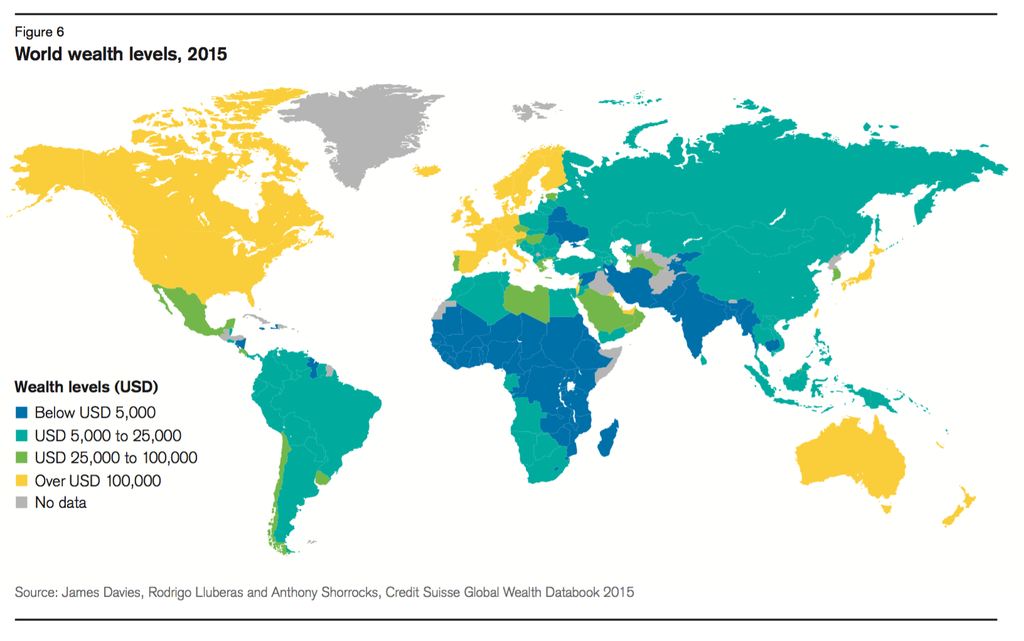

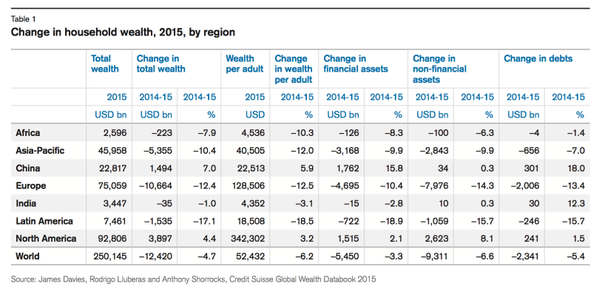

Credit Suisse issued an account of the World Wealth Levels for 2015. Greece is still not rock bottom… but definitely a far cry from Western European countries.

This year the investment bank looked at the persistent and worrying decline in the proportion of wealth owned by the middle class in different regions of the world.

