Artificial Intelligence: The Driving Force Behind NVIDIA’s Unmatched Success

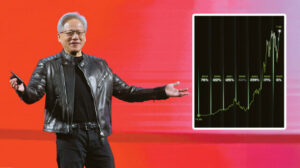

Artificial Intelligence (AI) stands as the undeniable secret behind NVIDIA’s extraordinary commercial rise. It may also be the key to understanding how Jensen Huang—the company’s founder and chairman for 32 years, famously known as the “man in the black leather jacket”—has amassed a personal fortune now estimated at $180 billion. Huang’s journey is remarkable: the son of Taiwanese immigrants, he began working menial jobs, from cleaning toilets in modest Oregon eateries to teaching literacy to juvenile delinquents.

In Huang’s case, even the quintessential American Dream struggles to fully capture the magnitude of his and NVIDIA’s “miracle.” The company has become the first private firm in the world to surpass—and somewhat exceed—a $5 trillion market capitalization, achieved by producing the best integrated circuits powering AI applications globally.

A Market Giant Rivaling Nations

NVIDIA’s valuation of $5.03 trillion places it on par with the economic powerhouses of entire nations, nearly equal to Germany’s $5.09 trillion GDP and surpassing both Japan and India, whose economies stand at $4.28 and $4.13 trillion, respectively. While market capitalization is not directly comparable to a country’s GDP, this comparison underscores the unprecedented scale of NVIDIA’s achievement in the corporate world.

A Geopolitical Superweapon

NVIDIA’s significance extends beyond business success; it has emerged as a new geopolitical force. The company serves as a strategic asset in the ongoing U.S.-China rivalry, significantly bolstering America’s negotiating power. Despite its American roots, NVIDIA has deep penetration in the Chinese market, up to 95% of AI integrated circuits there. However, amid the escalating cold war between the U.S. and China, the company’s exports to Asia have become a focal point of intense political conflict between Donald Trump and Xi Jinping.

Within the digital technology sector, NVIDIA commands a commanding lead, boasting a market value $1 trillion greater than its nearest rival, Apple, which stands below $4 trillion. It also dwarfs Amazon, whose market capitalization is approximately $2.44 trillion.

Surpassing Giants

NVIDIA’s rise was neither simple nor accidental. Until recently a relatively obscure chipmaker, it has decisively outpaced tech titans such as Apple, Amazon, Microsoft, Google, and Facebook, compelling them to emulate rather than surpass its innovation—at least for now.

Unlike the fame-first approach of entrepreneurs like Elon Musk, NVIDIA’s prominence followed its record-breaking profitability and growth. This reflects the unique leadership style of Jensen Huang, a visionary who maintains a relatively low profile despite being ranked among the world’s richest individuals. Huang’s recent rise to #8 on Forbes’ list of wealthiest personalities follows NVIDIA’s stock surge, which has further cemented his status as a billionaire tech icon.

The Future of AI and NVIDIA’s Monopoly

NVIDIA’s dominance in AI chips is expected to continue, fueled by unmatched expertise in data center technology. Originally founded in the early 1990s to enhance video game graphics realism, NVIDIA has since become a near-monopoly in the semiconductors essential to data center infrastructure—the backbone of AI. Since AI applications depend on these data centers, NVIDIA rightly claims its title as “the most valuable company in the world.”

Huang’s allegiance to Donald Trump’s “Make America Great Again” vision is clear; he has advocated for increasing domestic production of advanced AI components. Yet he also champions immigrant talent in the U.S., recognizing their crucial role in the innovative spirit driving NVIDIA’s chip design and manufacturing breakthroughs.

Navigating Uncertainty

Despite political uncertainties, Huang’s primary concern lies not with fluctuating presidential favor but with safeguarding NVIDIA against the fate that befell once-invincible tech giants like Blackberry, AOL, Cisco, and IBM. These cautionary tales remind him—and the industry—that no company is immune to disruption.

Huang firmly rejects the notion that AI is a passing bubble destined for spectacular failure. Instead, he is aggressively expanding NVIDIA’s reach, striving to maintain its leadership in next-generation chips and preserve its competitive edge.

Explosive Growth and Strategic Moves

On October 28, 2025, NVIDIA stock soared 5% in a single day, continuing a stellar run with a 50% increase in market capitalization since the beginning of the year. The company recently announced $500 billion in anticipated AI chip orders and is deploying seven supercomputers commissioned by the U.S. government. NVIDIA has also invested $1 billion in Nokia, revitalizing the telecommunications pioneer’s role in building 6G infrastructure.

Under Huang’s leadership, NVIDIA is diversifying aggressively across multiple sectors. His concept of “accelerated computing”—an ecosystem centered on AI technology from microchips to “AI factories” equipped with ultra-powerful data processing systems—is key to shielding NVIDIA from market volatility.

The Rise of Intelligence as a Commodity

“Accelerated computing has paved the way for productive AI,” Huang explains. “For the first time in human history, we can manufacture our most valuable asset: intelligence. Companies and governments worldwide are building AI factories using NVIDIA products. Intelligence has become a new commodity, creating profitability opportunities in a $100 trillion industry.”

A vivid example of NVIDIA’s impact is CUDA, a computing platform launched in 2006 that now boasts over 53 million subscriptions, including 5 million developers and 40,000 companies specializing in advanced AI applications. NVIDIA has been a catalyst for a booming AI market that is now generating immense profits.

Expanding Horizons Amid Challenges

After revolutionizing graphics quality in PCs and video games, NVIDIA moved into cloud gaming and developed chips for medical and pharmaceutical research, accelerating diagnostics and treatment innovation. Its technology powers robotic processes across industries, including automotive and autonomous driving—areas where Huang continues to invest heavily.

Market excitement around NVIDIA was partly fueled by rumors of a potential U.S.-China dialogue on exporting the company’s most advanced Blackwell chip. Though removed from formal negotiations due to its sensitive nature, this issue highlights the high-stakes geopolitical drama surrounding NVIDIA’s technology.

The Human Cost of AI’s Rise

While NVIDIA’s AI-driven success reshapes the world, it also accelerates job displacement. Tens of thousands have been laid off by companies adopting or attempting to develop alternatives to NVIDIA’s products. The rise of AI is not without its human toll, as increased automation leaves many workers redundant and struggling to find their place in the new digital economy.

NVIDIA’s extraordinary journey—from a small chipmaker to a global technology and geopolitical powerhouse—is inseparable from the rise of artificial intelligence. Led by Jensen Huang’s visionary leadership, the company continues to shape the future of technology, innovation, and global power dynamics—while navigating the complex challenges of progress and its impact on society.

Ask me anything

Explore related questions