Greece may not find its old glory days anytime soon, but it will rise again from the swamp of the recent six-year long depression, offering great opportunities for long-term investors.

Democracy and human development will pave the way for the rise.

Since ancient times, democracy has often created chaos in the street of Athens, but it has served as a diffusion mechanism for political tensions. And it has accommodated the peaceful transition from one political leadership to another– a process that has accelerated in periods of economic crises.

That’s been the case in the recent crisis, a period during which Greek citizens have placed in and out the office several leaders, in the search of a figure who will guide the country out of the ongoing economic crisis.

There’s good news and bad news in Greece’s democratic process.

The good news is that the country has managed to maintain social cohesion throughout the crisis.

The bad news is that Greece hasn’t managed to escape from an old villain — a big and corrupt government sector that strangles the private sector, as evidenced by Greece’s corruption and economic freedom rankings.

But democracy will eventually change this situation, placing in office a leader who will deal with corruption by scaling back the size of the government sector, and by paving the way for the country to return to markets and reschedule its debt.

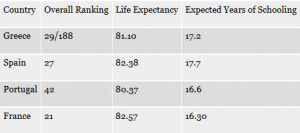

Then there’s is human development, an index in which Greece ranks among the top thirty countries in the world. One important factor is the nation’s years of general and postgraduate education, which has helped produce a Greek labor force that is both creative and innovative enough to compete in the global economy.

Greece’s Human Development Metrics (2015)

(Source: Human Development Report)

Democratic institutions and high levels of human development will help Greece get out of the unprecedented depression it has slid into, and rise again. All it takes is a nudge, a few pro market measures that will release the ingenuity and creativity of its people.

Foreign investors have taken notice. Like Minneapolis-based Varde Partners, which invested $65 millions in Greek shopping malls, as Athens Exchange begins to show signs of life, gaining close 10 percent in the last three months.

Ask me anything

Explore related questions