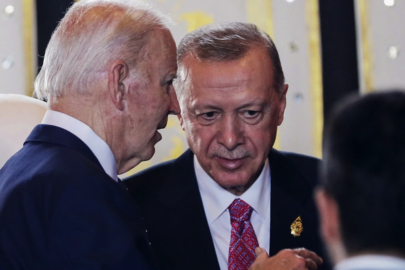

Just about every US president gets a Middle East crisis, and President Biden now has his. The war between Israel and the Palestinian Hamas group, which attacked Israel on Oct. 7, could be long and complex. Iran, which backs Hamas and seeks the destruction of Israel, might be involved. Israel has vowed a massive operation in Gaza, which Hamas controls, and months or even years of urban warfare there are likely to be grueling and ugly.

Financial markets are insulated from the direct effects of this unfolding war, which doesn’t immediately threaten energy supplies, corporate profits, or banking stability. But there are market concerns nonetheless, especially if the war escalates. Here are three things to watch.

“Modified gravity” could rule out both dark matter and Planet Nine

Oil supplies in 2024. Crude prices jumped by about 4% following the Hamas attack, which is a fairly typical reaction as markets apply a “fear premium” premised broadly on the perception of higher risk. That’s not a huge jump and the price hike could quickly fade if the oil market continues to function normally.

Continue here: yahoo