A thriller for deep pockets and even stronger nerves has been unfolding in Thessaloniki over the past few days. At the forefront are the shareholder dynamics of the Thessaloniki Port Authority (OLTH), but behind the scenes, speculation is rife about a case with geopolitical, political, and economic ramifications.

The story began last Friday afternoon when it was revealed that a public offer had been submitted by the newly formed Dutch company LeonidsPort for up to 21% of OLTH. Newsrooms were abuzz when it was discovered that behind the company was the Louis-Dreyfus family, owners of the French agricultural giant Louis Dreyfus Company—one of the world’s most powerful conglomerates with annual revenues of $50–60 billion, operations in 100 countries, and 22,000 employees. In the following days, there was a frenzy on the stock market, as investors accepted the public offer at a price of €27 per share, selling to LeonidsPort, named after the grandfather of Margarita Olegovna Louis-Dreyfus, who now owns the group after her husband’s death.

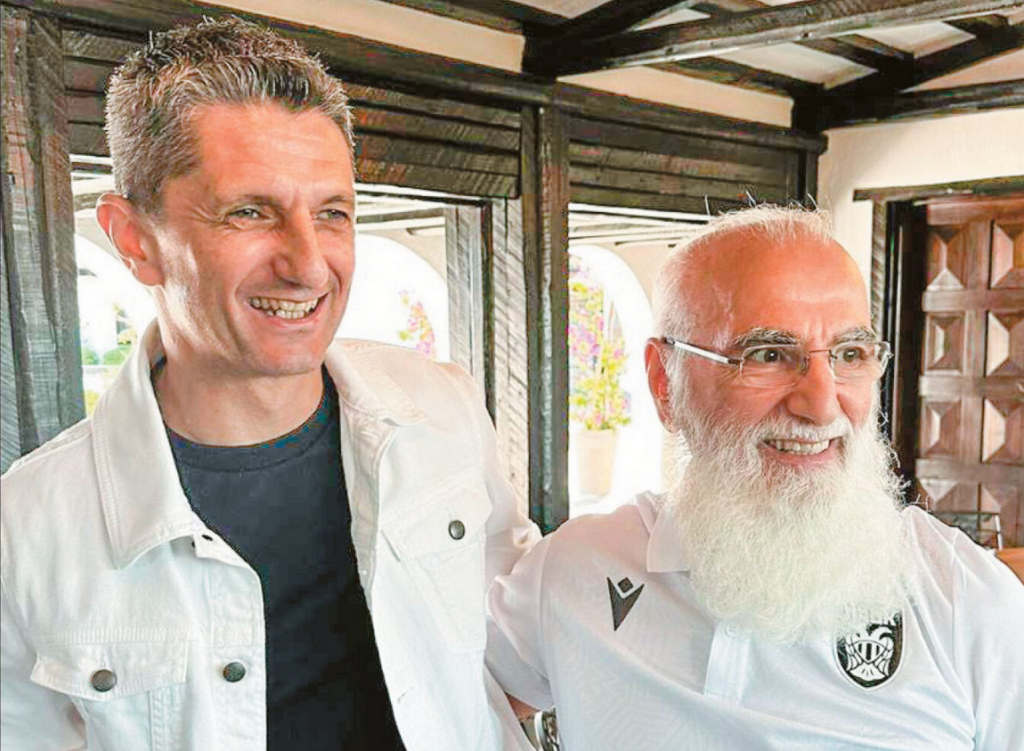

Then, Ivan Savvidis, the major shareholder of OLTH S.A., entered the scene. By purchasing shares at prices well above €27, he seemed to halt (?) the developments. By acquiring a small number of shares, he increased his direct stake to just over 50% and his indirect stake to 72.62% through a consortium with the French shipping giant CMA CGM.

The situation is now delicately balanced, with the stock price exceeding €29. Speculation abounds about the true intentions of the Louis-Dreyfus family, their next moves regarding Thessaloniki Port, and whether they are collaborating with one of OLTH’s major shareholders.

What Brought the Dreyfus Family?

The Louis-Dreyfus family, particularly Margarita Louis-Dreyfus and her three sons, Kirill, Maurice, and Eric, appear to be seeking to expand their private investment portfolio, estimated at $50–60 billion in turnover, by venturing into a new sector of strategic global infrastructure investments, with a focus on Europe.

Their first move, reportedly, is OLTH. However, market observers describe LeonidsPort’s public offer as somewhat hastily planned, which was evident in the relatively small percentage of shares acquired compared to the initial target. Others suggest that the aim might have been to secure a minor stake from the outset.

Market circles also question how a group of Louis-Dreyfus’s global stature did not gauge market intentions before making a public offer for 21% of OLTH. They also express concern over why the Louis-Dreyfus group, in targeting such a critical strategic infrastructure, did not inform Greece’s Hellenic Republic Asset Development Fund (HRADF), which holds a 7.3% stake, or other institutional stakeholders. Moreover, they wonder why the family chose Thessaloniki Port, given their lack of prior involvement in port operations. While they have a fleet for transporting agricultural products, owning and managing ports is a different venture altogether.

Savvidis’s Moves

On the other side, Ivan Savvidis, through Belterra, responded by purchasing shares above the Louis-Dreyfus offer price, signaling to the market that the public offer was “hostile.”

This is what those argue who claim that Savvidis’ move to purchase even a small number of shares indicates that there was no prior arrangement with the Dreyfus family, contrary to some of the circulating scenarios. But is that truly the case?

