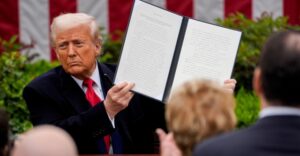

A fresh rise for the dollar, which touched its highest level in a year, as the US currency was affected by developments fuelled by Donald Trump’s victory in the presidential race.

The Bloomberg Dollar Spot Index rose as much as 0.7 percent on Monday to its highest level since November 2023, with traders betting Trump’s trade policies will boost the dollar and weigh on major currencies, including the euro. The yen was the worst-performing currency among developed world bonds on Monday. The dollar index later narrowed its move later in the day, trading up 0.5 percent.

The dollar also got a boost from the Federal Reserve, which cut its key interest rate by a quarter point last week after a half-point move in September.

The dollar is strengthening after six straight weekly gains as data points to solid US economic growth.

Meanwhile, weaker economic expansion elsewhere in the world is prompting central banks to cut borrowing costs, weighing on local currencies.

Ask me anything

Explore related questions