Prime Minister Alexis Tsipras unconditional surrender of Greece to Berlin and Brussels will go down as one of the most curious U-turns in history. It’s hard to fathom how a leftist government that won elections on January 25 while campaigning to end austerity could end up passing one of the most neo-liberal programs ever imposed on Greece. The deal comes just a week after holding a referendum where people rejected a lighter version of reforms to the ones finally agreed to.

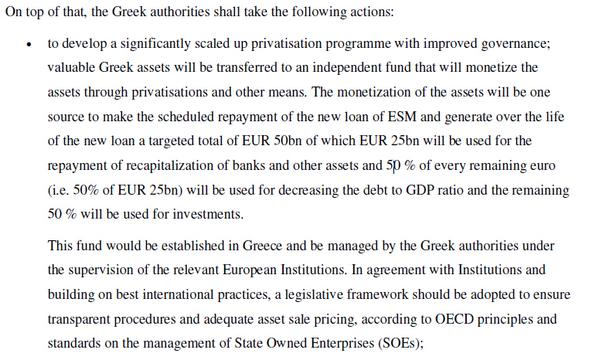

Now shackled in economic chains and branded from heros to traitors the government will impose the pretend “deal” for the Greek people. Troika becomes troika again, this time escrowing some 50 bln euros worth of Greek assets into a liquidation fund. In other words, Greece will sell itslef in pieces to repay creditors and top off its funding needs.

“That is good for Greece, but also good for us. We are in the end the ones from whom the money is borrowed,” he said, but didn’t make it clear why this would be good for Greece.

25bn euros worth of the hypothetical assets sale will be used to recapitalize the banks, 12.5-bn euros will be used to pay off debt and 12.5-bn euros will be used to pour into investments (or line a few Greek pockets, depending on how cynical you are).

The idea of selling the Acropolis had been raised early in Greece’s debt crisis when two conservative German lawmakers caused a furor in 2010 by suggesting that ancient ruins should be sold! Bild constantly irritates Greeks by asking why the Acropolis can’t be sold. Here are some of the assets on eBay or soon to hit eBay as Greece goes to the highest bidder in an agreement signed by the same government that temorarily blocked the privatization of the port of Piraeus as soon as it came to power:

Dijsselbloem admitted that the assets sale will be long-term. Privatization agency Taiped put out to tender assets with a nominal value of 7.7 billion euros since 2011 has only cashed in over 3 billion euros, according to 2014 figures. At this rate, it would take around 100 years to reach the 50-bn-euro target.