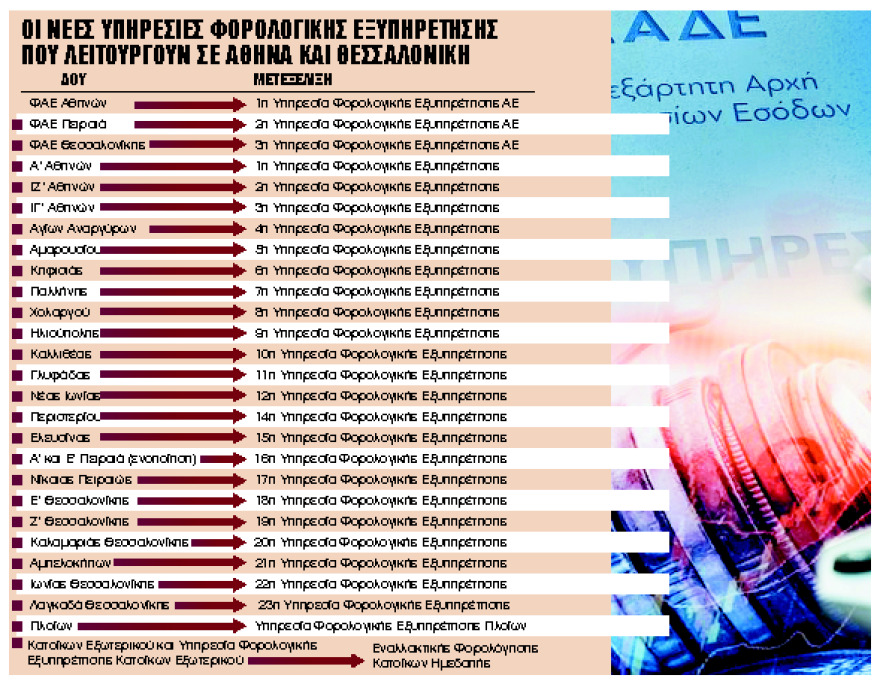

A new era is dawning for taxpayers’ relations with the Inland Revenue following the organizational transformation of the tax administration, which is being “run” by the ADEA and which puts an end to the DOUs replaced by the KEFODE, the KEFOK, the KEBIS, and the YFIs.

The start has been made from Athens as all taxpayers are now subject to the Centre for Tax Procedures and Services (KEFODE) with Thessaloniki taking the baton in November when the corresponding center will open.

In practice, for tax, income or VAT cases, taxpayers in the two largest Greek cities will only go to the KEFODE, while for real estate cases they will go to the Capital Tax Centers already operating in Athens and Thessaloniki.

The KEFODE should also be indicated on the documents they issue, in contracts or other transactions.

At the same time:

– for issues of tax arrears or tax refunds or tax offsets, taxpayers should contact the Certification and Collection Centers (KEBIS) while

– for matters of service and support, such as the receipt of a key number or VAT number, and the immobilization of vehicles, the Tax Service Services are responsible, for replacing the old tax offices