While Elon Musk’s public musings to take Tesla private in 2018 resulted in nothing more than a slap on the wrist courtesy of the SEC, his dogged determination in trying to acquire and subsequently “fix” Twitter has taken many by surprise.

When an SEC filing revealed that Musk had become Twitter’s largest shareholder on April 4, hardly anyone could have predicted that he would go on to buy the entire company. Back then, the assumption was that he would probably join Twitter’s board and try to make his voice heard that way. After that option fell through, however, it was widely assumed that Musk would move on to greener pastures while possibly making a nice profit from selling his Twitter stake. Instead, Musk doubled down on his mission to improve what he calls “the digital town square where matters vital to the future of humanity are debated.”

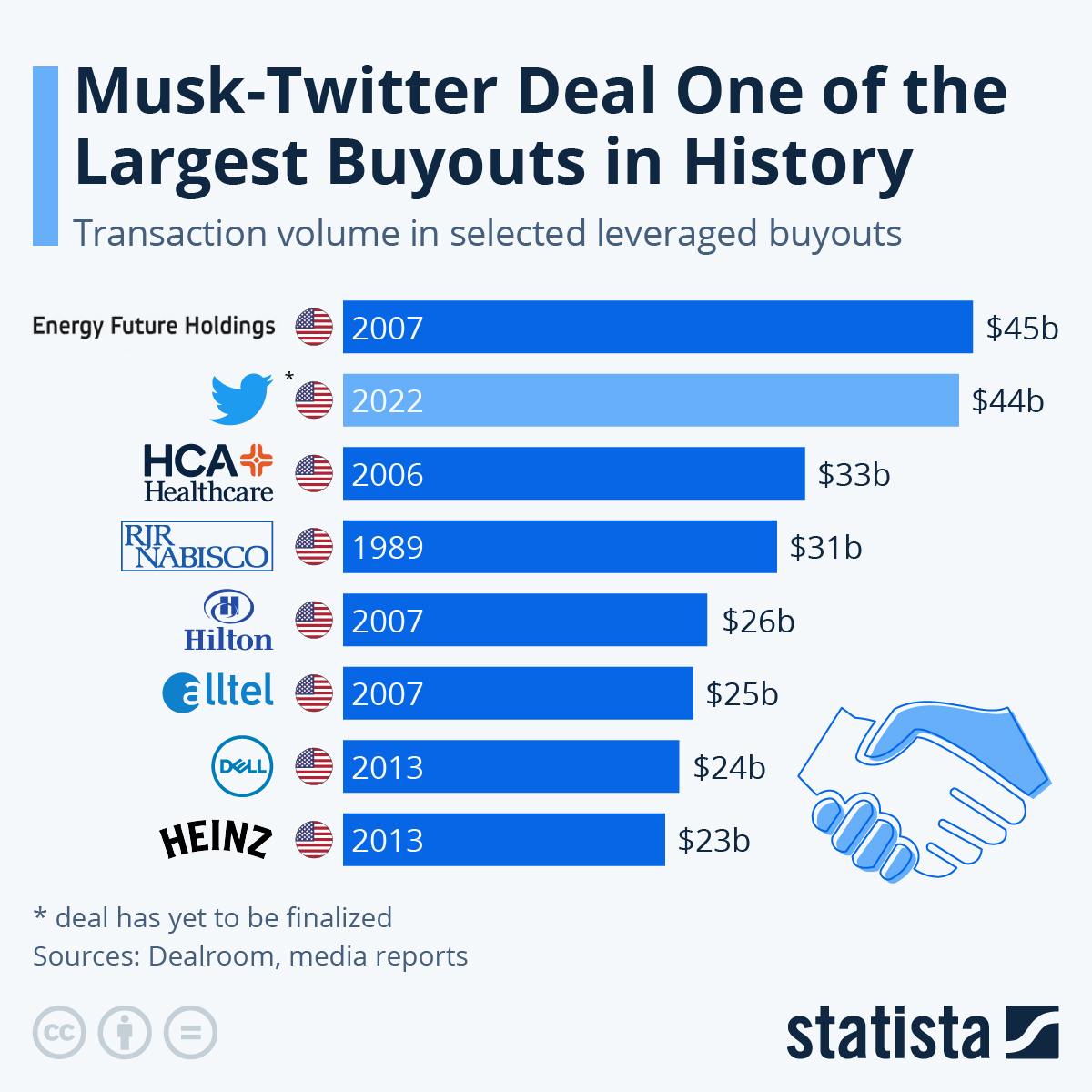

As the following chart shows, Musk’s acquisition of Twitter, worth approximately $44 billion, is one of the largest leveraged buyouts in history. According to Twitter’s announcement of the deal, Musk has secured $25.5 billion in loans, backed in part by his own assets and in part by Twitter’s assets, to finance the deal. He will also be providing roughly $21 billion in cash, although it is yet unclear how he plans to raise that amount.

You will find more infographics at Statista

Ask me anything

Explore related questions