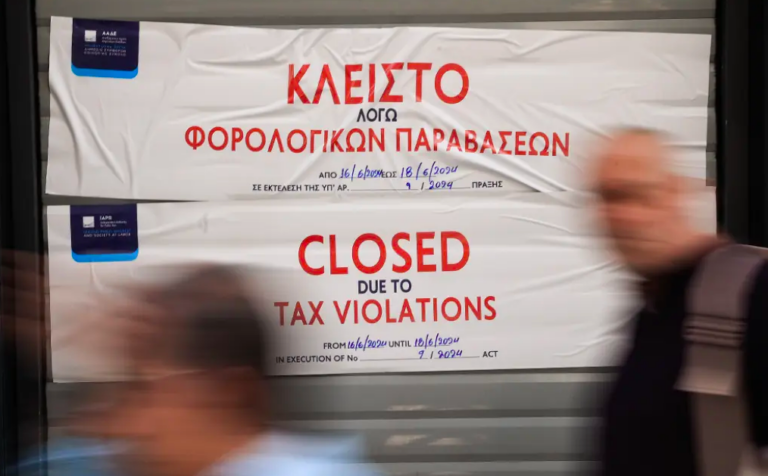

The noose is tightening for self-employed professionals who evade taxes – What’s changing

The new control system focuses on linking cash registers with POS devices and fully recording transactions through myDATA – New digital applications, such as IRIS and the digital customer database, will help combat tax evasion

Mitsotakis on the reduction of VAT evasion due to POS: Changes that in Greece were said to be impossible

Mitsotakis stressed that this battle for tax justice is also a battle for social justice

AADE: Tax evasion of more than €8.5 million from e-commerce sales

Most cases - Sole proprietorship in the southern suburbs of Athens, with jewellery trade, it was found that an unknown number of tax data for the period 2018-2022, with a net value of 2.13 million euros, were not issued