When Elon Musk started a poll on Twitter on March 25, asking his followers whether Twitter rigorously adhered to the principles of free speech, he added a disclaimer saying that “the consequences of this poll will be important.” A day later, after a majority had voted “no” to his question, Musk came to the conclusion that Twitter’s alleged failure to follow these principles “fundamentally undermines democracy” and publicly mulled over what should be done. “Is a new platform needed?” he asked. Naturally, some of his followers suggested that he, the world’s richest man worth roughly $300 billion, should simply buy the platform. Little did they know that by that time, Musk had already accumulated a sizeable chunk of Twitter stock.

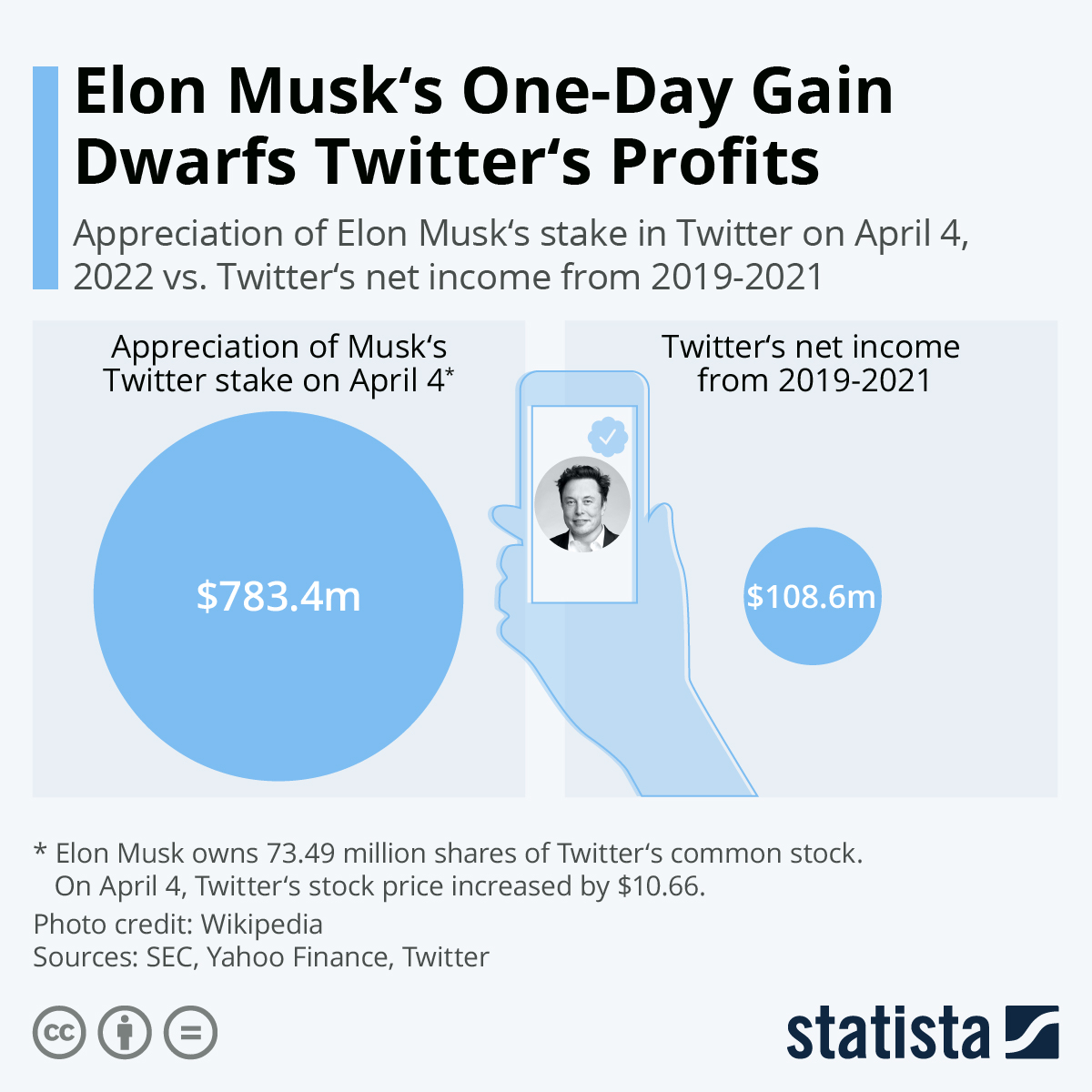

According to an SEC filing published on Monday, Musk had acquired 73.5 million shares of Twitter common stock by March 14, making him the company’s largest shareholder with a 9.2 percent stake. Given that the filing is for a passive stake, Musk doesn’t seem to be seeking control of the company and despite his outspoken nature, he hasn’t commented on his intentions yet. From a purely financial standpoint, his investment has already paid off. After the news of his investment broke, Twitter’s share prices surged 27 percent, adding roughly $780 million to his stake. Ironically, that single-day gain, even though it’s just on paper, dwarfs the combined profits Twitter made over the past three years. In fact, it’s more than the company has made since its foundation, as long struggled to reach profitability, accumulating sizeable losses along the way.

You will find more infographics at Statista

Ask me anything

Explore related questions