What is certain, stemming from a public offer that appeared out of nowhere, is that Savvidis’ side managed to slightly increase its stake in OLTH in a justifiable manner, fueling further speculation about potential future developments regarding the port’s ownership. So far, as market sources noted to To Thema, “if the goal of any party was to delist the company via the public offer, they did not succeed, at least for now.”

The same sources add that if Ivan Savvidis wanted or was able to sell, he would have already done so. Reportedly, there have been very serious offers for OLTH, the most recent from a major Arab port-operator group that valued OLTH at €400 million. All such offers were put on hold, as Savvidis either does not want to sell or is unable to do so.

The “French” Factor

Another aspect in play, as discussed in both economic and political circles, is the strained relations between major shareholder Ivan Savvidis and the French stakeholders CMA CGM, who hold nearly 20%. This might have catalyzed recent developments. Speculation suggests a possible connection between CMA CGM, based in Marseille, and the Dreyfus family, who until 2016 owned the French football club Olympique Marseille.

In the coming days, the initial outcome of these shareholder dynamics will become clearer. If the billionaire Dreyfus family secures the necessary percentage, they could request financial audits and appoint their own representative to OLTH’s board. Reports also indicate that there could be meetings between the two sides, potentially advancing the situation to the next stage.

The Importance of the Port

Regardless of the outcome, the potential involvement of a global financial powerhouse in OLTH’s investment landscape would expand its capabilities at a time of ongoing geopolitical developments. It would also signal confidence in the Greek economy and port infrastructure.

“This conflict over OLTH has political and economic dimensions, as the port is a key hub for the development of Northern Greece and the country’s relations with the Balkans and Central Europe,” comment political analysts. A shipping industry insider told To Thema, “The behind-the-scenes aspects of this case are tied to the high political and economic value of OLTH and the fact that control over the port could provide significant advantages to anyone overseeing its operations.”

Since 2018, €74.1 million has been invested in various infrastructure projects and mechanical equipment at OLTH S.A. In recent years, OLTH has increased the group’s turnover by 47% annually, maintains zero debt, holds approximately €100 million in cash reserves, and distributes dividends annually. However, it is also obligated to implement multimillion-euro investments committed as part of the privatization process, requiring significant capital.

Green light from the Council of State for the 25-year master plan and the €160 million investment.

The use of “industry and craft industry” in the main subzone A2, covering 353,880 square meters, was deemed illegal.

The Council of State gave the green light for implementing most of the master plan for Thessaloniki Port, classified as a port of international significance, with a budget of €160 million for mandatory investments. However, the Council of State ruled that the use of “industry and craft industry” in the vital subzone A2 of the port, covering 353,880 square meters, is unlawful.

Last September, a draft Presidential Decree for the “approval of the development program and management study (master plan) of Thessaloniki Port” was submitted to the Council of State’s Fifth Division for legislative review. Before submitting the decree, a positive recommendation was issued by the Port Planning and Development Committee of the Ministry of Shipping, the Strategic Environmental Impact Study was approved, a specialized scientific study was prepared, and the Thessaloniki Municipality provided a positive opinion.

The goal of the master plan is to define the strategic development of the “multifaceted” port of Thessaloniki over a 25-year horizon. Activities are divided into two sections: the eastern section, which is in the immediate vicinity of the city center and includes passenger traffic and spaces for cultural activities, and the western section, which concerns purely commercial operations of the port.

Specifically, for the port zone directly connected to the life of the city, urban uses of significant economic interest are planned, including commercial, financial, tourism, recreational, and cultural activities. It is important to note that green spaces play a significant role, occupying 51% of the area.

Indeed, the Council of State issued its first opinion of 2025 (1/2025) concerning the port’s master plan, emphasizing that “priority is given to the urban planning of the port zone, which is subject to the provisions of Article 24 of the Constitution for rational planning, adopting urban criteria consistent with the character, specificities, and needs of each port zone, based on a specialized scientific study.”

According to the 74-page opinion, “the Port of Thessaloniki is the most important in Northern Greece and one of the most significant in Southeastern Europe.” The planned projects, as well as those to be implemented after the port becomes fully operational, are not expected, based on studies, “to negatively impact the water renewal rate in the marine ecosystem of the Thermaic Gulf or the overall quality of the marine waters.” The cost of implementing the master plan is estimated at €160 million. Specifically, the expansion of port infrastructure at Pier 6 will amount to €130 million, the mechanical equipment for Pier 6 will cost €7 million, and the restoration of the old Customs Station will require €23 million.

The port has two zones: Zone A (eastern section), which is passenger-oriented and includes three piers with a total area of 385,507 square meters, and Zone B (western section), which is commercial-oriented with three piers covering a total area of 1,164,493 square meters, which will expand to 1,687,040 square meters with the planned extensions.

The focus of the Council of State (presided over by Vice President Margarita Gortzolidi and with advisor Zoe Theodorikakou as rapporteur) was on subzone A2. This zone aims to serve cruises, coastal shipping, and vehicle ferries. It is a port area for passenger, tourism, and cultural activities, functioning as a terminal for cruise ships, coastal shipping vessels, passengers, and vehicles.

In Zone A2, activities related to docking and servicing ships are allowed, including the provision of port services such as the Central Port Authority of Thessaloniki, the Fire Department, the Pilotage Service, waste collection ships, fuel supply for vessels, and fishing boats. Additionally, tourism reception, recreational and cultural uses (museums), commercial stores, supermarkets, and entertainment centers are permitted.

However, the Council of State deemed the related provision of the Presidential Decree concerning the use of subzone A2 unlawful. The reason cited was the lack of provisions in the study regarding the degree of disturbance it would cause in the area and the failure to specify its environmental classification to enable legality checks.

Ask me anything

Explore related questions