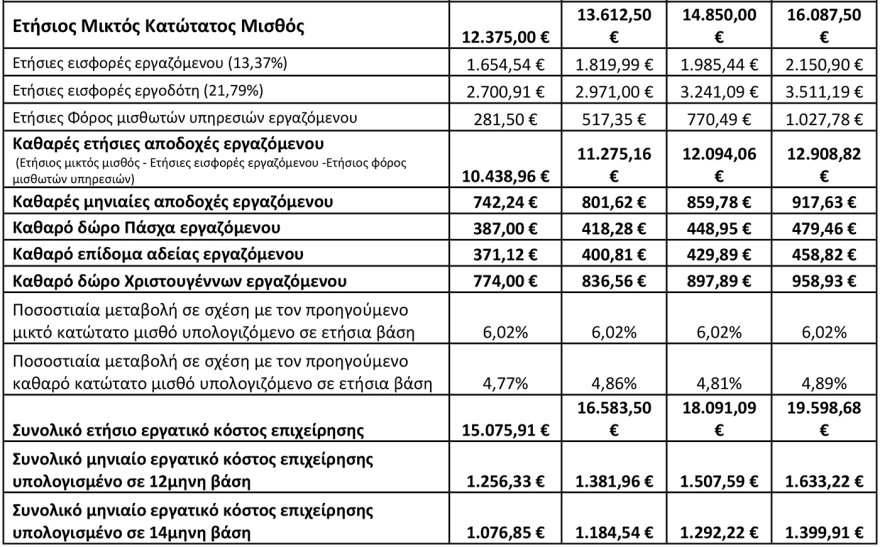

The cost to the business for each employee paid the new minimum wage of €880 per month starting April 1st is €1,256.33 per month and €15,075.91 annually, while the employee will receive €742.24 net monthly and €10,438.96 annually.

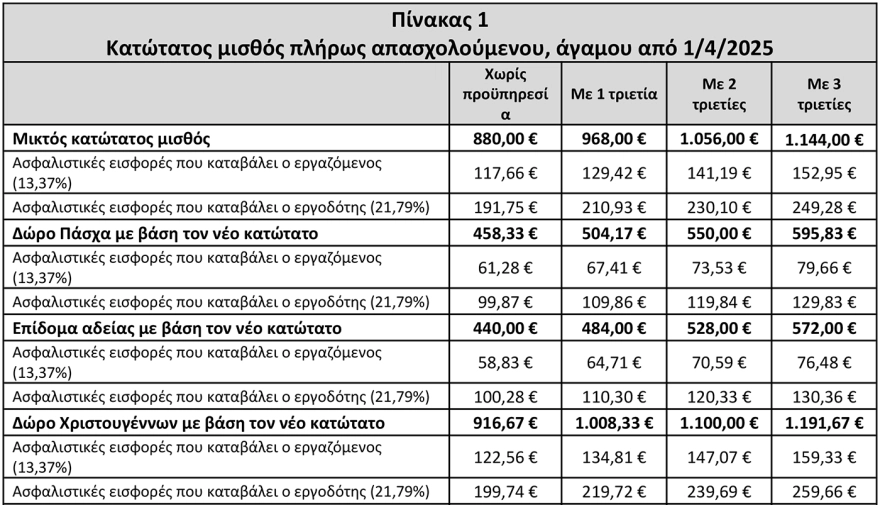

With the new wage, the Easter bonus, which will be paid on Holy Wednesday, April 16th, amounts to €458.33 (including an additional percentage for the bonus), the vacation allowance will be €440, and the Christmas bonus will amount to €916.67.

The tax for a single employee annually is €281.50.

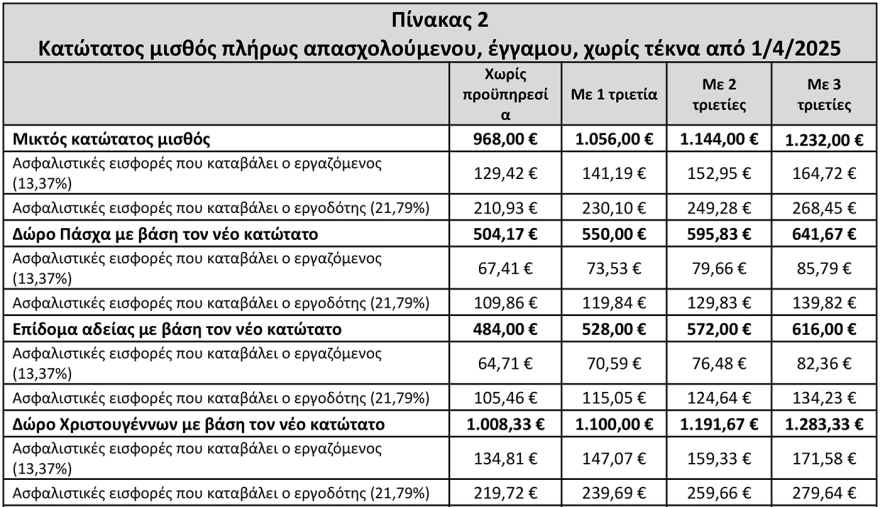

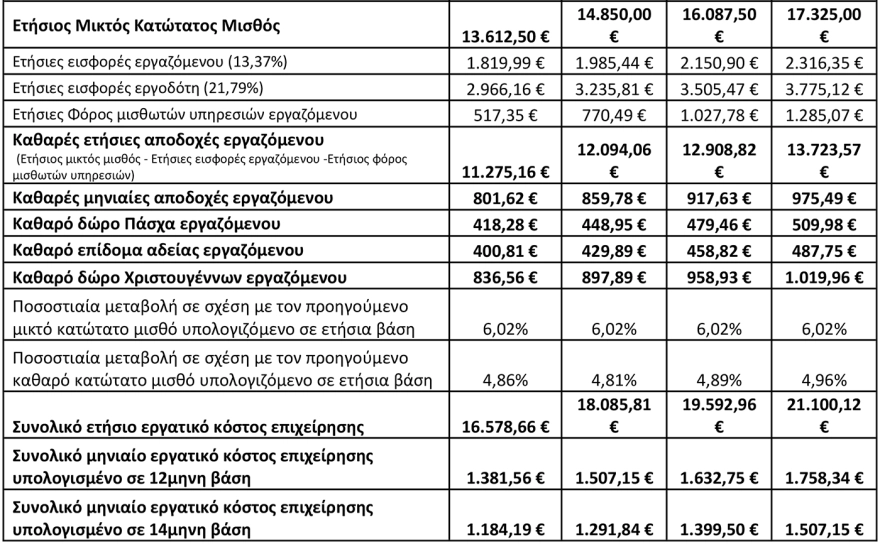

For married employees, wages increase based on seniority bonuses. A married employee with three seniority bonuses will earn €1,232 gross per month (€801.62 net) and €17,535 gross annually.

In another case, where the employee costs the business €1,758.34 per month, the annual cost to the business is €21,100.12, with an annual tax of €1,285.07.

According to the table created by Giorgos Thanopoulos, Head of the Research, Documentation & Analysis Unit of IME GSEVEE, the wages for employees paid the new minimum wage and the cost to businesses are detailed as follows.

Ask me anything

Explore related questions