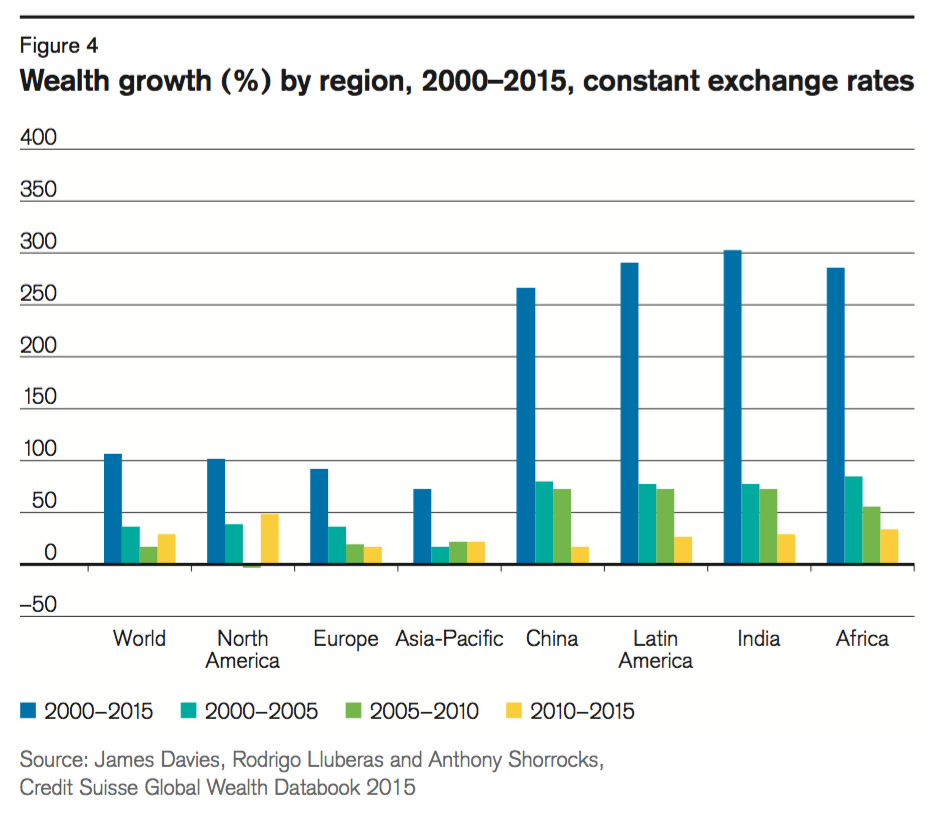

Credit Suisse said the middle classes grew at a slower pace in 2015 than top-end wealth. Still, the bank said the middle class will continue to expand in emerging economies overall, with a lion’s share of that growth to occur in Asia.

In every region during 2000–2015, the rise in the aggregate wealth of the middle class was less than that at higher wealth levels and this was true of most countries, the exceptions being Colombia, Greece, Mexico and Poland where the split was roughly 60:40 in favor of the core middle class.

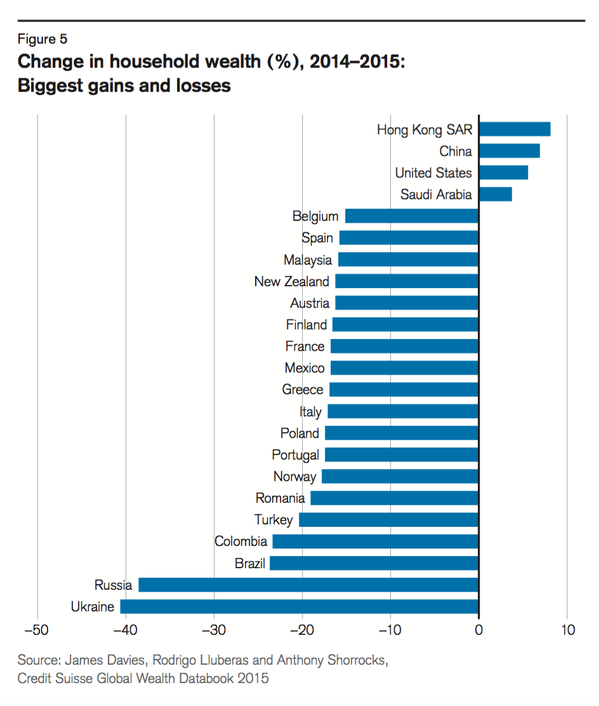

Regarding Greece, the middle class has seen its household wealth decreasing about more than 500 billion dollars, from 1.16 trillion dollars in 2007 (the highest level ever), whereas this year it declined about 41% reaching 678 billion dollars.

The main causes for this decline are the drop in real estate market and real assets, but also Euro to Dollar exchange rate decline, due to the global economic crisis.

According to the report Greece is the only country in the eurozone – even though during that period Ireland, Spain and Portugal applied their memorandum – that recorded this huge decline, while it is among the five worst countries, including Argentina, Russia, Egypt and Turkey.

Read the full report here.