Saks Global Enterprises, which manages major retail chains such as Saks Fifth Avenue, Bergdorf Goodman, and Neiman Marcus, is facing growing financial troubles and is considering filing for Chapter 11 bankruptcy protection as a last resort to address its precarious situation.

The company faces severely limited options ahead of a debt payment exceeding $100 million due at the end of the month, according to sources familiar with the situation. It is also exploring other ways to improve liquidity, such as raising emergency financing or selling assets. In recent talks with creditors, the possibility of debtor-in-possession financing during bankruptcy proceedings has also been discussed.

In 2024, the company raised billions of dollars from bond investors to finance an ambitious turnaround plan focused on acquiring Neiman Marcus, with the expectation that increased scale would help boost sales. Instead, the deal significantly increased the debt burden and failed to resolve longstanding supplier issues, many of whom stopped deliveries due to delayed payments, worsening losses.

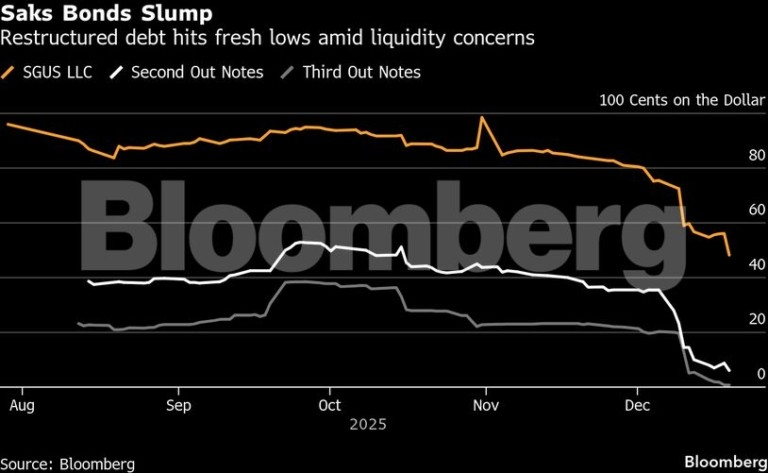

Last June, the company persuaded creditors to provide an additional several hundred million dollars as part of a debt restructuring that reshuffled repayment priorities, creating multiple layers of bondholders with differing claims on assets. Despite this, even these new bonds have seen a sharp drop in price, reflecting investors’ concerns that the recovery plan is running out of steam.

In a statement, the company emphasized that it is “considering all options to secure a strong and stable future for Saks Global and to advance its transformation while continuing to offer exceptional products and services to its customers.”

The partnership with Neiman Marcus last year aimed to create a luxury multi-brand group supported by new, high-profile investors, including Amazon.com Inc. and Salesforce Inc. However, by May, bondholders had already faced accounting losses exceeding $1 billion as the plan began to derail.

Following the restructuring, Saks revised down its full-year forecasts in October after reporting a sales decline linked to inventory management problems. Meanwhile, it continued to delay payments to some suppliers to preserve liquidity.

Saks is facing interest payments of over $100 million due by December 30, according to Bloomberg data. The $941 million tranche of Saks’ second-lien bonds restructured in August was trading on Monday at around 7.5 cents on the dollar, down from about 36 cents just two weeks earlier, according to Trace pricing. Approximately $762 million of senior debt was valued at nearly 48 cents on the dollar.

Saks Global is the world’s largest multi-brand luxury retailer, including brands such as Saks Fifth Avenue, Neiman Marcus, Bergdorf Goodman, Saks OFF 5TH, Last Call, and Horchow. Its retail portfolio includes 70 full-line luxury stores, additional off-price outlets, and five distinct e-commerce platforms.

The Saks Global Properties & Investments unit includes iconic properties of Saks Fifth Avenue and Neiman Marcus, representing nearly 1.21 million square feet of prime real estate and investments in the luxury markets of the United States.

Ask me anything

Explore related questions