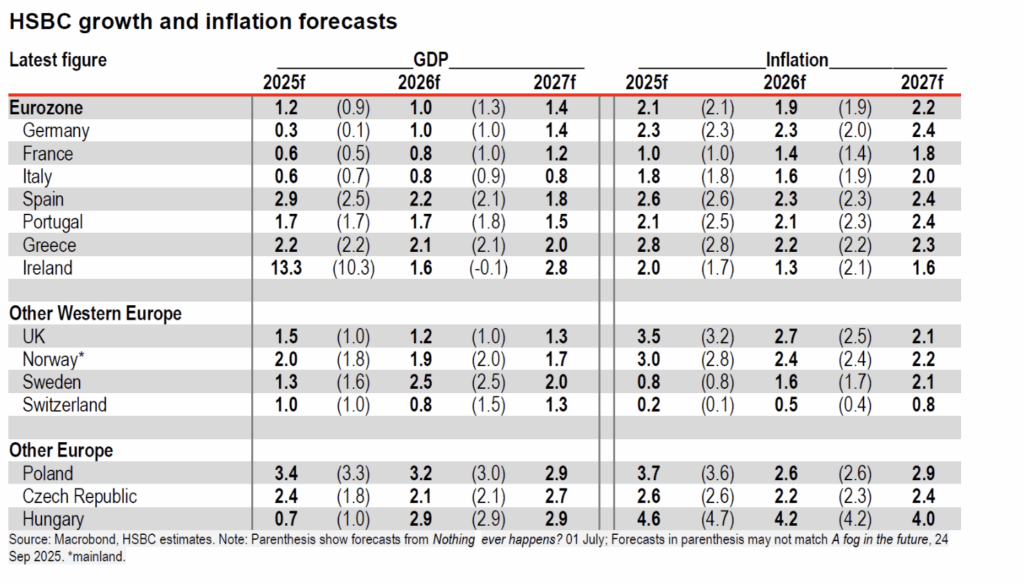

Greece’s GDP is projected to grow by 2.2% in 2025, 2.1% in 2026, and 2.0% in 2027, according to HSBC’s latest “European Economics Q4 2025” report (authored by Simon Wells and the European economics team). The bank notes that the Greek economy will maintain growth above 2%, consistently outperforming the Eurozone average, following five consecutive years of recovery since 2021.

Fiscal Outlook

HSBC describes Greece’s fiscal position as healthy and disciplined.

- The general government deficit is forecast at –1.8% of GDP in 2025, –1.6% in 2026, and –1.5% in 2027.

- Public debt is expected to continue its impressive decline:

- 209.4% of GDP in 2020

- 177.0% in 2022

- 153.6% in 2024

- 135.9% in 2026

- 129.4% in 2027

HSBC calls this reduction “significant and sustainable”, noting that Greece is one of the few European countries achieving stable primary surpluses alongside positive growth.

Inflation and Interest Rates

Inflation is expected to fall steadily, from 3.0% in 2024 to 2.8% in 2025, 2.2% in 2026, and 2.3% in 2027, aligning closely with the ECB’s target and well below the 2022 crisis level of 9.3%.

Lower interest rates and stabilizing energy costs are helping create low-inflation conditions and strengthen household purchasing power.

Labor Market and Consumption

The labor market continues to improve:

- Unemployment is projected to fall from 10.1% in 2024 to 9.2% in 2025, 8.6% in 2026, and 8.0% in 2027 — the lowest since 2008.

HSBC attributes this to rising investment, export expansion, digital and energy transition, and strong employment in tourism and services.

Private consumption is expected to grow moderately but steadily:

+1.9% in 2025, +1.6% in 2026, and +1.5% in 2027, supported by higher real incomes and improved consumer confidence.

Meanwhile, Recovery Fund (NGEU) inflows, public investment, and structural reforms continue to boost Greece’s productive capacity.

Policy and Outlook

HSBC praises Greece’s “exemplary prudent yet pro-growth fiscal policy”, emphasizing that the country has achieved sustainable fiscal consolidation without undermining growth.

Credit rating upgrades and lower borrowing costs are creating a stable deleveraging path while supporting private-sector investment.

Key Risks Identified

Despite the strong outlook, HSBC points to three main risks:

- A potential resurgence of inflation in the Eurozone after 2027, prompting new ECB rate hikes.

- Rising financing costs due to gradual monetary tightening.

- External geopolitical and trade shocks, especially from U.S.–China tensions.

Conclusion

HSBC concludes that Greece now enjoys solid fundamentals, sustainable public finances, and durable growth.

“The country has moved from an era of adjustment to a phase of stable European success, serving as a model of balance between growth and fiscal discipline,”

the report states.

Ask me anything

Explore related questions