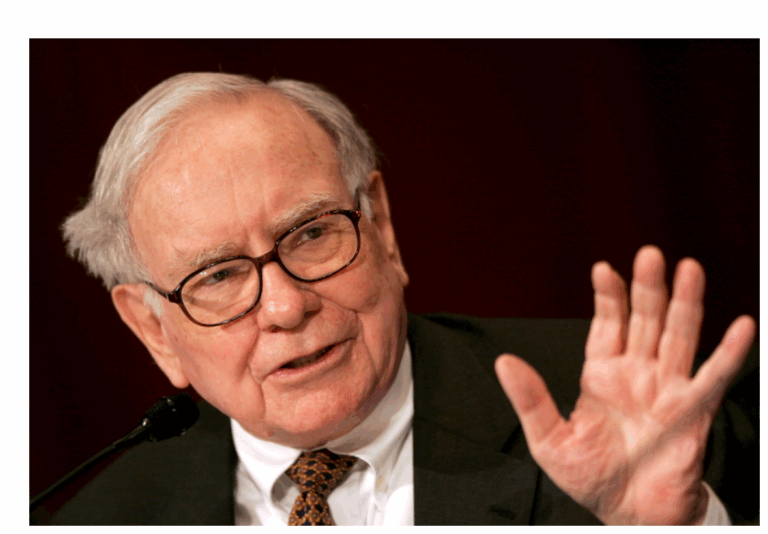

Shares of Berkshire Hathaway rose more than 4% last week, outperforming the market as investors anticipated Warren Buffett’s long-awaited letter — his first public message since announcing in May his plans to step down as CEO by the end of the year.

According to CNBC, the letter — expected to be released later today — will include Buffett’s reflections on philanthropy, the company, and other matters “that may be of interest to shareholders and others,” as stated by Berkshire. It is expected to serve as the farewell message of the 95-year-old investor, marking the end of more than six decades of leadership over the conglomerate, which began as a small textile company in New England.

The 4.6% surge in Berkshire Hathaway’s stock last week came amid a sharp decline in technology stocks, which dragged major indexes lower, with the Nasdaq Composite falling 3% as investors pulled away from high-growth equities.

In contrast, Berkshire’s diversified portfolio — spanning cash-generating businesses from insurance and railroads to utilities — provided a safe haven during the latest bout of market volatility.

Ask me anything

Explore related questions