The war in Ukraine grinds on with no clear end in sight. Russia continues to violate EU airspace, heightening tensions with NATO. Against this backdrop, U.S. President Donald Trump has issued strong warnings to European nations, urging them to stop buying oil and gas from Russia. According to Trump, these purchases directly fund Moscow’s war in Ukraine.

He emphasizes that Europe’s dependence on Russian energy undermines the West’s collective efforts to isolate Vladimir Putin and curb Russian aggression — a position he has repeatedly stressed, warning of serious geopolitical consequences.

From the Laconian Gulf to the North Aegean

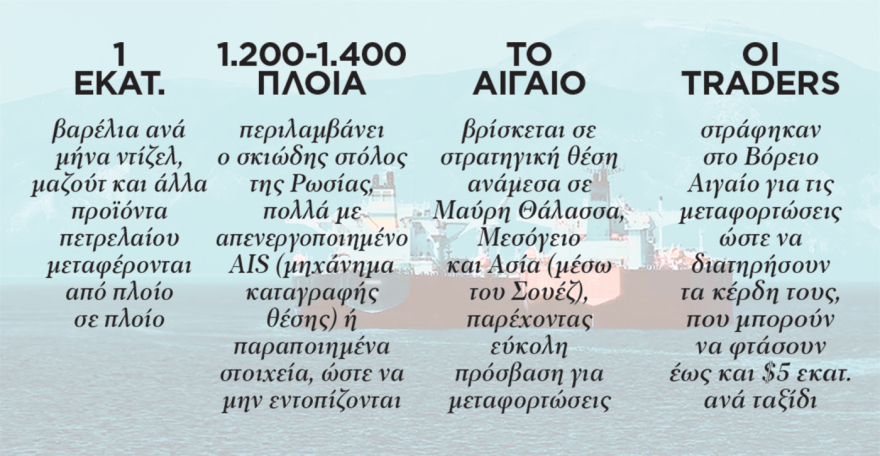

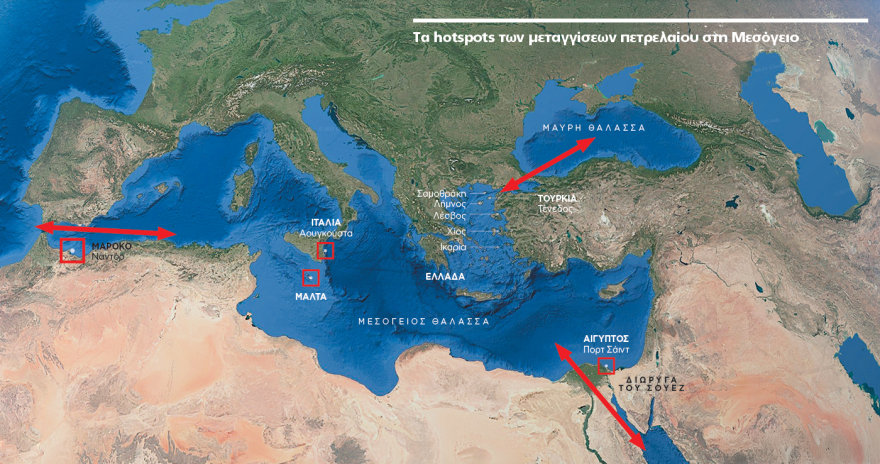

While diplomatic and economic pressures mount, Russian oil flows persist. New transshipment “havens” have emerged in the Aegean Sea, involving secret transfers from tanker to tanker. Market intelligence points to a shift: after Chios, Lesvos, and Ikaria, attention is now on the Chios–Samothrace–Lemnos triangle, where Ship-To-Ship (STS) activity is increasing.

The move comes amid a significant reshaping of the global shipping sector. The European Union’s 18th sanctions package, effective since summer 2025, targets Russia’s oil transport industry. In response, Athens has effectively blocked Russian activity in the Gulf of Laconia through naval exercises, forcing the so-called “shadow fleet” to seek new operational areas further north — turning billions of dollars in energy trade into a strategic game of relocation.

