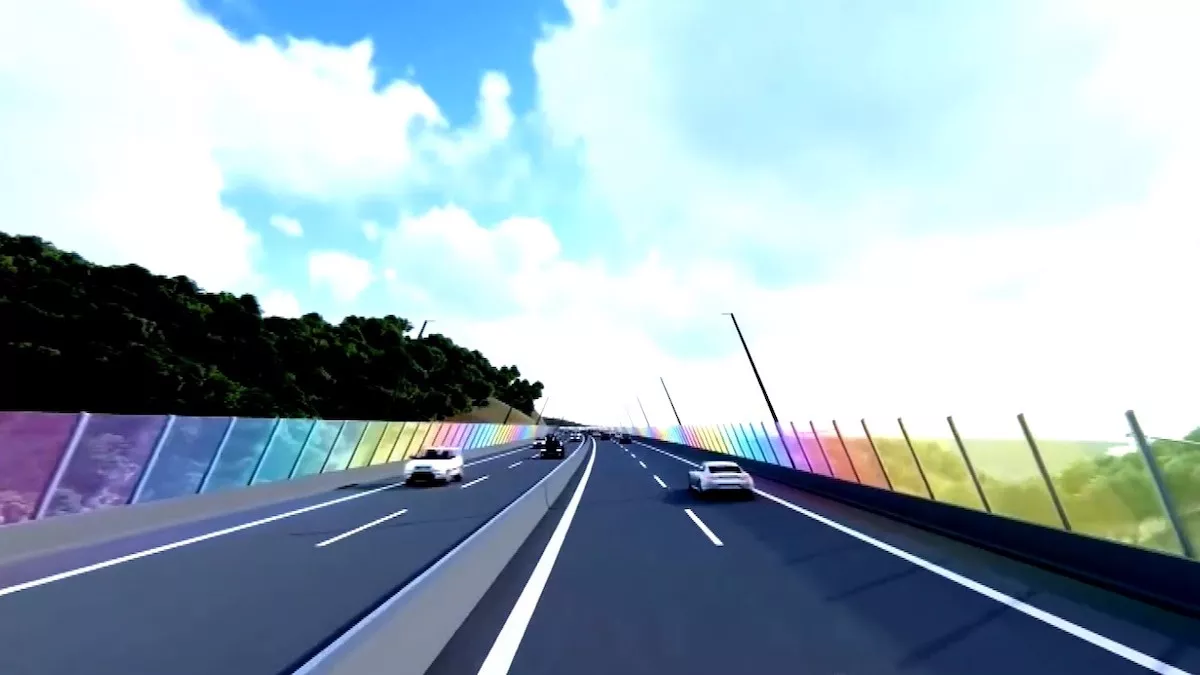

The Ellinikon project significantly impacts the residential real estate market with hundreds of homes under construction for high and mid-income buyers as part of a large redevelopment project. LAMDA Development’s CEO, Odysseas Athanasiou, recently noted that demand has exceeded expectations, with around 40% of buyers coming from international markets.

All units in the coastal front’s first phase, such as Villas, Riviera Tower, and The Cove Residences, are sold out. The new “Little Athens” neighborhood, comprising 1,115 residences and 115 commercial spaces, is experiencing a steady rise in pre-sales, with prices currently between €7,000 and €17,000 per sq.m.

Ask me anything

Explore related questions