A permanent financial “breather” — which for thousands of recipients reaches or even exceeds half of a monthly pension — is on the way for 1.44 million retirees, uninsured elderly individuals, and people with disabilities.

This government initiative leverages the overperformance of the economy and converts it into fiscal space — without which new, permanent support measures each year would not be possible.

Unlike in the past, this benefit won’t be a one-off bonus handed out before Christmas. With approval from the European Commission, deeming it compliant with fiscal rules, it will be automatically paid out by law every November, without application, around the same time as the December pension (which is paid at the end of the previous month). And it’s not limited to low-income pensioners earning up to €700–€800 — even pensioners receiving more than €1,000 or €1,150 per month (or much higher in some cases) will qualify.

Who Qualifies and How Much They’ll Get

According to the eligibility criteria, two out of three retirees over 65 will receive the €250 bonus starting this year, while retired couples will receive €500 — provided their total taxable family income (as declared on this year’s E1 tax form) does not exceed:

- €14,000 for singles (including widows, widowers, or divorced individuals),

- €26,000 for married couples or cohabiting partners.

Examples of Eligibility:

A person will receive the €250 bonus this November if they are over 65 and received a pension in September, in situations like:

- A single retiree with a total monthly pension income of €1,166 and no other income.

- A widow/widower receiving a €450 monthly pension (or €5,400 annually), plus additional income (e.g., part-time work), provided the total stays below €8,600 annually.

- A couple where only one person received pension income up to €2,166/month last year, and the other had no income at all.

- A retired couple jointly receiving a total of €2,166 in monthly pensions, with no other income — both will receive €250 each, totaling €500.

Since eligibility is based on total taxable income, not pension amount alone, more complex cases arise:

- A newly retired individual receiving a €3,500/month pension for four months in 2024 (totalling €14,000) will get the €250 in November. But if they also had salary income earlier in the year, pushing them over the €14,000 limit, they’re disqualified.

- Conversely, a low-income retiree taxed on imputed income over €14,000 (e.g., due to owning a car or property) may lose eligibility. However, for retirees over 65, imputed income is reduced by 30%, and further reductions are planned in 2026.

Other Eligible Groups

The same benefit will be granted to:

- 193,000 recipients of disability-related welfare benefits (via OPEKA).

- About 300,000 recipients of other disability allowances, such as:

- Institutional care exemptions,

- Public sector illness or incapacity pensions,

- Total disability pensions from the former OGA,

- And similar benefits from e-EFKA or the state.

Note: Property value limits do not apply to these last groups, unlike the ~1.1 million retirees (where the asset cap is €200,000 for singles and €300,000 for couples). Those eligible under multiple categories (e.g., retirees also receiving disability benefits) will only receive one payment, not multiple.

Where the Money Comes From

This annual bonus is part of a broader €1.1 billion yearly support package, which also includes:

- Housing rent reimbursement for ~948,000 households,

- An additional €500 million yearly for the Public Investment Program.

The €360 million annual cost of the pension bonus is funded by exceeding 2024’s budget targets. The year closed with a 4.8% primary surplus and 1.3% net surplus, creating the needed fiscal headroom.

More Measures on the Way

This record budget surplus — the largest since at least 1995 — will also fund additional measures to be announced in September, including pay and pension increases and middle-class tax cuts, starting January 1, 2026. A reserve is also being kept in case of emergencies or unexpected spending needs.

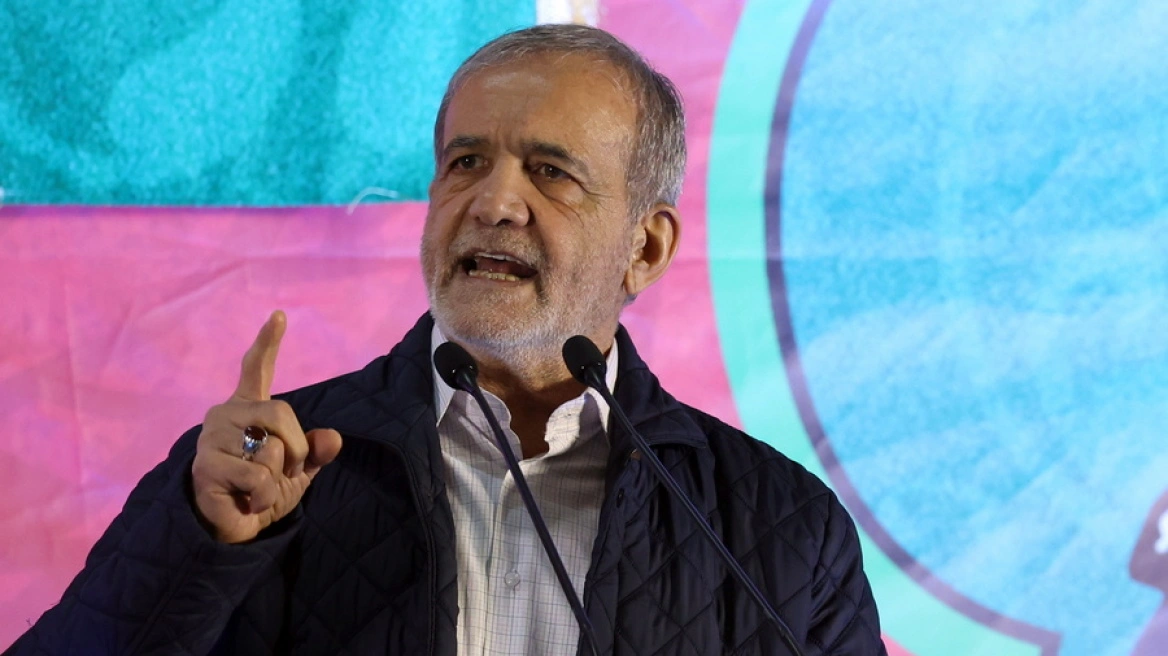

“As our economy improves, so will the financial situation of citizens — and in real time,” said Prime Minister Kyriakos Mitsotakis.

Finance Minister Kyriakos Pierrakakis explained that the surplus didn’t result from raising taxes but from:

- Combating tax evasion,

- Economic growth and higher employment,

- Cutting government waste.

How the Surplus Was Built

- Record tax revenue: €1 billion above expectations (Oct. 2024 – Feb. 2025), due to better compliance and earnings:

- €519M from income taxes (individuals + businesses),

- €497M from indirect taxes,

- On top of what was expected from growth, inflation, and imputed income measures.

- Insurance contribution overperformance: €862M more than forecasted, despite contribution cuts. Reasons include:

- Faster-than-expected wage growth (7.4% vs 5.2%),

- Lower unemployment (now at 8.6%),

- The work card system exposing undeclared work.

- Improved state expense and asset management, including:

- €430M from better performance of pension fund assets,

- €542M saved from central administration costs,

- €748M better results from state legal entities,

- €270M from interest savings and refunds,

- €100M from Public Investment Program improvements.

These allowed for a 4.5% increase in public spending for 2025 (roughly €4.5 billion more than 2024), exceeding the EU’s annual spending limit of 3.7%. However, Greece received special approval due to its 2024 performance.

Last year, the limit was 2.6%, but negotiations with the EU (which recognized €2B in permanent revenue increases) resulted in near-zero net spending change — despite dozens of new benefits and tax cuts, like the elimination of the business fee.

This created fiscal room to allow an annual spending increase of up to 0.3% of GDP (~€700M) — as long as Greece meets its two-year cumulative target. Hence, 4.5% is the ceiling for 2025, with room still left for 2026.

Ask me anything

Explore related questions