A Greek government official told THEMA:

“After repeated NAVTEX announcements in the Gulf of Laconia, transshipment activity is shifting northwards. We are monitoring movements of the shadow fleet, but as long as these take place in international waters, intervention is limited.”

However, unlike the calmer waters of the Laconian Gulf, the Northeastern Aegean is exposed and challenging. Winds often exceed 8 Beaufort, raising serious risks of accidents and environmental damage. As the official warns:

“The Aegean could be facing a major oil spill.”

The Evolution of Transshipment Practices

STS transshipments intensified after the EU imposed its first sanctions on Russia in February 2023. Fuel traders sought alternative routes to sustain exports to Turkey, Brazil, India, China, and Africa. The Gulf of Laconia became a hotspot due to its proximity to Russian Black Sea ports and the Suez Canal. Dozens of tankers anchored there, awaiting transfers.

That changed when the Greek Navy enforced blockades for war exercises, pushing transshipments north: initially south of Chios and Ikaria, then near Lesvos, and later to other Mediterranean hubs such as Malta, Port Said (Egypt), Augusta (Italy), and Nador (Morocco). Despite these diversions, Greek waters remain attractive. Now, activity is returning — this time near Samothrace and Lemnos, signaling a strategic shift.

Stricter Sanctions and the Shadow Fleet

EU sanctions on Russian oil have steadily tightened.

- December 2022: Cap of $60/barrel for maritime crude oil transactions.

- July 2025 (18th sanctions package): Cap reduced to $47.60/barrel, dynamically adjusted to remain about 15% below the average international price of Russian crude.

These measures, coupled with sanctions targeting the infrastructure enabling the “shadow fleet,” force Russian shipping into stealthier operations. Estimates suggest around 60 Aframaxes and 35 Suezmax tankers will exit the Russian market by mid-October, disrupting supply-demand flows and freight rates globally.

The new EU strategy focuses on dismantling the shadow fleet’s structural network — targeting not only ships but also their corporate registration systems. This marks a decisive turn for the shipping industry, compelling greater transparency while reducing Moscow’s oil revenue.

Why the North Aegean?

Several factors explain the shift to the Samothrace–Lemnos corridor:

- Strategic location linking the Black Sea to Mediterranean and Asian markets via the Suez Canal.

- Access to international waters within Greece’s economic zone, minimizing direct Greek authority intervention.

- The shadow fleet’s composition: over 1,400 ships, many with disabled AIS tracking or falsified data.

- Natural continuity with previous hotspots near Chios, Ikaria, and Lesvos.

- Lower detection and intervention risks compared to the Laconian Gulf.

- Approximately 1 million barrels/month of petroleum products transferred via STS here.

- Flexibility in movements due to mixed territorial waters.

- Avoidance of zones with naval exercises or heavy military presence.

This strategy reflects a legislative and operational adaptation to maintain Russian oil exports despite the EU’s sanctions.

Environmental and Security Risks

The rise in transshipments in the North Aegean raises major concerns:

- Safety risks: Many transfers occur in open sea under poor weather, increasing the likelihood of oil spills.

- Environmental impact: Any spill could threaten sensitive ecosystems around Lesvos, Chios, Samothrace, and Lemnos.

- Insurance challenges: Sanctions create difficulties for securing coverage for risky transfers.

The combined effect touches on security, environmental, shipping, and geopolitical concerns. Greece now finds itself in a pivotal role — enforcing EU sanctions while balancing national and regional security.

A Strategic Crossroads

The North Aegean phenomenon is more than a shipping shift. It is a calculated response to a tightening sanctions regime and evolving geopolitical tensions. Greece’s naval deterrence in the Laconian Gulf has redirected transshipment activity, transforming the islands of Samothrace and Lemnos into key nodes in a complex web of energy geopolitics.

For the EU and NATO, this represents both a challenge and an opportunity — to enforce sanctions while confronting the environmental and security implications of a shifting energy battlefield.

Ask me anything

Explore related questions